Subscribe

Sign up for timely perspectives delivered to your inbox.

A few years ago, when a colleague and I were discussing the investment case for European bank stocks, I expressed being somewhat mystified as to how the bulls could really get comfortable with the risks involved. He responded simply that “some people are comfortable living on the edge.” So it is! Today, as extreme developments pop up in the stock market at an alarming rate, one would be forgiven for assuming more than a little Aerosmith in the collective playlist. Living on the edge, in normal times, brings the risk of significant investment losses. Given the uncertainty brought about by COVID-19, the risks are now much greater, in our view. Investors would do well to tune out the mood music, avoid the extremes and take a more moderate approach.

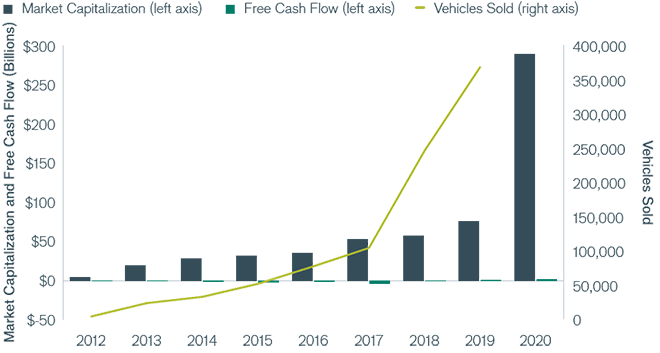

The U.S. stock market has recently surpassed its all-time high set in February amid the worst global pandemic in 100 years. Blank check companies have raised $24 billion this year, globally, already eclipsing last year’s record haul by 70%, according to Refinitiv. The largest 1% of stocks make up an incredible 48% of the Nasdaq, according to Strategas. Beyond these broader observations, Tesla is a case in point for today’s extreme developments within the stock market. While there is unquestionably tremendous growth potential for electric vehicle sales in the decades ahead, the business is extremely competitive and highly capital intensive. Thus, as Tesla’s vehicles sold have grown dramatically, the cash flows have, shall we say, not exactly kept pace. But no matter, the result in the stock market has been a stunning rise, with the company now among the most richly valued (in any industry) in terms of market capitalization.

The growth/value divide has widened dramatically and consistently throughout 2020. The MSCI World Growth Index outperformed its value counterpart before, during and after the coronavirus sell-off. The result is a nearly 30% performance gap for the year-todate through July 31, 2020. Not bad! But such dramatic outperformance of growth stocks leads naturally to questions about the reward-to-risk balance looking forward from here. Empirical Research Partners notes that while “it’s very hard to call a turning point in momentous moves like this one, particularly given the leadership’s exceptional fundamentals,” several “tells” are in place including newly public companies seeing red hot stock performance, an acceleration in the pace of appreciation and very high valuations (the latter two points for their universe of big growth stocks).

Source: Bloomberg. 2020 market capitalization and free cash flow estimate as of market close August 12, 2020. For reference, the 2019 Actual and 2020 Estimated free cash flows round to $1 billion and $2 billion, respectively.

The positive outlook embedded in growth stocks presents two risks. First, earnings may underwhelm. For example, stay-at-home benefits for certain tech/entertainment companies may prove temporary, or competition/regulation may heat up in unanticipated ways. Given current optimism, it may simply be that the future, while bright, isn’t bright enough to meet expectations. The second risk to consider is valuation multiples, which are high across a variety of metrics and have a long way to fall to a more normalized level. As one of Perkins’ founders likes to point out, if you are wrong twice in a stock (i.e., both the earnings and multiple move against you), you can lose a lot of money.

As one of Perkins’ founders likes to point out, if you are wrong twice in a stock (i.e., both the earnings and multiple move against you), you can lose a lot of money.”

The long underperforming value stocks represent another edge of sorts in the current market. COVID-19 has had a massive impact on the economy and high social contact industries. As noted in our second quarter Outlook, it appears the virus is here to stay and, barring an unexpected medical advance, many companies will be facing much weaker than anticipated demand for the next several years. While much cheaper than growth stocks, value equities often carry higher debt burdens (which limit staying power), and in many cases the earnings outlook is murky (e.g., when will travel reach 2019 levels again?) and vulnerable to any additional weakening in the economy (e.g., if recent federal fiscal stimulus payments are allowed to lapse).

Rather than focusing on the extremes/edges, our work is leading us to more moderate stock selections. We recognize the significant “disruption” underway across many industries, including the remarkable competitive positions certain companies have developed. While the most obvious beneficiaries may have been bid up too richly, we are identifying less obvious winners enjoying some of the tailwinds but with more reasonable valuations across software and IT services. Within cyclicals, our focus on balance sheet strength and competitive position is leading us to U.S. banks, non-U.S. autos and select luxury/apparel companies. Finally, we are fortifying the portfolios with relative laggards within consumer staples as well as “industrial staples” companies.

Make no mistake, the investing environment today contains many extreme elements. Avoiding these edges, and the significant downside risk they present, in favor of more moderate yet high reward-to-risk opportunities is a sound approach, in our view. Enjoy the remainder of your summer, and for those with school-age children … good luck this fall!

Thank you for your co-investment with Perkins Investment Management.

Gregory Kolb

Chief Investment Officer,

Portfolio Manager