June 2020

Are near-term debt levels a distraction?

Tim Winstone, CFA

Tim Winstone, CFA

Portfolio Manager John Lloyd

John Lloyd

Co-Head of Global Credit Research | Portfolio Manager

Key takeaways

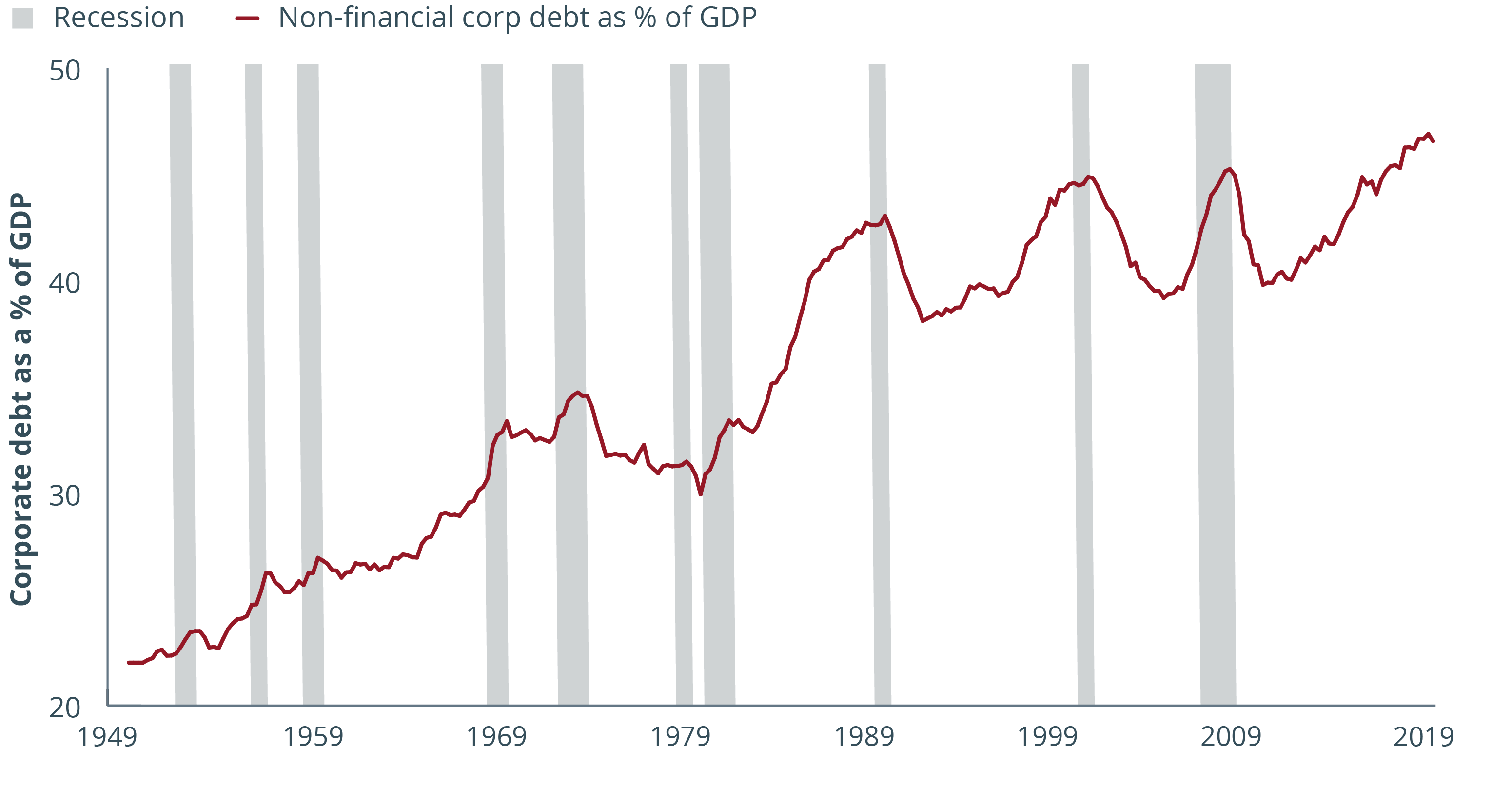

- The non-financial sector went into this crisis with record levels of borrowing and much of the central bank largesse, while welcome, will inflate this further (refer to exhibit 1).

- Yet corporates are adapting and refinancing their debt, which could help to reduce bankruptcy/default risk.

- We can expect an acceleration of structural disruption and differences in corporate responses, underscoring the need for discrimination in lending.

Please see glossary of terms beneath article

A cursory glance at the chart below and investors might be forgiven for thinking corporates have a debt problem.

EXHIBIT 1: US NON-FINANCIAL CORPORATE DEBT AS A % OF US GDP

This has reached record levels as interest rates have trended down

Source: FRED, Federal Reserve Bank of St Louis. Q4 1949 to Q4 2019, data as at 30 May 2020. GDP = gross domestic product.

Since the Global Financial Crisis, financials have been deleveraging but non-financial corporates have been leveraging up since 2011. In fact, as a percentage of gross domestic product US corporate borrowing reached a record high last year. Much of this is understandable: the downward trend in interest rates incentivises companies to use debt as a cheap source of financing.

Debt load is not uniform

The coronavirus crisis will raise leverage levels further as lost revenues are substituted by corporate borrowings to allow them to bridge the revenue valley caused by economic lockdowns and social distancing measures. Yet it may also lead to some positive longer-term outcomes. In Exhibit 1 there is a noticeable downward trend in borrowing after each recession event. We can probably expect something similar to occur post the COVID-19 crisis as companies scarred by the crisis seek to re-strengthen balance sheets.

This is where analysis of credit fundamentals come into play. We know 2020 aggregate leverage will rise. The leverage ratio of Net debt/EBITDA will see an expansion of the numerator as companies borrow more and a shrinking of the denominator as earnings fall.

Yet much of the recent issuance has been to refinance existing debt or to provide a liquidity cushion in case things get worse. Refinanced debt does not increase the total debt burden and actually reduces the near-term risk of restructuring/bankruptcy. For companies that are raising excess liquidity to protect in a downside scenario, this should not be considered a long-term increase in the debt burden as they will likely look to reduce debt once the economic environment normalises. And if the borrowing simply sits as cash on the balance sheet, then net debt is unchanged.

Of course, some companies are raising debt to fund negative free cash flow. This clearly increases the debt burden and it is where credit fundamentals matter the most. How long will companies burn through cash? Do these companies have the ability to support the increased debt burden? What might be the expected default rates?

We can establish which sectors and areas of fixed income are most likely to be hardest hit and which may come through this in even better shape. For example, in Europe, estimated earnings growth for 2020 sees sectors such as pharmaceuticals, technology and food retail experiencing positive single digit earnings growth. In contrast, consumer discretionary sectors are hardest hit, with year-on-year earnings declining more than 50% for sectors such as autos, energy and transport.1 The numbers appear stark, but we need to remember that 2021 figures are likely to show a significant bounce-back as economies recover.

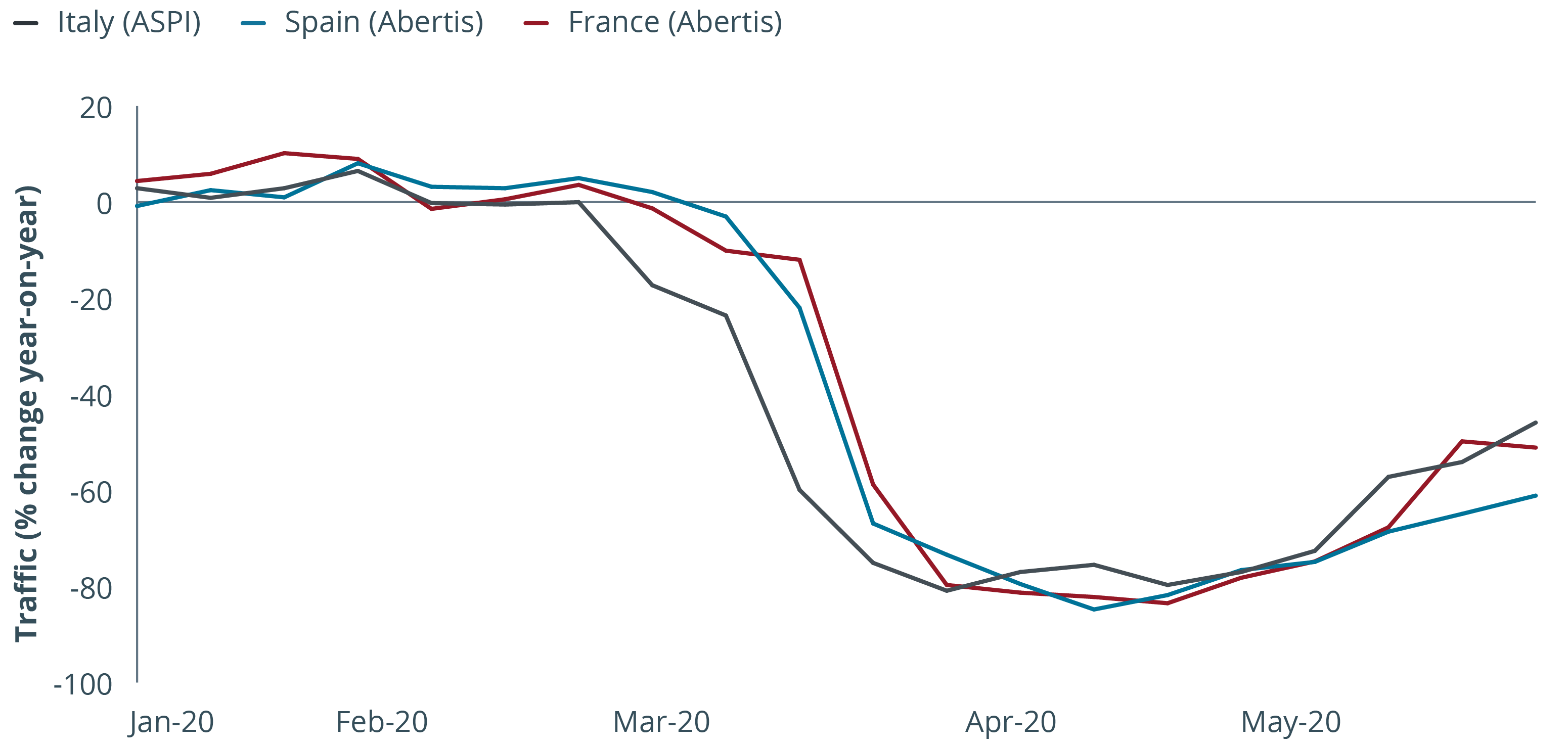

Yet taking one sector as a whole masks differences within that sector. The transport sector is a case in point. Companies within it are better placed than others for a re-opening of the economy. Social distancing is likely to present ongoing challenges for airlines and airport operators where passenger volume was a key element in driving revenues and cash flow. Some airline operators are expecting only to have 30% of their normal capacity in what would traditionally be the peak summer period. In contrast, toll roads could see a swifter return to normal given that social distancing here is not an issue and private vehicle use could potentially rise if people are reluctant to use public transport. Road traffic within Europe has quickly begun to recover as Exhibit 2 shows, even before lockdowns are fully eased.

EXHIBIT 2: TOLL ROAD TRAFFIC

Source: Goldman Sachs, company data, 12 January 2020 to 24 May 2020, data as at 28 May 2020

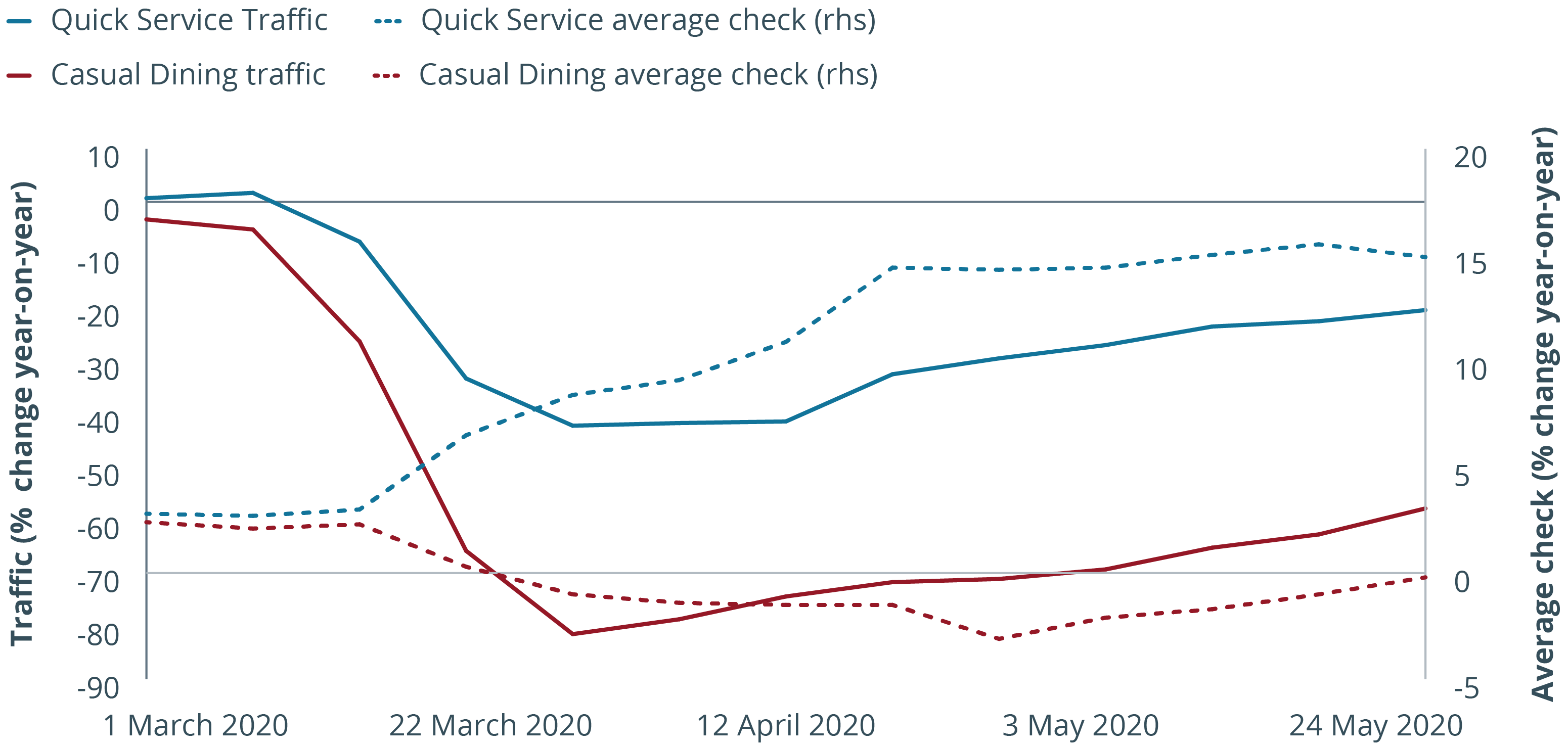

Similarly, in the US restaurant sector, we are seeing a dichotomy between quick service restaurants (QSR or fast food) and casual dining (more lingering at seat service). The former has traditionally carried higher leverage because cash flow tends to be more predictable and during recessions revenues have historically been firmer. This was certainly true during the Global Financial Crisis and looking at Exhibit 3 we can see this to be the case so far during the COVID-19 crisis, with traffic (footfall) declining far less in QSR. More efficient drive-thru only operations and consumers’ greater comfortability with off-premise oriented dining is helping QSRs to outperform casual dining. Structurally, QSRs are more likely to be national chains rather than independents and so are in a stronger position to benefit from enhanced scale and resources or to access capital markets to weather the pandemic.

EXHIBIT 3: TRAFFIC AND AVERAGE CHECK IN US RESTAURANT SECTORS

Source: Jeffries, Miller Pulse, 1 June 2020

Casual dining has also seen declines in average check (cost of meal) as patrons look to trim expenditure on a higher ticket meal. For QSRs, however, average checks have risen around 15% in recent weeks as they are offering more family meals and restaurant traffic has shifted to dinner (breakfast and lunch traffic have waned due to soaring unemployment and the shift to working from home), which is a higher ticket.

Structural change

The changes visible in the restaurant industry may be only temporary, more permanent is the acceleration in structural change. Technology companies are likely to be the winners as online retailing becomes more embedded, video-conferencing reduces the need for face-to-face meetings and streamed entertainment proliferates. Shifts in behaviour tend to become permanent when adopted by a majority and many people have (forcibly) begun to normalise a more digital world.

Equally potent is how individual corporates respond. The crisis is likely to bring forward internal structural change, with companies bringing in more technology and cutting costs. The pace of recovery will ultimately determine the default rate: a prolonged downturn or W-shaped recovery will erode cash reserves and challenge liquidity among more vulnerable and cyclical companies.

Policy response – this time it’s different

In that regard, it is worth highlighting the strength of the policy response, both in terms of its size and its speed. A trifecta of stimulus is available – low interest rates, quantitative easing and fiscal support. Moreover, monetary and fiscal policy are working in unison, unlike following the Global Financial Crisis when government austerity undid monetary easing.

The figures are impressive. By late May, central banks globally had announced nearly US$9 trillion of supportive measures, including a US$4.5 trillion expansion of their balance sheets since the end of February alone. Coupled with this is more than US$3 trillion of fiscal stimulus (not counting the automatic stabilisers of normal welfare) from governments and a further US$6 trillion of below-the-line fiscal measures such as guarantees, loans and capital injections.2

This is meaningful to both interest rate risk and credit risk. Central bank accommodation is facilitating bond issuance and expectations for low interest rates reduce duration risk. The fiscal support should directly and indirectly make its way into supporting corporates, lowering credit risk. Taken together, they help explain why credit spreads have snapped back significantly from their widest levels in March.

Ultimately, therefore, a near-term rise in debt levels may be both manageable in an environment where rates are held low and temporary as companies use the expected recovery to repair their balance sheets. Differentiating between those companies where this is true and those for which the crisis is an insurmountable obstacle will be key.

1Source: MSCI, IBES, FactSet Estimates, Morgan Stanley Research, 22 May 2020

2Source: Deutsche Bank, Covid-19: Policy responses by G20 economies, 21 May 2020.

Glossary

Leverage ratio: Any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations.

Net debt: Total debt minus cash and cash equivalents.

EBITDA: Earnings before interest, tax, depreciation and amortisation. A metric used to measure a company’s operating performance that excludes how the company’s capital is structured (in terms of debt financing, depreciation, and taxes).

Credit Spread: The difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, narrowing spreads are a sign of improving creditworthiness.

FIXED INCOME PERSPECTIVES

More Fixed Income Perspectives

Previous Article

Taking higher-quality risk in core plus bond portfolios

Greg Wilensky, Head of U.S. Fixed Income, discusses the importance of identifying and diversifying risk factors in bond portfolios.

Next Article

The long-term opportunity in structured securities

The Structured Securities team discusses its positive long-term outlook for U.S. structured securities in higher-quality, seasoned and shorter-dated exposures.

Next Article

A negative fed funds rate: not yet willing – or needing – to go “there”

Co-Head of Global Bonds Nick Maroutsos states that even without negative interest rates, bond portfolios must work harder to achieve desired results.