Partner wisely

QE is getting us to ‘the other side’,

but what happens when we get there?

Introduction

Massive purchases of government fixed income by central banks have caused prices of fixed income to rise. As a consequence, prices of other asset classes have also increased.

Conventional monetary policy involves central banks, like the Reserve Bank of Australia and US Federal Reserve, raising or lowering their official benchmark interest rate. Lower interest rates make saving less attractive relative to spending. Lower rates also make borrowing cheaper. By lowering the price of money, central banks around the world encourage economic activity.

In most advanced economies, official interest rates are close to zero or negative in the case of Japan and the European Union (EU). Hence, central banks have turned to an unconventional monetary policy tool called quantitative easing (QE). This sees central banks buy securities, typically government fixed income, from banks and other financial institutions. These purchases essentially inject more cash into the system. By increasing the quantity of money, central banks further lower the price of money.

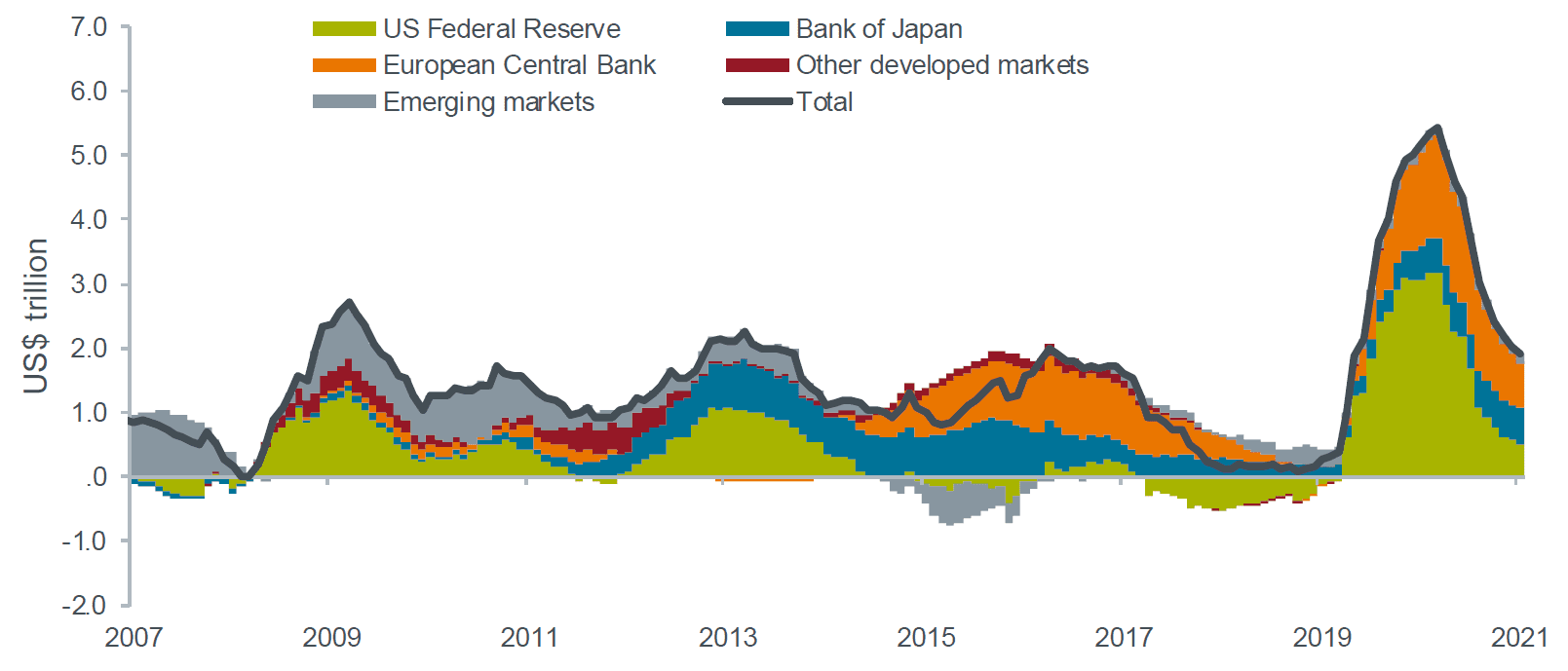

Total central bank purchases1.

Source: Citigroup, as at 30 June 2020. Data for 2020 and 2021 are estimated.

The impact on investors

These multi-trillion-dollar central bank purchases in response to the 2008 global financial crisis and COVID-19 have two impacts on investors:

The central banks’ huge demand causes prices of government fixed income to rise and therefore yields to fall, just as dividend yields fall as share prices rise (assuming unchanged dividend payments). Because yields on government fixed income are the benchmark interest rates against which other fixed income is priced, borrowing costs for banks and corporations in fixed income markets fall. This is an intended consequence.

As yields on fixed income fall, investors shift their money into other asset classes, such as property and shares. Again, the higher demand pushes up prices, therefore lowering yields on other asset classes.

By injecting so much money into financial markets, QE drives up prices of not only fixed income but also other asset classes.

What happens

when QE is reversed?

Traditionally, low interest rates eventually promote higher spending and investing. This creates jobs, so unemployment rates fall. Eventually, wages climb, and prices of goods and services follow, causing inflation to rise. Too much inflation is bad for economies, so central banks start raising interest rates to encourage saving instead of spending and investing.

So, when economic growth returns and central banks start tightening monetary policy (by raising interest rates) instead of easing, it follows QE should also be unwound.

As the earlier chart indicated, the scale of QE is unprecedented. Nobody knows for sure how financial markets will react when central banks stop being huge buyers of fixed income. Economic theory would suggest the fall in demand for fixed income would cause its prices to fall and yields to rise. A similar spill over effect into other asset classes may be expected, with prices falling on shares and property as investors move back into fixed income securities.

Having actively traded through the 2013 ‘taper tantrum’ (the market panic that resulted from the US Federal Reserve’s announcement of plans to taper of its post-Global Financial Crisis QE program), we have seen how markets can react to the mere mention of tapering QE.

In situations like these, markets often ‘throw the baby out with the bathwater’, indiscriminately selling securities, regardless of their quality and strength. For active fixed income investors that are nimble enough and skilled enough to identify and capitalise on these sorts of opportunities, they can result in both capital preservation and superior returns relative to the market.

Share article on LinkedInPartner wisely

Knowing when and what proportion of the defensive part of your portfolio to allocate to cash, floating rate credit, fixed interest, higher yielding securities is not a simple process. Together we’ll navigate uncertainty.

Learn more

1 https://www.janushenderson.com/en-au/investor/article/after-the-virus-a-binary-world/