Partner wisely

Why is everyone talking about fixed income?

Introduction

Fixed income can provide predictable returns, while its low correlation with equities diversifies investment portfolio returns, helping preserve capital when economic storms hit.

COVID-19 broke Australia’s record run of uninterrupted economic growth. The Reserve Bank of Australia (RBA) says Australia’s economy is experiencing its largest economic contraction since the 1930s.1

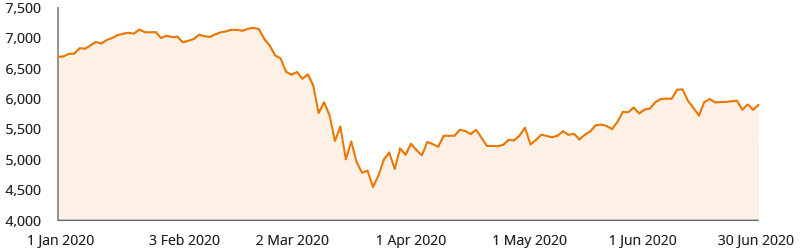

Australia’s stock market, as measured by the S&P/ASX 200 Index, fell 36.5% from its 20 February peak of 7,162.5 to 4,546 on 23 March. As of 30 June it had since risen again by 29.7% to 5,898. This volatility reflects the RBA’s observations that the outlook remains “highly uncertain” and the pandemic is “likely to have long-lasting effects on the economy”.2

S&P/ASX 200 Index – a rollercoaster ride for share market investors

Source: Bloomberg. As at 30 June 2020.

Three implications for

equity investors

At such uncertain times investors need diversified portfolios. This means spreading investments across sectors and across a range of asset classes such as equities, alternatives, cash and fixed income.

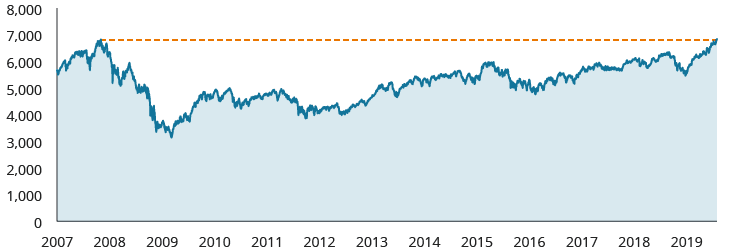

It is also a time to preserve capital. It took the ASX 200 more than 11 years to recover the ground it lost during the global financial crisis (GFC).3 Many Australians were forced to delay their retirement.

S&P/ASX 200 Index – through the GFC

Source: Bloomberg. As at 30 June 2020.

With some companies deferring or dramatically cutting dividends, investors who typically rely on stocks that pay high dividends – such as the Big Four banks and Telstra – may no longer have the income they seek. Meanwhile, rates on term deposits continue to fall.

Conservative, low risk

investments

Fixed income can address all three issues for investors.

Fixed income securities pay fixed interest payments until maturity when investors’ money is repaid. Fixed income resembles IOUs, except they can be bought and sold. Investors receive predictable income, plus their original investment is repaid at the maturity date.

With the exception of high yield debt, fixed income is generally a low risk investment. Statistically, it is very unlikely that high-quality, investment-grade fixed income securities will miss scheduled interest payments or not repay investors in full at the maturity date. That is because fixed income sits high in company capital structures. This means that if a company becomes distressed, its fixed income investors will be repaid ahead of equity investors. Equity investors on the other hand have greater risk of not being repaid and dividends aren’t guaranteed – as demonstrated by Westpac and ANZ in May. Equities pay higher returns to compensate for their higher risk versus fixed income.

Historically, fixed income has a very low correlation with equities. When equity prices fall, fixed income prices tend to rise and vice versa. This is how fixed income brings diversification to investors’ portfolios, helping to preserve capital and provide peace of mind.

Share article on LinkedInPartner wisely

Knowing when and what proportion of the defensive part of your portfolio to allocate to cash, floating rate credit, fixed interest, higher yielding securities is not a simple process. Together we’ll navigate uncertainty.

Learn more 1 https://rba.gov.au/monetary-policy/rba-board-minutes/2020/2020-06-02.html

1 https://rba.gov.au/monetary-policy/rba-board-minutes/2020/2020-06-02.html2 https://rba.gov.au/monetary-policy/rba-board-minutes/2020/2020-06-02.html

3 The ASX 200 closed at 6,828.7 on 1 November 2007 and didn’t return to that level until it closed at 6,845.1 on 30 July 2019.

https://www.afr.com/markets/equity-markets/asx-200-on-track-to-break-2007-record-20190708-p52529