Knowledge. Shared Blog

August 2020

2020 Trends in Investing Survey: ETF Usage Poised to Increase

Nick Cherney, CFA

Nick Cherney, CFA

Head of Exchange Traded Products

More than half of financial professionals who responded to the 2020 Trends in Investing Survey, which Janus Henderson conducted in conjunction with the Financial Planning Association® (FPA®) and the Journal of Financial Planning, said they plan to increase their usage of exchange-traded funds (ETFs) over the next 12 months. In this Q&A, Head of Exchange-Traded Products Nick Cherney discusses what he thinks is driving this increased interest in ETFs and other trends he is seeing in the space.

Key Takeaways

- Lower cost, greater transparency and tax efficiency have helped ETFs gain traction among financial professionals and retail investors.

- ETFs have also evolved from a vehicle used to build passive portfolios to, in many cases, being an efficient means of implementing a dynamic asset allocation in active investment strategies.

- During the COVID-19 correction, the transparent nature of ETFs made it easier for investors to see the liquidity constraints of the fixed income markets, something many mistook for liquidity issues within ETFs themselves. But a benefit of ETFs is that they are generally more efficient at allocating cost to those who are selling in a challenging time, rather than to those who stay the course.

Why do you think financial professionals are increasingly gravitating to exchange-traded funds (ETFs)?

The growth of the ETF industry is a confluence of many factors. While it is true that, all else being equal, ETFs provide a more tax efficient structure with greater intraday liquidity than mutual funds, there are many considerations related to the plumbing of the financial services industry that can make choosing between a mutual fund and an ETF a rather complex undertaking.

That being said, a lot of the growth in ETFs is deeply intertwined with the move to fee-only advisory and brokerage services and the fact that ETFs often offer lower costs and a more transparent investment vehicle for the general investing public.

Additionally, the customization factor associated with ETFs is something that many investors find appealing. Whereas mutual funds tend to focus on broader themes, ETFs enable financial professionals, institutions and retail investors to invest in a more specific manner to create very tailored and nuanced investments. In many ways, the growth of ETFs parallels the societal changes that the tech world has brought about, where consumers now expect virtually instant and fully personalized service at low cost and with total transparency.

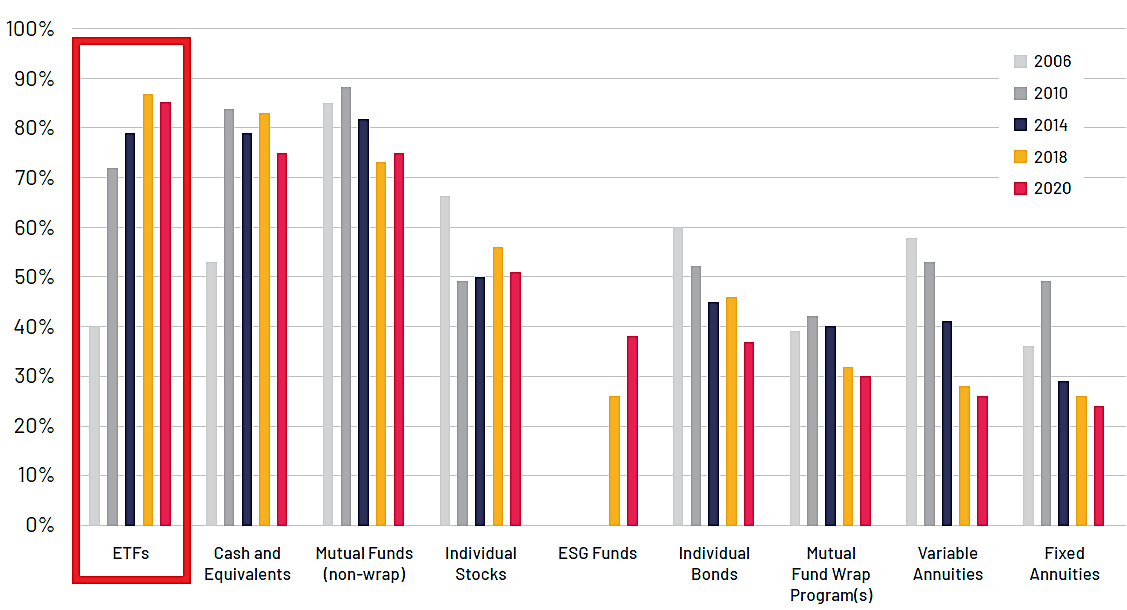

Investment Vehicle Usage, 2006-2020

Since 2006, Trends in Investing Survey respondents have more than doubled their use of ETFs, and 52% of 2020 respondents said they plan to increase their usage of ETFs over the next 12 months.

[caption id=”attachment_312304″ align=”alignnone” width=”1127″] Source: 2020 Trends in Investing Survey, Financial Planning Association® (FPA®), Journal of Financial Planning and Janus Henderson Investors, March 2020.[/caption]

Source: 2020 Trends in Investing Survey, Financial Planning Association® (FPA®), Journal of Financial Planning and Janus Henderson Investors, March 2020.[/caption]

Another unique aspect of ETFs is their ability to take client orders in-kind. In a traditional mutual fund structure, the portfolio manager needs to deliver cash to redeeming shareholders; as a result, the cost of trading to generate that cash is borne by the remaining shareholders. In the case of an ETF, the ability to deliver securities to redeeming parties in-kind moves the cost of those redemptions outside of the fund, thereby mitigating the impact to remaining shareholders. This can be particularly useful in cases where the underlying instruments may be intermittently less liquid or more expensive to trade.

What trends do you see taking shape in the ETF landscape?

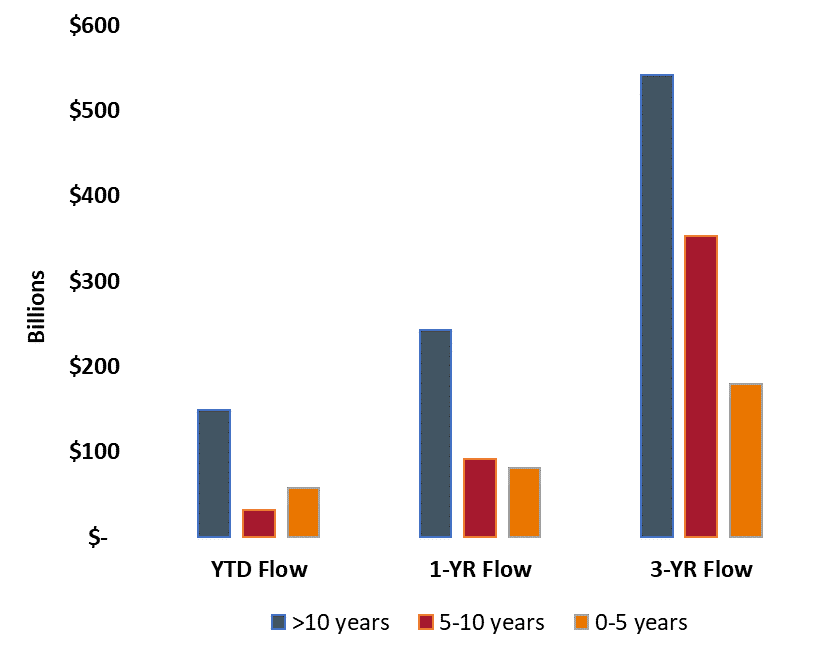

First and foremost, the market is crowded and top heavy. We see outsized flows into the most well-established products, which creates one of many hurdles for new products to succeed. Over the last 12 months, more than 60% of net flows have gone to ETFs that are more than 10 years old, with only 16% going to products launched in the last five years (see following chart).

ETF Net Flows by Age of Product

[caption id=”attachment_312341″ align=”alignnone” width=”576″] Source: Bloomberg, Janus Henderson Investors, as of July 31, 2020.[/caption]

Source: Bloomberg, Janus Henderson Investors, as of July 31, 2020.[/caption]

Secondly, the use case for ETFs has evolved dramatically. In particular, they are no longer a vehicle that is used solely by financial professionals looking to build purely passive portfolios. Active ETFs are gaining traction, and the use of passive products is often now part of an active strategy, where the ETF is one of the most efficient vehicles to implement a dynamic asset allocation.

Ultimately, we believe many investors are seeking better ways to build portfolios that can deliver risk-adjusted excess returns, and ETFs are often the vehicle of choice for them. While we do not think the world needs more cheap beta vehicles, we do believe there is value in offering a curated selection of products that are truly differentiated and based on a firm’s expertise.1

Some fixed income ETFs experienced liquidity issues in March. Does this pose a serious risk?

What is interesting is that fixed income liquidity issues were mistaken for ETF liquidity issues in March. The transparency of ETFs made it much easier for investors to see that those liquidity constraints existed, whereas the illiquid nature of an underlying portfolio is not generally visible to investors because all they see is a once-a-day net asset value (NAV).

The stress that was experienced across fixed income markets – and particularly in corporate credit – during the COVID-19 correction meant that investors who wished to sell fixed income securities faced significant market volatility and wide bid/ask spreads.2 That underlying market dynamic was fairly efficiently reflected in the intraday prices of many fixed income ETFs, which often traded at discounts to their NAV. Those ETFs that did not experience significant selling pressure in March tended to not trade at discounts. Across the board, fixed income ETF bid/ask spreads actually remained relatively tight – often tighter than the spreads3 in the underlying fixed income markets, in fact. This meant that investors who wanted to sell their fixed income ETFs were bearing the cost of doing so, while investors who remained in the ETFs were generally not impacted.

It is often the case that the most expensive time to sell a position is during market stress. In the case of fixed income ETFs, not only is that cost very visible to investors on an intraday basis, but generally ETFs are more efficient at allocating that cost to those who are doing the selling, rather than those who stay the course.

2020 Trends in Investing Survey

Conducted by the Journal of Financial Planning® and the Financial Planning Association® (FPA), and sponsored by Janus Henderson Investors.

Download Now  1Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

1Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

2Bid/ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price a seller is willing to accept.

3Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating creditworthiness of borrowers, tightening spreads are a sign of improving creditworthiness.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox