Subscribe

Sign up for timely perspectives delivered to your inbox.

With the COVID-19 pandemic expected to disrupt businesses and the economy for many months to come, Perkins Chief Investment Officer Gregory Kolb explains why he thinks investors need to recognize the likely impacts on their portfolios.

A few months into the deepest economic slump in decades, it is quickly becoming clear that COVID-19 represents more than just a “bump in the road.” Barring a major medical advance soon – which we can hope for but shouldn’t count on – the situation warrants a significant adjustment in how we think about stock portfolios.

According to Dr. Marc Lipsitch, an infectious disease epidemiologist at Harvard’s T.H. Chan School of Public Health, the novel coronavirus will be with us for a long time. “It’s going to be a matter of managing it over months to a couple of years. It’s not a matter of getting past the peak, as some people seem to believe.”1

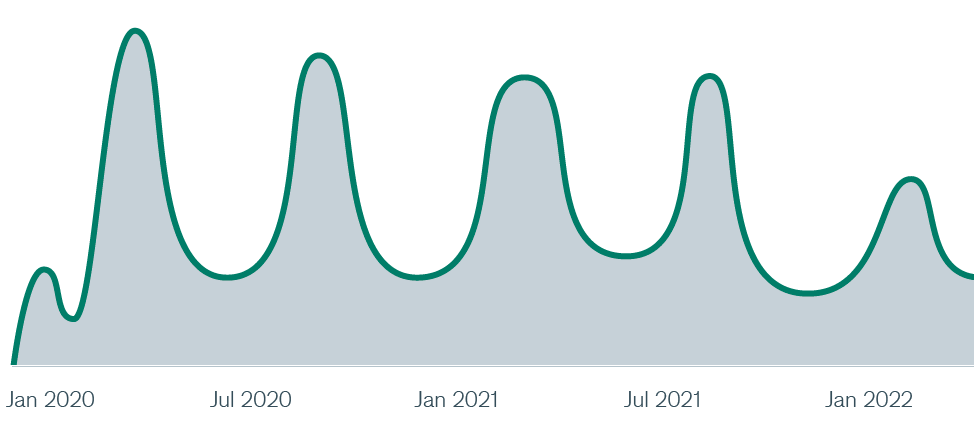

Dr. Lipsitch is co-author of a recent analysis from the Center for Infectious Disease Research and Policy at the University of Minnesota, which outlined several different scenarios for the future of the COVID-19 pandemic, one of which is reproduced below.2 The analysis suggests a series of incidence waves extending into 2021-2022 that will likely require disease-mitigating measures to avoid overwhelming the health care system. Eventually, herd immunity may be reached once an estimated 60%-70% of the population has been infected with the virus. In the meantime, vaccines take time to develop, and challenges are likely to arise.

Scenario 1: Peaks and Valleys

[caption id=”attachment_294546″ align=”alignnone” width=”976″] Source: Modified from the Center for Infectious Disease Research and Policy, University of Minnesota. Viewpoint, Part 1, April 30, 2020. The example provided is hypothetical and used for illustrative purposes only.[/caption]

Source: Modified from the Center for Infectious Disease Research and Policy, University of Minnesota. Viewpoint, Part 1, April 30, 2020. The example provided is hypothetical and used for illustrative purposes only.[/caption]

Stay-at-home orders and other COVID-19 mitigating measures – while perhaps warranted from a public health perspective – are ruining the economy. Unemployment has risen to Great Depression-era levels, retail sales and industrial production have suffered historic declines and economic anxiety has gripped both businesses and households, with confidence measures for both plunging.

Central governments have stepped in with massive quantities of money creation and deficit spending, while policy makers have moved quickly to attempt to avoid a deflationary collapse. Coupled with the beginnings of a “reopening” strategy, the hope is to limit the worst of the damage and get the economy growing again. But many of the business and consumer aid packages are set to expire in the summer or fall, creating an uncomfortable gap in economic support. Furthermore, while we suspect people are eager to get on with their lives, we also expect they will be hesitant to do so until they feel they can safely avoid the virus.

Given all the moving parts, it strikes us as absurd to be working with point estimates of business value. Rather, we consider two distinct scenarios: A realistic negative scenario and a more optimistic (but not blue sky) upside scenario. We find this approach helpful in assessing reward-to-risk amid today’s confusion.

The degree of difficulty in simply enduring the next several quarters will be higher than ever before across a range of industries. Some business models that worked well just five months ago may not function at all in this new environment. Especially in economically sensitive and/or high social contact areas, companies will likely need to be profitable for several years at a much lower level of revenue versus 2019 or else face reorganization. Market darlings such as technology and various growth securities (e.g., many Nasdaq stocks) will face the test of decoupling their revenues/profits from customers that are sustaining big hits or risk seeing their valuation multiples decline, perhaps substantially.

In our view, investors would also do well to remember the upside potential in equities. Many stocks are down meaningfully year to date and are recording subnormal levels of profits. But while a reasonable upside scenario may be pushed a bit farther out than is typical, we think brighter days still likely lie ahead. For example, we feel stocks in beaten-up areas of the market, such as select financials and health care, could see significant growth in a reasonable longer-term scenario.

The gap between the pandemic’s coming and going is proving uncomfortably long. We can hope for a medical advancement or for the virus to unexpectedly peter out. More practically, however, we think the sooner investors recognize the likely impacts on companies and stock portfolios, the smoother their investing experience is likely to be.

1Roberts, Siobhan. “This Is the Future of the Pandemic.” The New York Times, May 8, 2020.

2COVID-19: The Center for Infectious Disease Research and Policy. Viewpoint, Part 1, April 30, 2020.