Knowledge. Shared Blog

July 2020

Can Narrow Mid-Cap Leadership Continue?

-

Philip Cody Wheaton, CFA

Philip Cody Wheaton, CFA

Portfolio Manager | Research Analyst -

Brian Demain, CFA

Brian Demain, CFA

Portfolio Manager

Portfolio Managers Brian Demain and Cody Wheaton discuss the outperformance of overvalued mid-cap growth stocks and whether their leadership can continue.

Key Takeaways

- We are currently witnessing extreme behavior in mid-cap stocks, whereby the most expensive and most speculative names are dramatically outperforming the rest of the index.

- Some companies’ high valuations are being driven by network-effect economics, winner-take-most business models and strong revenue growth that has persisted despite an uncertain economic environment.

- While we respect the business models of many of these companies, in the long term a significant portion of these very expensive stocks may struggle to justify their worth on a fundamental basis.

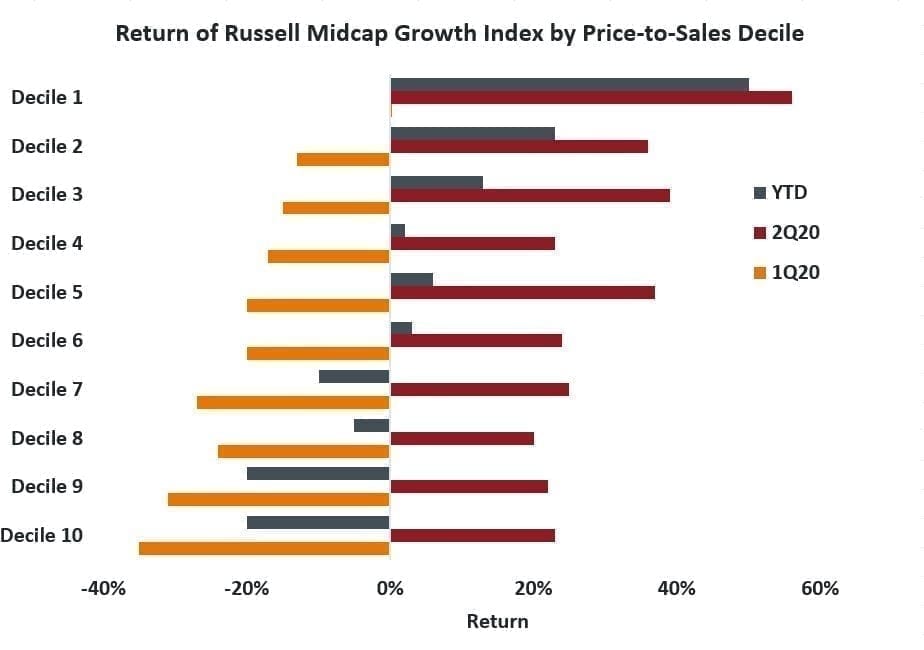

In mid-cap stocks today, we are witnessing an extreme divergence in performance, whereby the most expensive and most speculative companies are dramatically outperforming the rest of the peer group. In terms of the dispersion of returns, this is behavior that we have not seen since the late 1990s tech bubble. To illustrate this point, we can look at the Russell Midcap Growth® Index, segmented into deciles by price-to-sales ratio. In the first half of the year, the most expensive decile of the Russell Midcap Growth Index had a total return over 50%. The second most expensive decile had a total return over 22%. Conversely, the remaining 80% of the benchmark’s contribution to return was down over 5% during the same period.

[caption id=”attachment_308473″ align=”alignnone” width=”924″] Source: Janus Henderson Analytics, as of 6/30/20.[/caption]

Source: Janus Henderson Analytics, as of 6/30/20.[/caption]

This outperformance by the most expensive stocks has caused the entire Index to be revalued materially higher. We have become accustomed to the Russell Midcap Growth Index generally trading between 20 and 22 times expected earnings on average over the last seven years, yet the Index is currently trading north of 40 times expected earnings.1 As valuations have moved higher, we have seen the Index increasingly reweighted to the most aggressive and most expensive names.

What Is Driving Outperformance?

In examining the reasons for the recent outperformance, we see real fundamental underpinnings. Some of these companies benefit from powerful network-effect economics and winner-take-most business models. At the same time, many of the most expensive stocks are not valued on bottom-line earnings, but rather on top-line revenues. The near-term dynamic caused by the COVID-19 pandemic has led to earnings compression, and companies that have been able to deliver strong revenue growth irrespective of the macroeconomic environment have benefited during this uncertain time. Stimulus from the Federal Reserve (Fed) has also likely fueled higher valuations for growth stocks. In many cases, these companies may take years to reach profitability, and falling rates reduce the market’s discounting mechanism. This combination of inexpensive capital and the Fed’s willingness to backstop debt markets has likely encouraged investors to take on greater risk in the mid-cap space.

Are High Valuations Justified?

Historically, we have found that when stocks reach very high valuation metrics, they rarely are able to produce the type of forward growth rates that would justify their valuations. For instance, about 30% of the Russell Midcap Growth Index trades at greater than 15 times enterprise value-to-sales (EV/S). Based on our assumptions, a company trading at a 15 times EV/S multiple could need to compound revenue at 23% per year for a decade to achieve a 10% annualized return. Looking back 10 years, only 4% of public companies were able to grow revenues at even a 20% rate. When we look at the most speculative areas of the Index, while some companies will likely grow into their valuations and may even exceed expectations, in aggregate we think they will struggle to justify the valuations and may underperform on a multiyear basis from this starting point.

Will the Leadership Change?

Over the long term, as we move past the pandemic, our view is that we will return to a more normal economic environment where the typical laws governing stock valuation should once again apply. At that point, we think these very expensive stocks will struggle to justify their worth on a fundamental basis. In contrast, many profitable growth stocks that have felt real business impacts from the pandemic may emerge with a dramatic reacceleration and recovery of earnings.

Thus, despite extreme valuations in a small percentage of stocks, we still find the mid-cap growth space to be an attractive area of the market. At this market capitalization level, we think there are many companies that have growth rates similar to small-cap stocks, but as they are generally older, larger and more mature, they tend to have stronger competitive advantages. While investors in the space currently appear to be paying any price for growth, we also recognize that many undervalued stocks face considerable headwinds to revenue and profit growth. Accordingly, we think it is wise to focus on well-managed, fundamentally strong growth companies with durable competitive advantages and strong earnings trajectories that can fully support their valuations.

1Source: Janus Henderson Analytics, as of 6/30/20.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe