Knowledge. Shared Blog

July 2020

Certainly Uncertain: Managing Expectations When the Future Is Unclear

-

Ben Rizzuto, CRPS®

Ben Rizzuto, CRPS®

Retirement Director

Investors have long relied on historical market and economic trends to get a sense of what the future might hold. But while in a “normal” year the data suggest the third quarter of 2020 could bode well for client portfolios, the forthcoming election and ongoing global pandemic make for an exceptionally murky outlook. Retirement Director Ben Rizzuto explains why, amid this uncertainty, it is more important than ever to help clients stick to their long-term plans.

What each man wishes, that he also believes to be true.” – Demosthenes

The quote from Demosthenes encapsulates the kind of thinking many of us may have fallen victim to over the past few months. We wish that all of this would just be over, and as a result we may believe that the pandemic – and the ensuing market and economic turmoil – isn’t as bad as some say or that it won’t affect us.

We as humans don’t deal with uncertainty very well. As a coping mechanism, we often create emotional and mental distortions to help us feel more confident in uncertain situations.

Significant research has been done on uncertainty and how it affects the human mind. Some of the key findings are that:

- Uncertainty breeds overconfidence. Humans are notoriously bad at estimating probabilities, but we consistently overestimate our ability to do so.1

- Uncertainty encourages risk-taking. Uncertain humans will go to extraordinary lengths to avoid losses.2

- Uncertainty triggers short-term thinking. Humans tend to prioritize the present over an unknown future.3

Each of these findings highlights the idea that long-term financial planning is key to making sure investors don’t let uncertainty get the best of them by falling into these emotional traps. The stock market and the economy are two entities we must contend with when we create a financial plan, and both are inherently uncertain: We cannot predict with 100% accuracy what will happen next. Still, using historical market and economic data to help at least get an idea of what to expect has long been common practice. Financial professionals often use this data – with its consistent patterns of ups and downs – to set expectations with clients and illustrate the importance of sticking to their long-term plans.

But in 2020, those rules have changed. As we contend with a once-in-a-lifetime global pandemic, financial professionals will need to help clients understand that what we experienced in the recent past may not be a reliable indicator for what we can expect in the near future. And while that can be challenging, I also see it as an opportunity to remind investors why having a long-term plan is more important than ever. Because with the level of uncertainty we’re facing as we head into the second half of the year, investors need to be prepared to stick with their plan, stay focused on long-term goals – and steer clear of wishful thinking.

What You Might Expect … Were this a “Normal” Year

With that in mind, let’s take a look back at the second quarter of 2020: The S&P 500® Index added 20%, making it the best quarter since 1998 and the best second quarter since 1938! Based on this rather stunning performance, what might we see in the third quarter of 2020?

Again, in the midst of a global pandemic – and with a highly contentious U.S. presidential election on the horizon – the outlook for equity markets is extraordinarily murky. If this were a “normal” year, we might expect positive returns to continue in the third quarter, given the fact that this is historically what happens when markets enjoy quarterly gains. For example, in the second quarter of 2009, the S&P 500 returned 15.2%. That was followed by another 15% gain the next quarter, 21.3% over the next two quarters and 12.1% over the next four quarters. In fact, when looking over the past several decades, going back to the third quarter of 1970, when the S&P has seen a strong quarter, the subsequent quarter has been positive 100% of the time, the next two quarters have been positive 100% of the time and the next four quarters have been positive 87.5% of the time.4

On the other hand, it’s also important to remember that the third quarter is historically the weakest quarter for market returns. Between 1950 and 2019, the third quarter has returned on average 0.6% – still positive, but not the returns we would expect based on the strong trend outlined above.

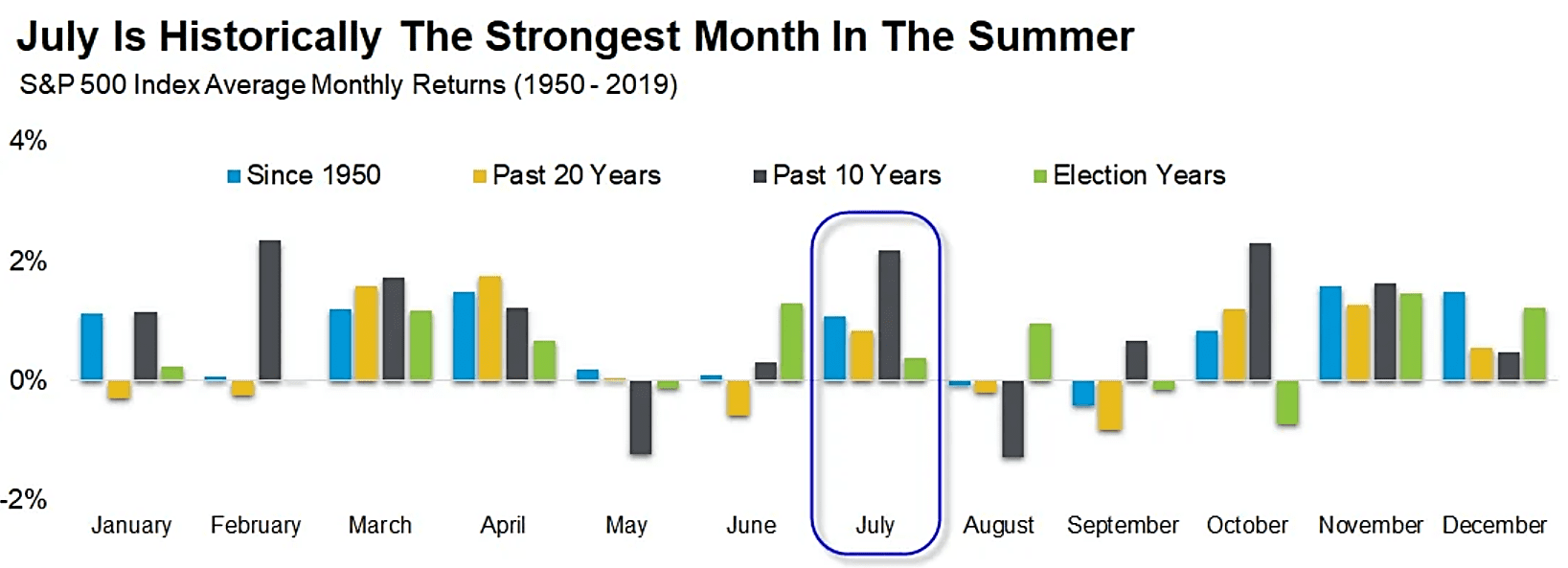

Taking this one step further, we can look at how those returns have historically broken down by month. July is typically the strongest month of the summer; however, as we move into August and September, things usually become a little less rosy.

[caption id=”attachment_306694″ align=”alignnone” width=”1637″] Source: LPL Research, FactSet, 6/30/20 (1950-current). All indices are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.[/caption]

Source: LPL Research, FactSet, 6/30/20 (1950-current). All indices are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.[/caption]

Why This Year Is Different … On Many Levels

In 2020, however, using one quarter’s worth of data to predict what will happen over the next six months is a foolhardy approach. For one, on top of COVID-19, we have the aforementioned presidential election to contend with. And historically, when we add an election to the mix, returns can be even more atypical. As you can see above, July and August are usually positive during election years, whereas September and October are negative.

It’s also important to remember that while last quarter was positive, the past six months were not. Historically, if the S&P 500 has seen positive returns in the first six months of the year, which has happened 48 times since 1950, the rest of the year continued positively 77% of the time and added an average 5.8%. Conversely, if the S&P 500 was negative for the first six months of the year, which has occurred 21 times since 1950, the remaining six months of the year were positive only 52% of the time, with average gains of 1.2%. (Remember, the S&P 500 was down 4% for the first half of 2020.5)

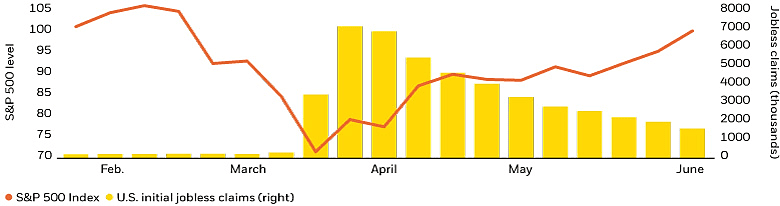

And let’s not forget the virus (as if that were possible). Until recently, it looked as though government lockdowns were having the positive effect of lowering case numbers. In the meantime, massive fiscal and monetary stimulus provided a lifeline to businesses and consumers and gave confidence to investors. Such policies are still having positive effects. The Paycheck Protection Program, for one, has been extended until August 8. With approximately $130 billion remaining of the initial $660 billion approved for the program, small businesses may be able to use these funds to stay afloat amid further lockdowns. Furthermore, on July 9, weekly jobless claims totaled 1.314 million – a decline of nearly 100,000 from the week prior – while continuing claims decreased to 18.06 million, a drop of 698,000. As jobless claims have dropped, the S&P 500 has rallied.

But the pandemic is far from over. With cases increasing across the country and states now being forced to reconsider closures, many more people could lose jobs, businesses may be forced to close and the economy may suffer even more.

S&P 500 Index performance and U.S. jobless claims, 2020

[caption id=”attachment_306705″ align=”alignnone” width=”780″] Source: BlackRock Investment Institute, with data from Refinitiv Datastream, June 2020. Jobless claims are weekly from Jan. 31-June 5, 2020. S&P 500 level rebased to 100 as of Jan. 31, 2020. Index performance shown for illustrative purposes only. It is not possible to invest directly in an index. Past performance is not a reliable indicator of current or future results.[/caption]

Source: BlackRock Investment Institute, with data from Refinitiv Datastream, June 2020. Jobless claims are weekly from Jan. 31-June 5, 2020. S&P 500 level rebased to 100 as of Jan. 31, 2020. Index performance shown for illustrative purposes only. It is not possible to invest directly in an index. Past performance is not a reliable indicator of current or future results.[/caption]

Thus, while in a normal year historical data might suggest the third quarter could bode well for client portfolios, the forthcoming election and ongoing global pandemic suggest the next several months are likely to be volatile for investors. Which brings us back to our original point: It is more important than ever for financial professionals to set expectations with clients – as unclear as those expectations might be right now.

I realize this is a difficult reality to accept. As financial professionals, we always attempt to bring as much certainty as possible to the table when we sit down with clients. But by helping clients come to grips with the reality of the situation, we can help them avoid the overconfidence, risk-taking and short-term thinking that often accompany uncertainty. And by helping clients steer clear of these emotional traps, we can help them put a long-term plan in place that they can stick to so that short-term bumps in the road don’t push them off track.

If you’re looking for more ideas on how to create or enhance your clients’ financial plans, check out our Essentials of Wealth Planning.

Abandon Your Doubts,

Not Your Goals

Learn More 1Harris, A. J., Corner, A., & Hahn, U. “Estimating the probability of negative events.” Cognition, 110(1), 51-64, 2009.2Levy, J. S. “Loss aversion, framing, and bargaining: The implications of prospect theory for international conflict.” International Political Science Review, 17(2), 179-195, 2009.

3“Brain battles itself over short-term rewards, long-term goals.” Princeton University, October 2004.

4“The Best Quarter Since 1998.” LPL Research, July 1, 2020.

5“Does a Weak First Six Months Mean Trouble?” LPL Research, July 9, 2020.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe