Subscribe

Sign up for timely perspectives delivered to your inbox.

Jenna Barnard and Nicholas Ware, Portfolio Managers on the Strategic Fixed Income Team, explain why they believe the second half of 2020 will see lower net issuance in corporate bond markets following the dizzying volume of new bond issues in the first half.

Following $1.2 trillion of corporate bond issuance since the start of 2020, which is up 95% versus 2019*, we are now making an argument for lower investment-grade net issuance in the second half of the year, helped by bond buybacks and repayments. We feel companies will be more aggressive in managing their ratings and leverage levels following the COVID‑19 pandemic to ensure they qualify for central bank‑backed bailouts.

The Federal Reserve (Fed) has set up two COVID crisis facilities: The Primary Market Corporate Credit Facility for new bond issues and the Secondary Market Corporate Credit Facility to provide liquidity for outstanding corporate bonds, both of which will be part of a toolbox for the next recession if needed.

To qualify for these facilities, corporates needed to be rated at least BBB-/Baa3 by at least two major ratings agencies as of March 22, 2020. Similarly, the European Central Bank (ECB) has been using its existing corporate sector purchase program (CSPP) and a newly created pandemic emergency purchase program, which requires the corporate to be rated investment grade by at least one agency to qualify.

So, if you are a chief financial officer of a company, you know that you are going to be much safer retaining an investment grade rating heading into the next downturn, where you will be able to access these tools.

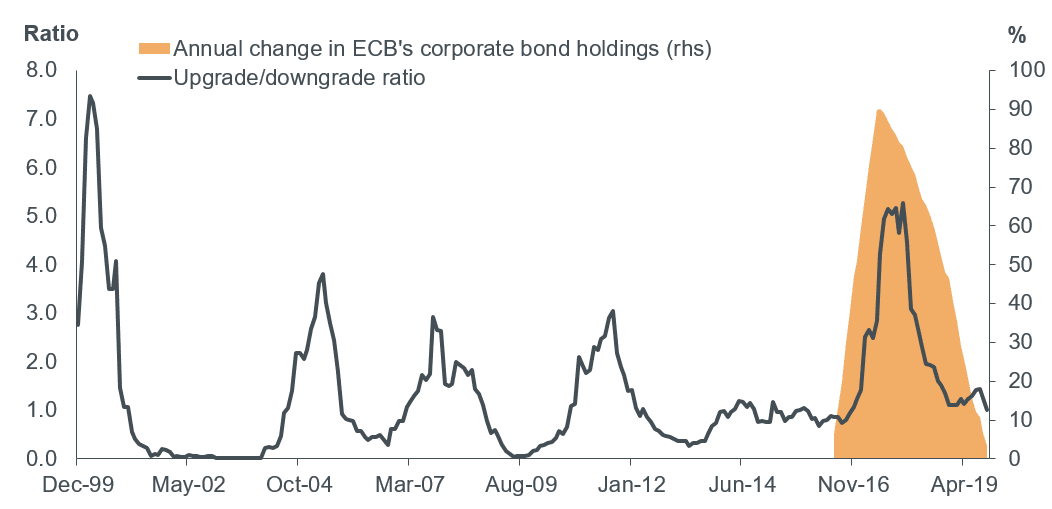

We believe corporations will be working hard to protect their investment-grade ratings; we may even see companies with high-yield debt trying to be upgraded to investment grade in the next few years (also known as rising stars). We saw this in Europe in June 2016 when CSPP was launched, and many companies realized it was beneficial to carry an investment-grade rating. Exhibit 1 shows the changing pattern in ratings that followed the ECB’s bond purchases.

[caption id=”attachment_308408″ align=”alignnone” width=”1052″] Source: BofA Global Research, data from December 1999 to October 2019, as of July 2020.[/caption]

Source: BofA Global Research, data from December 1999 to October 2019, as of July 2020.[/caption]

Larger companies are more likely to be diversified, have greater access to capital and have proven that they can adapt to crises. This is evident through the significant cuts that have been made to dividends, employees and capital expenditures in order to shore up credit positions. Hence, we are in a sweet spot in the credit cycle – and this is why we continue to remain constructive on corporate credit.

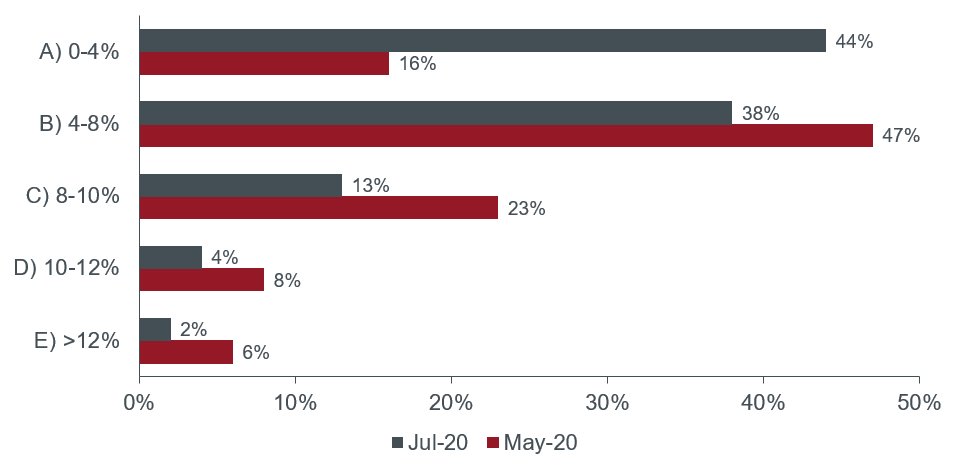

It looks like investors are now catching up with this change in behavior. Investment bank Bank of America recently conducted an investor survey and found that clients’ expectations to see fallen angels (investment-grade companies downgraded to sub-investment grade) over the next 12 months are now much lower than even a couple of months ago.

[caption id=”attachment_308419″ align=”alignnone” width=”967″] Source: BofA U.S. Credit Investor Survey, as of 7/13/20.[/caption]

Source: BofA U.S. Credit Investor Survey, as of 7/13/20.[/caption]

Of course, there will be some fallen angels, but we believe that the story might be overhyped given the actions taken by many corporates and the support – both monetary and fiscal – from authorities. Between March and May of this year, companies raised sufficient funding, providing liquidity for their operations. We now expect them to try to reduce leverage on their balance sheets and buy back bonds in the second half of the year and into next year.

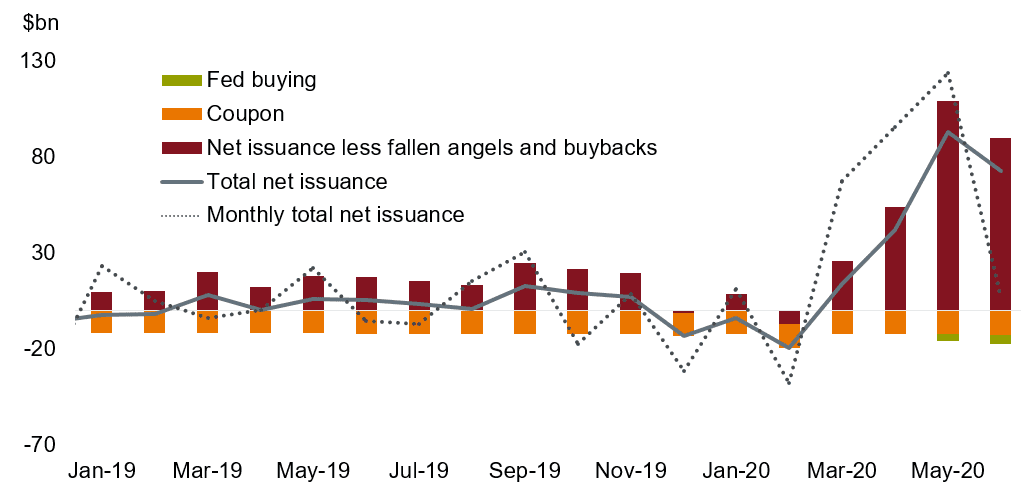

In addition, the Fed remains in the background, buying up bonds, too. While the Fed has had a huge impact on sentiment, it has not needed to buy many bonds in the new issue market, as shown in Exhibit 3. The data, from BNP Paribas, shows that strong bond buybacks by U.S. companies in June brought the total net issuance (dotted line) to a mere $6.5 billion for the month, although gross issuance was north of $100 billion – a real slowdown versus the period of March through May.

[caption id=”attachment_308431″ align=”alignnone” width=”1021″] Source: BNP Paribas, Bloomberg, monthly data, as of 6/30/20. Note: Coupon, net issuance less fallen angels and buybacks and total net issuance: three-month moving averages; net issuance data from February 2004 to June 2020; Fed buying: U.S. Federal Reserve, May and June 2020.[/caption]

Source: BNP Paribas, Bloomberg, monthly data, as of 6/30/20. Note: Coupon, net issuance less fallen angels and buybacks and total net issuance: three-month moving averages; net issuance data from February 2004 to June 2020; Fed buying: U.S. Federal Reserve, May and June 2020.[/caption]

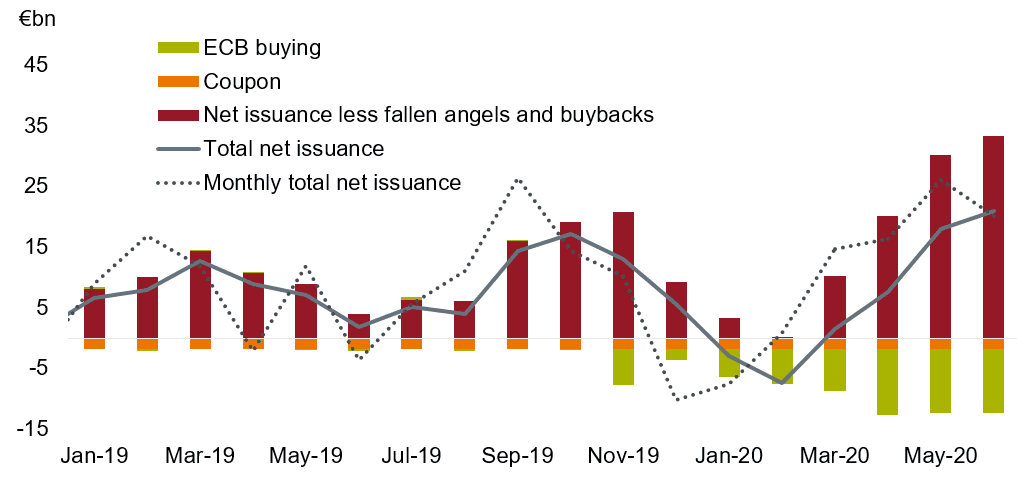

There was also robust issuance in the European investment-grade market in the second quarter as companies focused on hoarding cash. Heading into the summer, we expect issuance to slow while a dominant ECB plays its part in buying corporate bonds at roughly €11 billion per month.

[caption id=”attachment_308444″ align=”alignnone” width=”1017″] Source: BNP Paribas, Bloomberg, monthly data, as of 6/30/20. Note: Coupon, net issuance less fallen angels and buybacks and total net issuance: three‑month moving averages; net issuance data from February 2004 to June 2020.[/caption]

Source: BNP Paribas, Bloomberg, monthly data, as of 6/30/20. Note: Coupon, net issuance less fallen angels and buybacks and total net issuance: three‑month moving averages; net issuance data from February 2004 to June 2020.[/caption]

The fact that corporations have taken several steps, such as front-loading issuance, cutting investments and shareholder payouts, may not fully offset the impact from weaker earnings going forward (due to the twin shocks of COVID‑19 and the oil crisis), but it could set them up nicely for 2021. We believe lower issuance for the remainder of 2020 will be an important story leading to credit remaining a well‑supported asset class.

Fixed Income Perspectives

Quarterly insight from our fixed income teams to help clients navigate the*As of 6/19/20