Subscribe

Sign up for timely perspectives delivered to your inbox.

The global natural resources sector represents about 15% of global listed equity and has exposure to growth, infrastructure spending and a very broad range of underlying commodity prices.

The COVID-19 crisis has created a short-term demand shock that has been largely balanced by temporary reductions in commodity supply. Oil has been hit the hardest given the decline in global air travel, but other commodities, like iron ore, have been far more resilient as Chinese demand, which was first to be hit by the virus, leads the way out.

In China, rising infrastructure spending, rate cuts, more delegation to local governments to support car manufacturing and some relaxation of housing policies are positive for metals demand. The bellwether copper price has gained 50% to US$3/lb, while gold has set a new record high price of US$2,000/oz. Silver, rare earths and uranium are also emerging quickly from long slow periods and other commodities will likely follow.

Valuations are attractive and earnings momentum is positive. Unless we see widespread second lockdowns, iron ore, copper and gold price strength points to double-digit earnings upgrades for the mining sector.

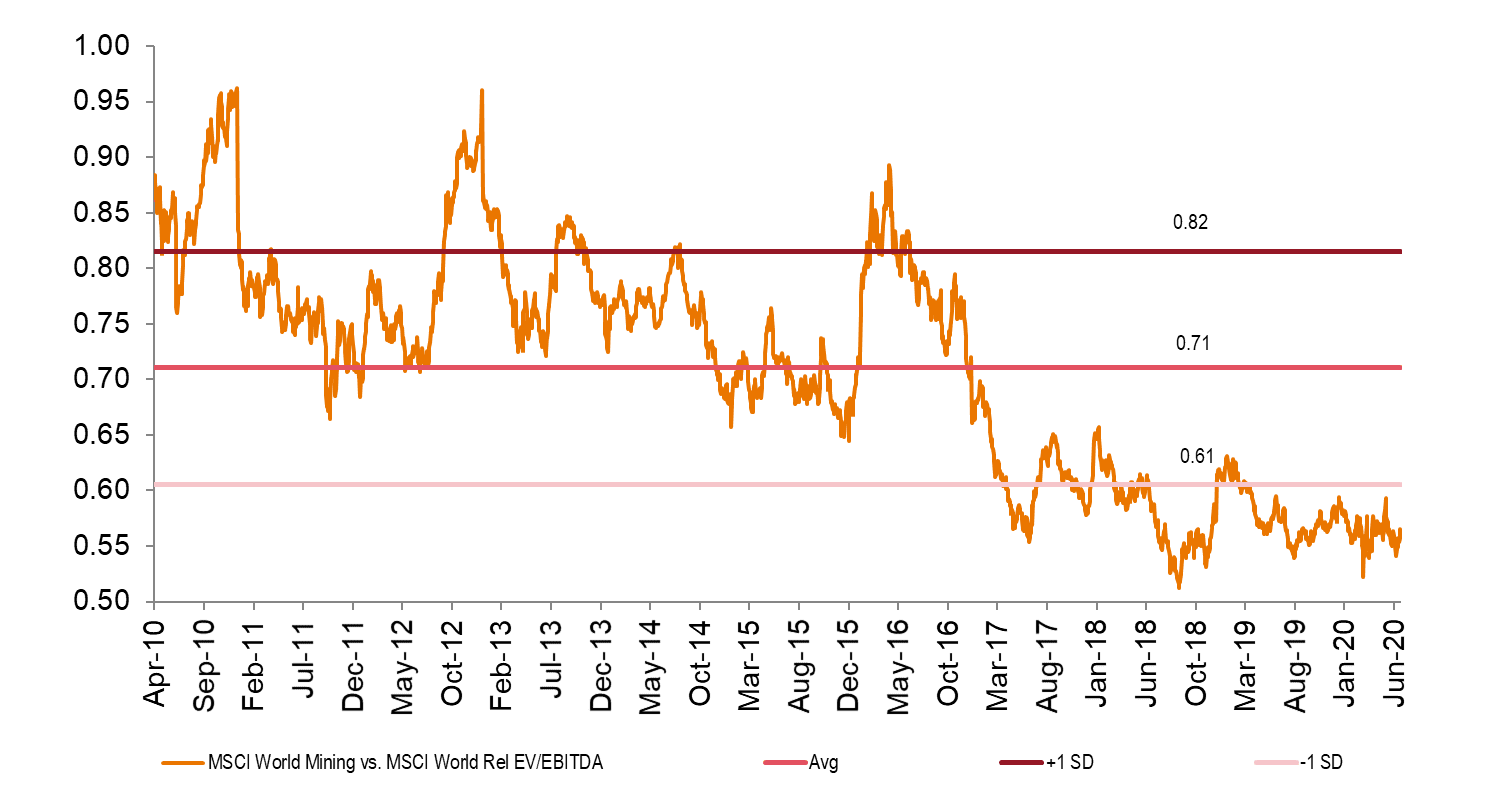

Traditional valuation multiples, such as EV/EBITDA, show mining stocks to be cheap relative to the market. In absolute terms the implied returns embedded in share prices currently are at trough levels.

Source: Citi Group Research, FactSet.[/caption]

Source: Citi Group Research, FactSet.[/caption]

*EV/EBITDA: Enterprise Value / Earnings Before Interest, Taxes, Depreciation & Amortization

Source: CSFB Report July 2020.[/caption]

Source: CSFB Report July 2020.[/caption]

Near term, the virus-related crisis is a deflationary shock, but inflation expectations may well start to edge higher based the enormous global stimulus in response to the demand shock. Longer term, however, the reaction to the virus may well be inflationary.

Rising money supply, expansionary fiscal policy, de-globalisation/re-shoring, a weaker US dollar and waning technology disruption are all reasons to expect higher inflation. In addition, the most politically, socially and economically expedient way deal with enormous debt is to inflate it away.

Valuations do not reflect the mining sector’s high correlation with inflation expectations, real asset characteristics, China exposure, infrastructure and construction exposure, and attractive industry structure. Furthermore, mining is not technically disrupted, in fact, it is a beneficiary of the ongoing carbon transition.

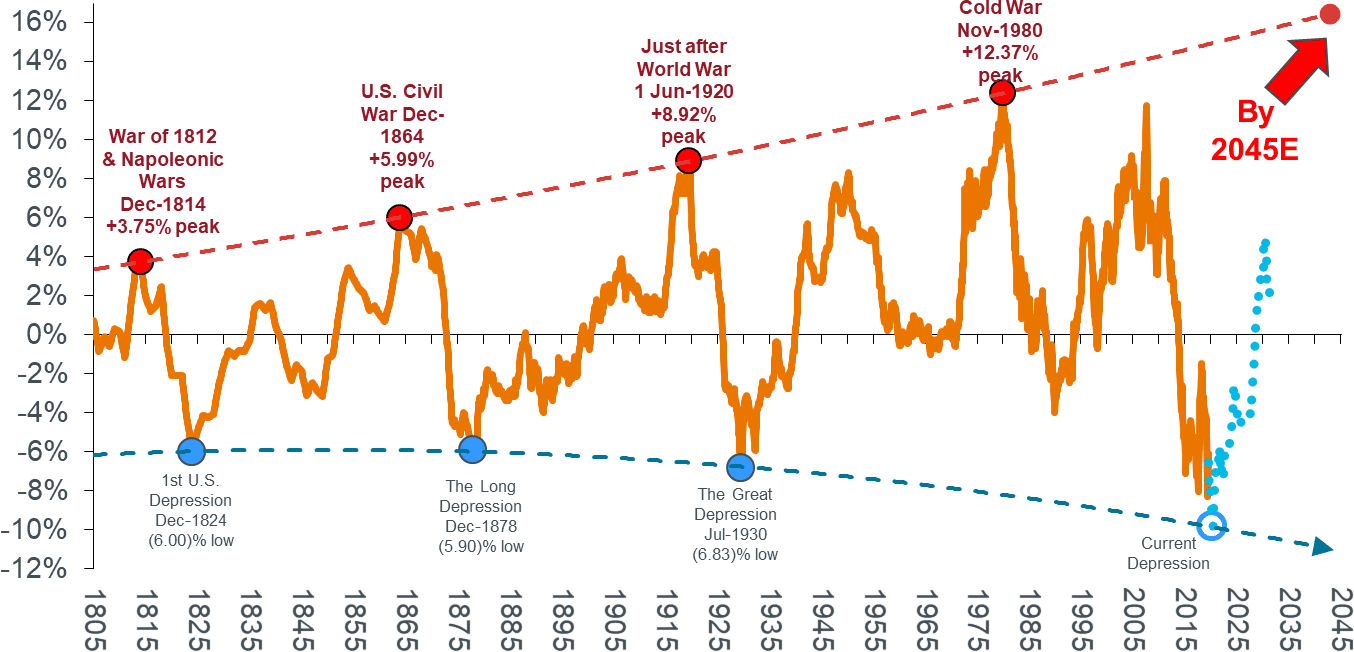

Timing is always important. Tactically, market expectations of inflation will start to move ahead of a possible pick-up in inflation that typically lags money supply growth by around two years, suggesting that 2021 could see the start of a long commodity price cycle. There have been six commodity peaks in the last 227 years, most recently in June 2008. The current cycle is following the average path of these historic supercycles, which confirms a likely turn in commodities through the 2020’s.

Red dots: major inflation peaks, Blue dots: major inflation troughs

[caption id=”attachment_311184″ align=”alignnone” width=”1354″] Source: Stifel Report June 2020. Note: Shown as 10yr rolling compound growth rate with polynomial trend at tops and bottoms. Blue dotted line illustrates a forecast estimation. Source: Warren & Pearson Commodity Index (1795-1912), WPI Commodities (1913-1925), equal-weighted (1/3rd ea.) PPI Energy, PPI Farm Products and PPI Metals (Ferrous and Non-Ferrous) ex-precious metals (1926-1956), Refinitiv Equal Weight (CCI) Index (1956-1994), and Refinitiv Core Commodity CRB Index (1994 to present).[/caption]

Source: Stifel Report June 2020. Note: Shown as 10yr rolling compound growth rate with polynomial trend at tops and bottoms. Blue dotted line illustrates a forecast estimation. Source: Warren & Pearson Commodity Index (1795-1912), WPI Commodities (1913-1925), equal-weighted (1/3rd ea.) PPI Energy, PPI Farm Products and PPI Metals (Ferrous and Non-Ferrous) ex-precious metals (1926-1956), Refinitiv Equal Weight (CCI) Index (1956-1994), and Refinitiv Core Commodity CRB Index (1994 to present).[/caption]

The Janus Henderson Global Natural Resources Strategy is well diversified to capture value across the range of opportunities in metals (copper, nickel, iron ore), gold, oil and gas production and technical services, renewable energy especially in wind and offshore services, agricultural products, high quality food (salmon, dairy, etc.) and water services.