Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Doug Rao discusses the outperformance of secular growth companies and the themes that have allowed this leadership to become more entrenched during the COVID‑19 pandemic.

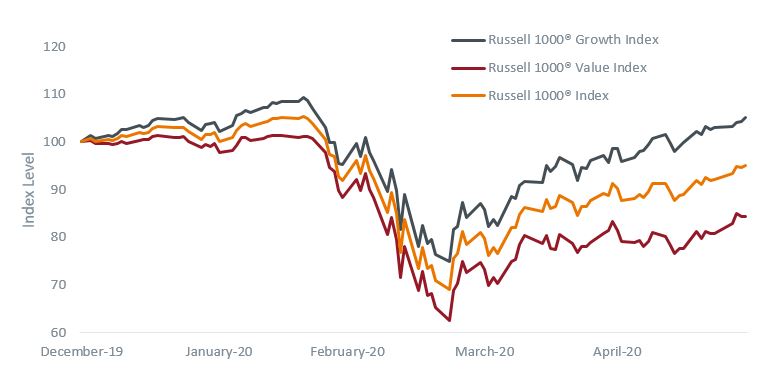

While large cap growth stocks have significantly outperformed their value counterparts and the broad market during the recent decade‑plus‑long bull market, they have also proven to be resilient amid the sharp economic downturn caused by the COVID‑19 pandemic. As evidenced in the chart below, the Russell 1000® Growth Index is positive on a year‑to‑date basis, while both the Russell 1000® and Russell 1000® Value indices are negative.

Source: Bloomberg. Data as at 29 May 2020. Past performance is not a guide to future performance.

During the market shock of the Global Financial Crisis in 2008-09, banks were some of the largest institutions in the economy and also among the hardest hit by the contraction, as many of them proved to be undercapitalised. Today, the US economy is dominated by large technology firms that are driving the outperformance of the large cap growth index versus other indices. These companies, boasting some of the strongest balance sheets in the world and generating robust free cash flows, have remained resilient and in some cases, have even benefited during this crisis as secular growth trends accelerate.

We are likely facing an extended period of low global growth and, consequently, low overall revenue growth for companies. In recent years, many companies not benefiting from secular growth have manufactured earnings growth by increasing productivity through outsourcing and financially engineering higher EPS (earnings per share) through mergers and acquisitions and share repurchases. This strategy appears to be losing steam, however, as markets have begun to re‑evaluate acceptable levels of leverage to some extent. Based on long‑term and recent performance, markets are rewarding companies that are durably growing and on the right side of technological trends that now appear to have been pushed forward several years by the crisis.

Digital transformation across almost all industries was clearly taking place before the current crisis but we have recently seen an acceleration of technological change. As an example, over the top (OTT) video consumption has picked up substantially during the pandemic, with Netflix adding over 15 million subscribers1 and Disney+ surpassing 50 million subscribers2 in the first quarter of 2020. The gains made now may enable pricing power in the future, increasing the value of these businesses. Furthermore, Netflix and Disney+ do not rely on advertising revenue, in contrast to their linear television competitors. The net effect has been to put Netflix and Disney+ at an advantage as advertising budgets tighten. What is more, it has also sped up the switch to digital advertising platforms like Facebook and Google.

While consumer spending overall has declined as a result of slowing economic activity, e‑commerce has gained as a percentage of total expenditures. Not only does this represent behavioural change but the increase in online spending also includes new demographic groups, such as older people who had not been as likely to shop online before the pandemic. The same forced adoption has taken place in areas of retail that were slower to go digital, like grocery shopping and online learning. In short, certain people and industries have been forced to adapt to a changed world and these behavioural changes may very well continue after the crisis.

As employees have had to work from home during the pandemic, and, by most accounts, productivity has remained high, corporations will begin to analyse the potential benefits of a permanent shift to a work‑from‑home environment. Companies not only face a level of business continuity and legal risk by returning to offices too quickly, but there are also potential productivity benefits from reduced commute times and cost benefits from needing less office space. Tangentially, permanent work‑from‑home situations could have significant impacts on the housing and commercial real estate markets as individuals and enterprises choose to live and operate outside of high cost urban centres.

Enabling all these technological trends are the extensive public cloud services built by companies like Amazon (Amazon Web Services), Microsoft (Azure Cloud) and Google (Google Cloud Platform). In fact, many of these themes could not exist without massive cloud infrastructure. The cloud offers cheaper, more agile and more secure enterprise information technology than on‑premises alternatives. But while these platforms have grown tremendously in the last five years, the buildout of the cloud is still in its early stages as corporate information technology penetration remains relatively low.

Consequently, we believe investment in cloud infrastructure has a long runway of growth, especially as the shutdown of physical locations across industries drives demand for new cloud solutions. We believe this demand will benefit the current leaders in cloud technology. For one, the current environment has brought technology budgets under pressure, making cost even more important. There are also high barriers to entry with enormous amounts of capital and sophisticated software developers needed to compete.

While we cannot predict macroeconomic outlooks, nor the trajectory of COVID‑19, we believe many of the themes we have discussed will not only persist but also get stronger over the coming months and years. Now more than ever, we think it is important to own companies that can benefit from these secular trends and that can continue to invest and grow. These are firms that have durable business models with deeply rooted competitive advantages, including strong balance sheets. Such qualities should allow these companies to allocate capital into growth opportunities despite a recessionary environment.

1 Netflix 1Q 2020 Shareholder Letter, April 21, 2020.

2 Disney Press Release, April 8, 2020.