Knowledge. Shared Blog

July 2020

How Stable Is Your Fixed Income?

-

Lara Reinhard, CFA

Lara Reinhard, CFA

Portfolio Strategist

This year’s dislocation in bond markets impacted even core fixed income portfolios, resulting in a wide dispersion of both returns and risk. Portfolio Strategist Lara Reinhard explains why investors may need to assess whether their fixed income portfolios can offer sufficient stability given the high likelihood of continued volatility in the months ahead.

Key Takeaways

- While the surprisingly wide dispersions of both risk and return in August of last year primarily affected diversifying and non-investment-grade categories within fixed income, a similar dislocation appeared in core fixed income in the first quarter.

- The wide range of both returns and portfolio volatility we saw in the Morningstar core fixed income categories shows that not all core fixed income portfolios are created equal.

- Investors should assess whether their fixed income portfolio can help provide stability through potentially heighted volatility. With most global sovereign bond rates below 1% or negative, traditional benchmarks with large, passive weightings to sovereign debt are no longer a bond investor’s North Star.

The events of 2020 remind us of what we witnessed in actively managed bond portfolios on a much smaller scale in August 2019, when a shock in fixed income markets resulted in strategies within the same asset class exhibiting surprisingly wide dispersions in return and risk – and these were not pleasant surprises.

As we reflect on this year’s dislocation, we must reiterate our belief that bond allocations should be built to feel like bonds – especially when you need them to feel like bonds. While the comments we made in August 2019 focused on the diversifying and non-investment-grade categories within fixed income, the dislocation we saw this year was more widespread and, unfortunately, particularly impactful on the core portion of fixed income portfolios. Because a “core” fixed income allocation traditionally consists of high‐quality government and corporate bonds and is intended to help stabilize portfolios in exactly these types of sell-offs, the wide dispersion of returns is alarming.

Thrive … or Barely Survive?

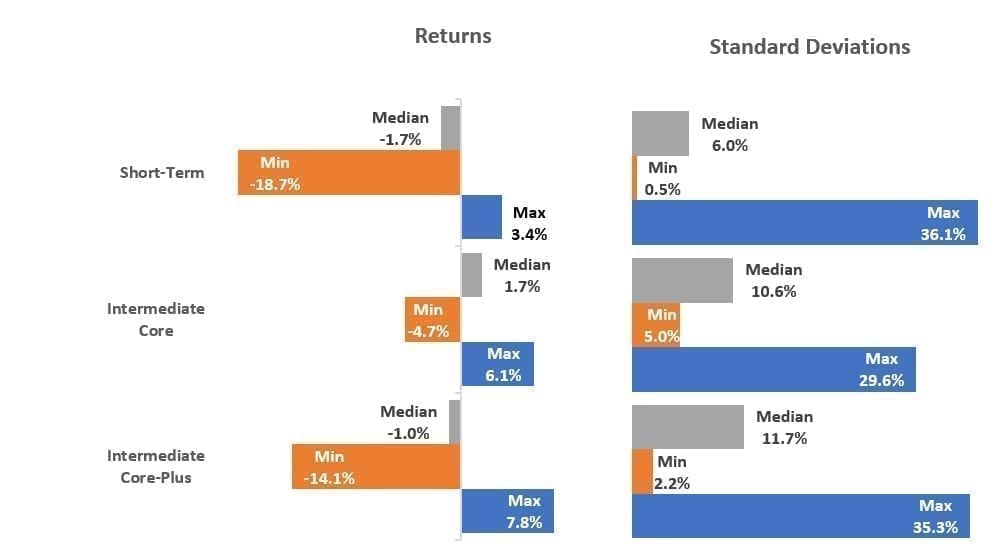

Just as we saw in August 2019 with diversifying fixed income asset categories, it has again become clear that all core fixed income portfolios are not created equal. The chart below shows the wide range of return and volatility we saw in the Morningstar core fixed income categories, which are not constrained only to government, in the first quarter of 2020.

Short-Term, Intermediate Core and Intermediate Core Plus Category Returns and Standard Deviations (Q1 2020)

[caption id=”attachment_308702″ align=”alignnone” width=”1006″] Source: Morningstar. Past performance is no guarantee of future results[/caption]

Source: Morningstar. Past performance is no guarantee of future results[/caption]

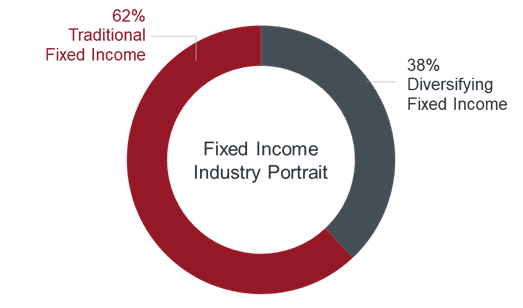

Based on recent readings from our proprietary database of almost 10,000 financial professional models, the average fixed income portfolio we encounter today allocates 62% to core fixed income. These average weights show that the reach for yield that has become ubiquitous since the Global Financial Crisis continues to stretch the risk boundaries of traditional fixed income asset classes – the preservation anchor of a portfolio.

With the COVID-19 crisis an ongoing narrative, the U.S. in an election year and equity markets amazingly near record highs at the same time, it’s important for investors to assess whether their fixed income portfolio can provide stability through potentially heighted volatility. With most global sovereign bond rates below 1% or negative, traditional benchmarks with large, passive weightings to sovereign debt are no longer a bond investor’s North Star. We believe investors need to dig deeper into the defensive tool kit in order to understand new opportunities and trade-offs within securitized, investment-grade corporates and both short and intermediate duration.

Our Portfolio Construction and Strategy team’s framework around fixed income can be a useful resource to help financial professionals address today’s increasingly disoriented market. Through a personalized consultation with our team, we can help financial professionals apply our fixed income framework to help address their clients’ goals and help them maintain balance in these uncertain times.

Abandon Your Doubts,

Not Your Goals

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe