Knowledge. Shared Blog

August 2020

Can the Market’s Immunity Last?

-

Jim Cielinski, CFA

Jim Cielinski, CFA

Global Head of Fixed Income

Global Head of Fixed Income Jim Cielinski discusses the outlook for bond markets and why he believes economic growth is likely to remain modest – yet positive – in the quarters ahead, justifying continued exposure to corporate bonds.

Key Takeaways

- In our opinion, economic growth is likely to be modest, yet positive over the next few quarters, as partial closures are offset by pent-up demand.

- We think credit markets have responded rationally to the restoration of liquidity and the promise of central bank support, but it is difficult to imagine a sustained rally from current levels without confidence that economic growth will persist.

- With the support of the Federal Reserve, we think the yields in credit markets generally are attractive, although further spread tightening could very well be limited.

The U.S. economy has decisively rebounded from the lows reached in March, but momentum has waned in both the economy and the financial markets as rising cases of the COVID-19 coronavirus have forced some regions to once again restrict activity. The more high-frequency data from credit cards and other financial transactions suggest there has been, to date, only a modest slowing in consumption. However, online job postings have reversed course and fallen sharply in recent weeks, raising concerns about the outlook for employment in the coming months. Still, despite being balanced between pent-up demand and partial closures over the next few quarters, we think economic growth is likely to remain modest, yet positive.

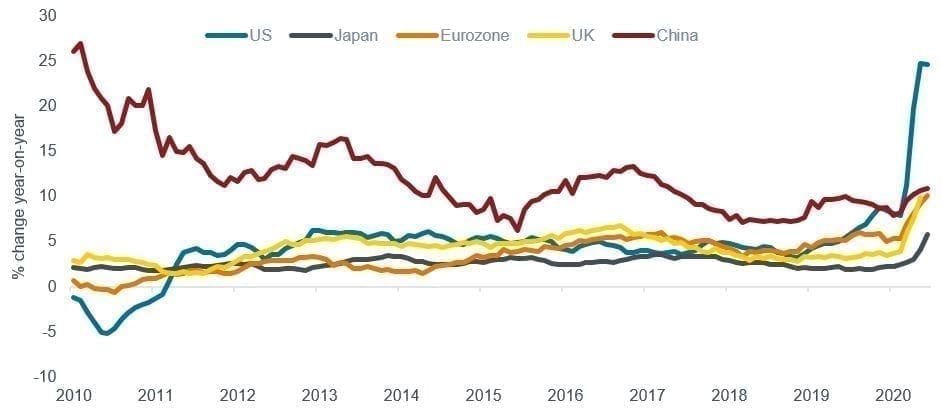

Following the Money

The aggressive actions taken by global central banks since the crisis began have pushed their balance sheets to historic levels and, particularly in the U.S., caused the amount of money in circulation to surge. The question investors may be asking is “Where does that money go?”

Because the rise in balance sheet levels is historic, it is difficult to answer that question based on past experience. However, we believe inflation is an improbable result in the current climate given weak demand and, similarly, the real economy will be slow to absorb the liquidity as corporate capital expenditures and hiring are likely to remain subdued.

That leaves the financial markets. As a matter of financial dynamics, the money does have to go somewhere, and buying more financial assets is both relatively quick and easy. By lowering policy rates to zero, the Federal Reserve (Fed) has made it clear it does not want the money to flow to government securities. Given the Fed’s explicit support for investment-grade and high-yield corporate bonds, it seems natural for liquidity to flow into credit markets. Investors seem to agree: As of this writing, flows into investment-grade corporate bond funds have had their fourteenth consecutive week of positive inflows.

Broad Money Growth

[caption id=”attachment_310190″ align=”alignnone” width=”942″] Source: Refinitiv Datastream, monthly datapoints, January 2010 to June 2020.[/caption]

Source: Refinitiv Datastream, monthly datapoints, January 2010 to June 2020.[/caption]

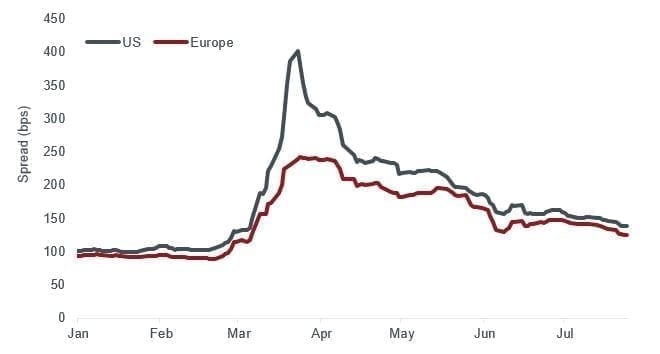

The Valuation Problem

Year to date, global central banks have bought more than the net supply of new bonds. Intervention by central banks, by definition, distorts markets, so it follows that historic intervention should create historic distortion. Thus, we are in an unusual – but understandable – period where the volatility of bond prices and their spreads over Treasuries have diverged. Current spread levels have historically been accompanied by lower volatility (as lower volatility typically signals a lower risk premium) and vice versa.

Investment-Grade Corporate Credit Spreads over Treasuries

[caption id=”attachment_310232″ align=”alignnone” width=”660″] Source: Bloomberg, ICE BofA US Corporate Index, ICE BofA Euro Corporate Index, Govt OAS (option adjusted spread), 1/1/20 to 7/24/20. Credit Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, tightening spreads are a sign of improving creditworthiness. One basis point (bps) equals one hundredth of one percent.[/caption]

Source: Bloomberg, ICE BofA US Corporate Index, ICE BofA Euro Corporate Index, Govt OAS (option adjusted spread), 1/1/20 to 7/24/20. Credit Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, tightening spreads are a sign of improving creditworthiness. One basis point (bps) equals one hundredth of one percent.[/caption]

The logical conclusion is that financial markets are being inflated, at least relative to the degree of uncertainty that remains for the world’s economies. Does this mean markets are overvalued? We don’t think so. Instead, we think credit markets have responded rationally to the restoration of liquidity and the promise of central bank support. But it is difficult to imagine a sustained rally from current levels without a drop in volatility, which can be seen as a proxy for confidence – specifically, confidence that economic growth will persist. In our view, the speed of the recovery matters less than the direction. As the market becomes more confident that growth will normalize at some point, we think volatility will trickle lower and spreads will grind tighter.

Can Credit Markets Remain Immune?

Credit markets have stayed relatively resilient in the face of negative headlines, including the recent surge in cases of COVID-19 in the U.S. While Fed support is largely the cause of this stability, the question still stands: Can markets remain immune to crisis? More specifically, could credit spreads stay stable if economic activity dips again or if a recovery is pushed back? In our view, the short answer is yes. But the magnitude of any setback to growth is important. Should the economy wobble, or its strength wane, we think credit markets would largely look the other way, though some sectors and securities may experience worse damage than others. In the event of another country-wide lockdown, however, we think aggregate spreads would widen.

Fortunately, there is little evidence that a severe economic setback is likely. Instead, we think a “muddle through” scenario is by far the most probable result given the complicated formula of rising cases, regional shutdowns, progress on treatments and the eventual arrival of a vaccine. We believe that at some point the U.S. economy will normalize and that both the Fed and Congress will strive to do what it takes to shoulder markets until that happens.

Looking Ahead

The outlook for global economic growth depends on the growth rate of the COVID-19 virus. Should the latter accelerate exponentially, a larger-scale shutdown in the impacted region or regions could very well be necessary. While this appears most likely to occur in the U.S., infections in Latin America have been climbing steadily and emerging regions in Asia have also seen a rise in new cases. However, progress in medical solutions has been rapid, with numerous vaccine candidates now in trials, ahead of many experts’ expectations. Both the growth rate of the virus and the progress on vaccines must be monitored closely, as the effects will have a wide impact.

The U.S. in particular is also vulnerable to fiscal support being influenced by politics as the November election draws nearer. While we expect Congress will ultimately provide support to the unemployed and to states facing unexpected budget deficits, we are aware that politics doesn’t always follow logic. As the market shares our view that fiscal support is likely, a failure to provide it would be a shock to markets and would probably cause spreads to widen dramatically. Meanwhile, tensions have escalated between the U.S. and China, and while we think it is doubtful that there will be market-moving geopolitical events before the November election, we acknowledge the risk.

Barring a coronavirus- or politics-induced shock, we think fiscal policy and central bank support can provide enough fuel to keep economic activity strong enough to support financial markets. And since the money has to go somewhere, we think credit spreads should fare well in this environment, even if economic growth is slow to return. Admittedly, absent better-than-expected economic news, credit markets might not rally significantly, but the yields offered in the meantime are, in our view, attractive.

Fixed Income Perspectives

Quarterly insight from our fixed income teams to help clients navigate the

risks and opportunities ahead.

Read Now

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe