Partner wisely

Where to find income when interest rates are zero

Introduction

Fixed income offers predictable income which can be boosted by taking credit risk and interest rate risk. However, both risks need to be actively managed.

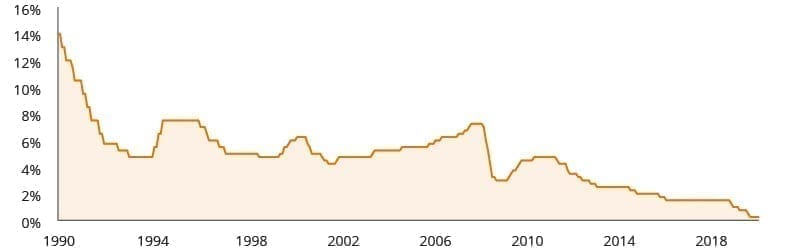

Interest rates in Australia have been trending down for at least 30 years. The Reserve Bank of Australia’s (RBA) benchmark cash rate most recently peaked at 4.75% in November 2010 and has since fallen to its current record low of 0.25%.

RBA Cash Rate

Source: Reserve Bank of Australia. Data from 2 August 1990. As at 14 July 2020.

Meanwhile, the outlook for dividend payments looks highly uncertain as Australia experiences its largest economic contraction since the 1930s.1 Some listed companies – including three of the Big Four banks – have already either deferred dividend payments or dramatically reduced them.

As a result, Australian investors’ two most popular sources of income look unappealing. In this context, fixed income is an alternative source of income worth exploring as fixed income investors can boost their income by taking on two types of risk.

Boost Income Through

Interest-Rate Risk

Just as 12-month term deposits typically pay a higher rate of interest than three-month term deposits, longer-dated fixed income securities generally pay higher rates of interest than ones with shorter maturity dates.

This is to compensate investors for having their money locked up for a longer period of time, and therefore, greater risk that interest rates could move higher during that time. Higher interest rates are bad for fixed income securities because they reduce the value of the future stream of interest payments. This causes prices of fixed income securities to fall. This is known as interest rate risk or duration risk. It is the major cause of price changes in fixed income.

Boost Income Through

Credit Risk

Another way that fixed income investors can receive higher interest payments is by taking credit risk. As an example of the risk/return trade-off, fixed income securities with no credit risk (such as government bonds) pay lower interest rates than fixed income with higher credit risk (for example, corporate bonds).

Generally, high-quality, investment-grade fixed income securities have extremely high probabilities of making their regular coupon payments on time and repaying the original investment in full on the maturity date. However, within the group of investment grade securities, those issued by government entities are statistically lower risk than those issued by corporates which come with credit risk.

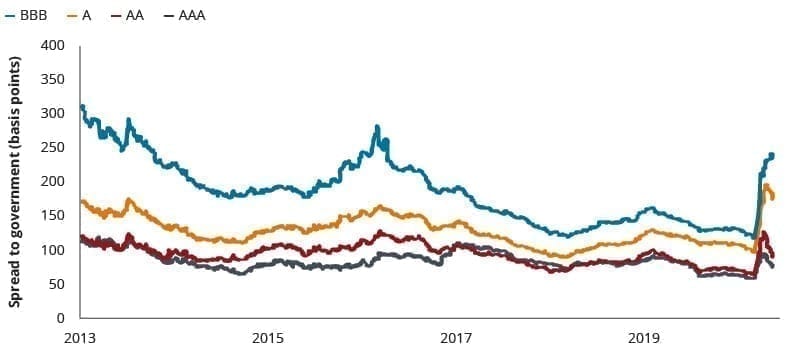

The chart below shows the spread of how much more corporate fixed income securities must compensate investors with relative to government bonds across a range of credit ratings. This is measured in basis points, where 1 basis point is equal to 0.01%, meaning 100 basis points is 1%. As the quality of the credit rating declines, the spread increases in order to compensate investors for taking on additional risk. In times of crisis, when investors generally want to reduce risk, credit spreads widen in response to the declining risk appetite. The most recent example of widening credit spreads is on the right of the chart, showing the impact of the COVID-19 crisis.

Australian corporate credit spread by credit rating band

Source: ICE BofAML Indices, Australian Corporate index (AUC0), as at 15 May 2020

As a result, corporate fixed income generally pays higher coupon payments than government fixed income. This is to compensate investors for the credit risk, or the slightly higher likelihood that corporate issuers of fixed income securities may miss coupon payments or be unable to repay the original investment in full on the maturity date.

Boosting income requires active management

Fixed income investors can boost income by taking interest rate risk and credit risk, but both risks need to be actively managed in order to balance the risk/return trade off and the preservation of capital.

Share article on LinkedInPartner wisely

Knowing when and what proportion of the defensive part of your portfolio to allocate to cash, floating rate credit, fixed interest, higher yielding securities is not a simple process. Together we’ll navigate uncertainty.

Learn more

1 https://rba.gov.au/monetary-policy/rba-board-minutes/2020/2020-06-02.html