Knowledge. Shared Blog

August 2020

Dollar-Cost Averaging: A Formula for Consistent Investing

-

Ben Rizzuto, CRPS®

Ben Rizzuto, CRPS®

Retirement Director

Many younger investors may be financially unable – or emotionally unready – to invest large sums of money in the market all at once. Investing smaller sums in regular intervals over time is one alternative to consider. Retirement Director Ben Rizzuto explains how this strategy, known as dollar-cost averaging, can provide a useful approach for consistent long-term investing that carries other potential advantages.

In a previous post – Millennials’ First Market Correction: Advice from an Ancient Philosopher – we discussed how, during market corrections, bear markets or just volatile markets in general, a philosophic view may be helpful. But we can’t just bliss out on our yoga mats when it comes to investing for our futures; we need to actually put our money to work and develop an investment plan.

It would be nice to be able to invest a lump sum of money, but many of us – particularly younger investors who might still be paying off student loan debt – don’t have a lot of disposable income set aside that we can just plop down into an investment account. Plus, putting a sizable lump sum into the market all at once may seem a bit scary for those who are new to investing. As a result, we might have to invest periodically over time, perhaps timing our investments based on biweekly paychecks and the budgets we have set up that allow us to save money at particular times during the month.

The good news is this method of investing small amounts over time is the basis of a powerful concept called dollar-cost averaging (DCA). Put simply, DCA breaks up the total sum to be invested into smaller amounts that are put into the market at regular intervals, allowing you to consistently invest a set amount of money on a systematic basis over time. DCA can help ensure you’re investing consistently without derailing your monthly budget, but there are many other potential advantages. Following are some examples that demonstrate the power of this fundamental investing concept.

Lower Your Cost Basis

In addition to helping keep your budget on track, DCA also makes sense in terms of your cost basis, which is the original price you paid for an investment that is used for tax purposes. By regularly investing a fixed amount, you will end up purchasing more shares of a stock when the share price declines and fewer shares as the price increases. Over time, DCA may result in a lower average cost per share than investing a lump sum.

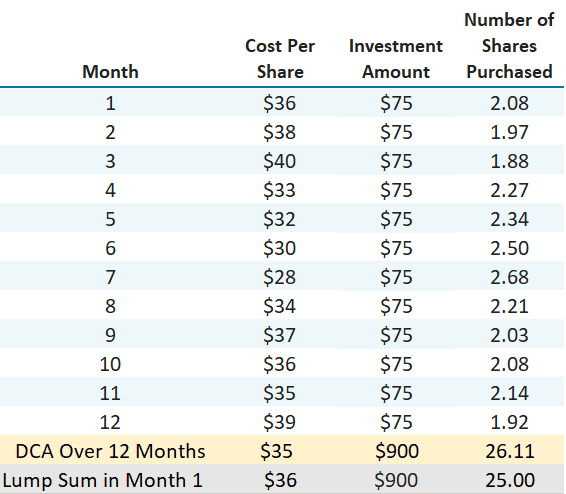

If you’ve read our Marching to a Million brochure, you know that if you started saving approximately $75 per pay period at age 25, you could theoretically retire at age 65 with $1,000,000. So, for example, let’s say you decide to update your monthly budget to include $75 that will be invested into a diversified mutual fund. The table below illustrates how that investment would play out over the course of 12 months.

DCA in Practice

As you can see, using DCA, at the end of the 12-month period you could potentially have more shares, and you also may have paid a lower average share price for those shares than you would have with a lump-sum investment in the first month. Furthermore, you could possibly have created a larger investment with lower tax ramifications just by systematically investing. (For more information on cost basis and taxes, see our investor education piece on the subject.)

Smooth Out Volatility

We have seen a lot of market volatility over the past several months and will likely continue to contend with it in the months ahead. Volatile markets can be stressful and lead investors to make untimely, emotional decisions. And as a young person who may be new to investing, such extreme volatility could sour you on the idea of investing in general. However, if you’re not saving for the future and providing yourself with growth potential by investing some of those savings, you may miss out on your future goals.

Now, you may be saying to yourself, “Yeah, but volatilely still stresses me out.” And while there’s no way to completely eliminate the emotions associated with investing in choppy markets, dollar-cost averaging may help allay those fears.

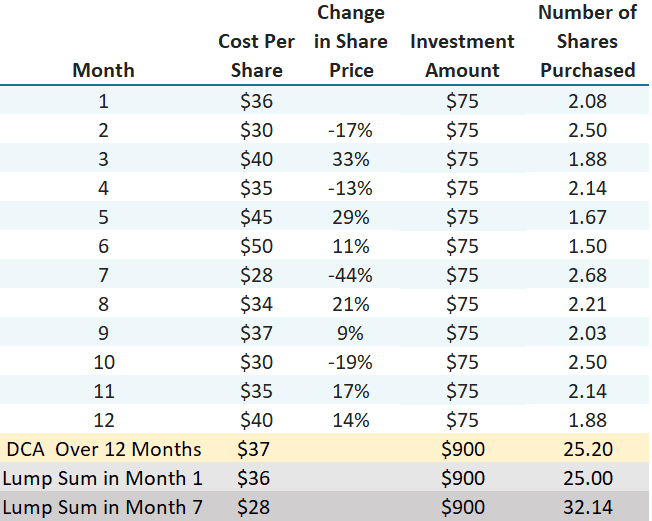

In the table below, we revisit our original example of the $75 lump-sum investment vs. DCA, but we have added the change in the stock’s share price each month. Again, if you had invested a lump sum of $75 in month 1, you would own 25 shares with a cost basis of $36. However, if you had waited until month seven, you would own 32.14 shares with a cost basis of $28.

How DCA Can Help Avoid Emotional Traps

The key here, however, is that in month 1, you didn’t know a downturn was coming. And when your investment decreased in value by 44% in month 7, you would likely have been afraid that the share price was going to continue to decline, which may have led you to decide to continue to wait it out in cash. The problem is you probably wouldn’t have expected the share price to increase in value by 21% the next month.

Dollar-cost averaging helps smooth out the impact of price volatility, so you don’t fall into these kinds of emotional traps. By systematically investing, according to our other example, you end up with 25.2 shares with an average cost basis of $37 over the 12-month period. And most importantly, you didn’t have to try to figure out the best time to get in to or out of the market.

Develop a Good Investing Habit

The topic of emotional investing traps leads me to my last point on why DCA makes sense: It forces you to stick to your plan. I personally believe you should view saving and investing as a monthly bill, and dollar-cost averaging does just that: It allows you to treat your investments just like your Netflix bill. You set a specific amount to invest every month and add that amount to your other monthly fixed expenses like rent, cell phone, Internet and the aforementioned Netflix subscription. You know what these fixed expenses will be in advance, so you can plan for them and adjust your variable expenses, like groceries and entertainment, as needed.

Automation and habits are so important when it comes to reaching our goals, financial or otherwise. By making a commitment and setting up a monthly deposit into your investment account, you can focus on other things, and you don’t have to go through the decision-making process as to when to invest. By creating this investing “rule,” you won’t have to second-guess yourself or get overly emotional as market conditions change.

Investing is known for having too much jargon. And while DCA may sound like one of those complex concepts, as you can see, it really isn’t. Whether you view it as a rule, a system or just another monthly bill you must allocate for and pay, it’s this consistency that can help us achieve our long-term financial goals.

Marching to a Million: The Millennial Journey to Retirement

Resources to help engage clients’ children and prepare the next

generation for retirement.

View Now View NowThe examples provided are hypothetical and used for illustrative purposes only.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe