Subscribe

Sign up for timely perspectives delivered to your inbox.

Head of Global Bonds Nick Maroutsos describes Wednesday’s Fed decision to hold rates steady as a nonevent given that the central bank, through its actions, has already proven its willingness to do whatever it takes to support the U.S. economy during this unprecedented period.

Today’s decision by the Federal Reserve (Fed) to keep overnight lending rates between 0.00% and 0.25% was a nonevent, in our view. But as evidenced by the level of attention showered upon the statement by Chairman Jerome Powell et. al., it once again proved that within financial markets, the Fed pretty much is the only game in town.

Chairman Powell maintained his recent tone that the U.S. economy remains mired in a significant slump as flagging demand due to the COVID-19 pandemic has weighed heavily on employment and business activity. Consequently, the Fed stuck to its highly accommodative guidance and reiterated that it stands ready to utilize the full range of tools at its disposal to achieve its dual mandate of full employment and price stability.

Yet given the nature of this crisis and the potential for a second wave of the virus to emerge later in the year, we are asking the question, “What’s next?” After all, a $7 trillion balance sheet may have been enough to support financial markets, but with an unemployment rate of 11.1% (18% when including those marginally attached to the workforce) – numbers that could rise as certain states seek to tamp down on an increase in infections – we can make the argument that much remains to be done to support the real economy.

That bridge is likely an assurance to the corporate sector that borrowing conditions will remain favorable for the foreseeable future. One of the tools that has been suggested is Yield Curve Control (YCC). In this program, a central bank commits to maintaining interest rates within a certain band by whatever means necessary rather than simply committing to purchase a specific amount of assets, which may – or may not – result in the desired effects on rates. In the buildup to the Fed’s September meeting, we believe that calls for such a program may increase and we’ll be listening to comments by Fed members addressing this subject over the next several weeks.

Implicit in YCC is a veiled threat that markets should not test a central bank’s resolve. Our view is that the Fed has already accomplished this task by indicating they will keep rates steady through at least 2022 as well as by the speed – and dare we say comfort – with which it nearly doubled the size of its balance sheet over the past year. Given the pronounced rally in equity and corporate credit prices, the market clearly thinks so.

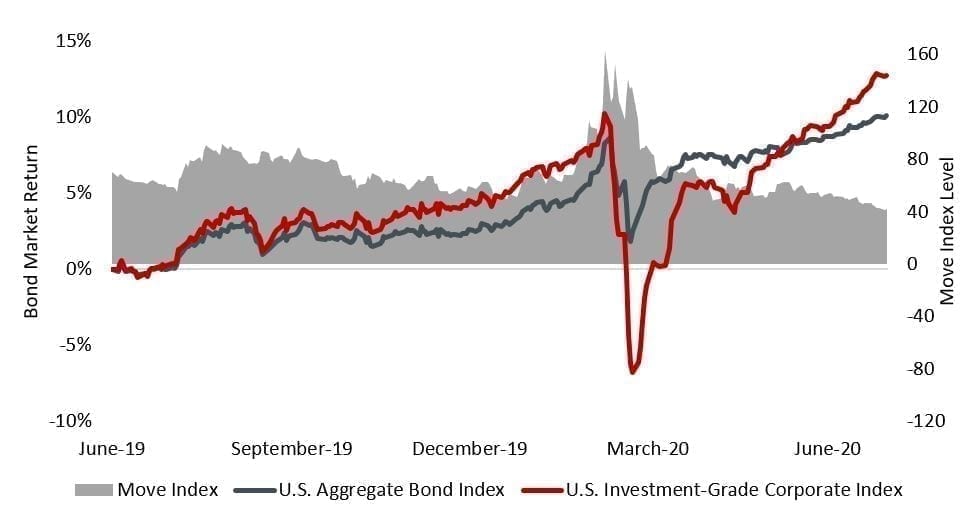

Further validating expectations of rates being set in stone over the medium term is some measures of bond market volatility reaching all-time lows. And by observing countries that have already instituted YCC – namely Japan and Australia – massive bond purchases have proven unnecessary as markets have been unwilling to take the opposite side of the “central bank trade.” We imagine this would be even more the case in the U.S. given the global sway held by the Fed and the U.S. dollar. In short, YCC in the U.S. would at best be marginally effective, but likely completely unnecessary.

[caption id=”attachment_309408″ align=”alignnone” width=”971″] Source: Bloomberg, as of 7/28/2020. Note: Move Index a measure of U.S. Treasury market volatility.[/caption]

Source: Bloomberg, as of 7/28/2020. Note: Move Index a measure of U.S. Treasury market volatility.[/caption]

The Fed’s immense presence in financial markets not only distorts signals of economic health, inflation and company prospects, its suppression of yields has complicated the task of bond investors. Over the past decade, investors have grown used to diminished coupon levels in their fixed income holdings. To compensate for this, capital appreciation has come to represent a greater share of overall returns. Harvesting these returns was easier in the years leading up to 2015, before the Fed began raising overnight rates. During that period, steeper yield curves enabled prices on mid-dated bonds to rise as they neared maturity. While yields on 2-year U.S. Treasuries have plunged in the wake of the pandemic, those on 10-year notes are not far behind, diminishing the roll-down potential as bonds mature.

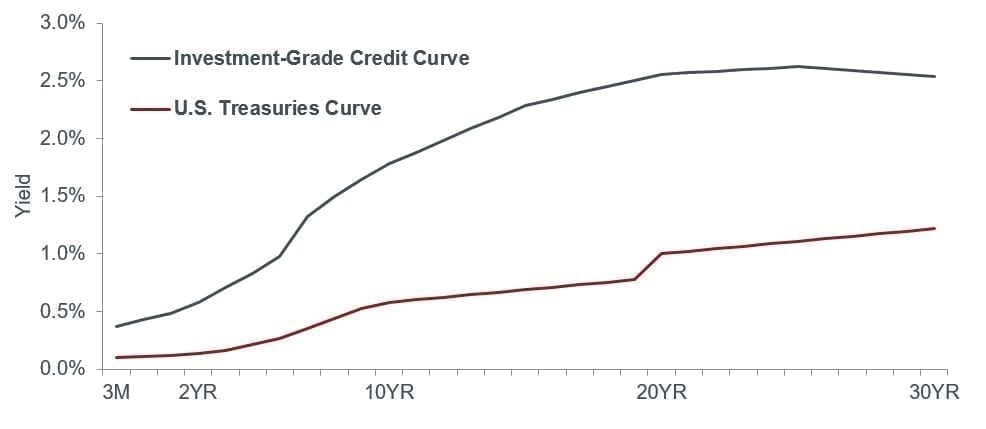

With the world hungrier for yield, bond portfolios must work harder to deliver on their mandate of providing attractive levels of risk-adjusted returns. While we can argue the Fed had a hand in creating this problem, it’s also provided part of the solution. That, in our view, is investment-grade credits. Not only is the corporate yield curve steeper than that of Treasuries, but with the Fed’s implicit backing of the investment-grade credit market – and we doubt the Fed has any interest in losing money on it investments – this segment of the market appears to offer attractive potential for capital appreciation with lower-than-usual risk of a material price decline thanks to the Fed’s largesse.

Similarly, countries such as Australia, New Zealand and many in Asia ex Japan offer opportunities to identify higher-quality credits – often with quasi state backing – that trade at greater discounts to U.S. peers of similar credit quality.

[caption id=”attachment_309419″ align=”alignnone” width=”986″] Source: Bloomberg, as of 7/28/2020. Past performance is no guarantee of future results.[/caption]

Source: Bloomberg, as of 7/28/2020. Past performance is no guarantee of future results.[/caption]

While seeking to identify attractive risk-adjusted returns, we must not lose sight of the challenging environment in which we find ourselves. Virus cases are rising in the U.S.; parts of Europe are seeing a reemergence; and a vaccine is no sure thing. Lest we forget, the U.S. finds itself in an election year with everything from taxes to trade and regulation on the table. Given this stew of potential risks, bond portfolios likely need to prioritize their ability to provide diversification from riskier assets and dampen volatility over the remainder of the year.