June 2020

How do opportunities within Asian equities change post COVID-19?

Andrew Gillan

Andrew Gillan

Head of Asia ex Japan Equities | Portfolio Manager

Key takeaways

- The coronavirus has accentuated the widening gap between companies that can be classified as ‘winners’ and the rest of the market, and investors are discriminating against stock markets of countries with weaker fiscal* positions.

- Overall, Asian equities have traded significantly lower, but the Chinese stock market has been particularly resilient.

- While it may be a painful short-term shock to Asian companies and economies, we do not expect COVID-19 to alter the long-term growth potential that Asia offers.

In Asia, as with other regions, the experience so far has been that COVID-19 has either accelerated or emphasised some of the changes, tensions and challenges that were apparent before the virus appeared. Even as the crisis subsides, some of these are likely to have longer-term implications for how we interact and offer investment opportunities.

First, online and asset-light business models (that have fewer physical assets relative to the value of their operations) have proven more resilient so far, with significantly less disruption to their existing businesses. As an example, consumption habits and daily activities have adjusted to more time spent at home, which has led to increased usage of streaming services, computer gaming and e-commerce in general.

Second, the relationship between the US and China has once again deteriorated, reversing the progress made following the phase one trade deal. At the time of writing it is being suggested that the US is seeking compensation from China given the origins and global impact of COVID-19. Equally concerning is the US government’s decision to place restrictions on suppliers to Chinese technology company Huawei, citing national security concerns; this is likely to result in some form of retaliation from China.

Third, stock markets of the more emerging nations within Asia that are less capable of providing fiscal support to boost their economies, such as India, Indonesia and the Philippines, have been among the hardest hit despite possessing attractive demographics and compelling long-term consumption stories.

How has the virus changed sentiment towards Asian equities?

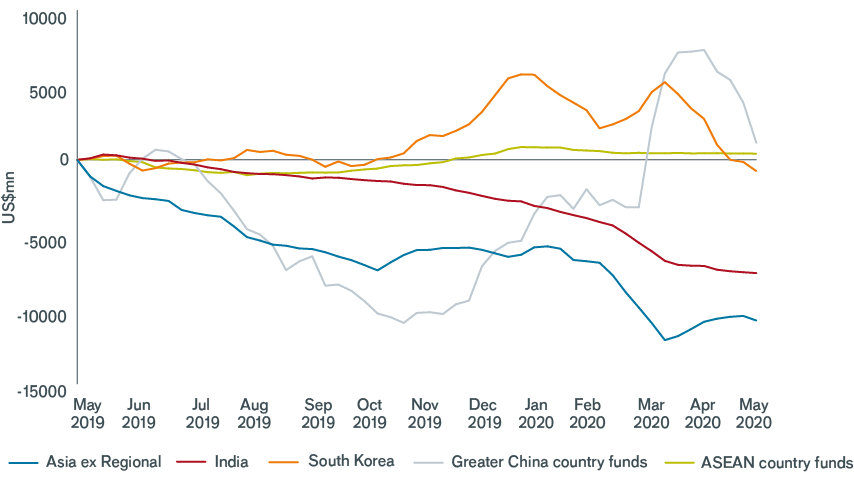

Globally, the majority of asset classes that carry a degree of risk have sold off since the January and February market highs, and it is no surprise that Asian equities, along with other emerging market equities, have fallen significantly to date in 2020, although there has been some recovery from the March lows, with China particularly resilient. Asian equities as an asset class has suffered outflows; but flows into China have generally been comparatively favourable (year-to-date to 13 May, see chart); a key driver has been the country’s increased benchmark weighting in global indices such as the MSCI Emerging Markets Index.

OUTFLOWS FROM THE REGION – BUT CHINA REMAINS FAVOURABLE

[caption id=”attachment_296658″ align=”alignnone” width=”854″] Source: EPFR Global, Citi Research. Asia ex Japan 52-week cumulative equity fund flows to 13 May 2020. ASEAN (Association of Southeast Asian Nations) includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.[/caption]

Source: EPFR Global, Citi Research. Asia ex Japan 52-week cumulative equity fund flows to 13 May 2020. ASEAN (Association of Southeast Asian Nations) includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.[/caption]

2020 had started on an optimistic note, following the US-China trade war resolution, but the increasing news flow initially about the virus in China just before the Lunar New Year holidays resulted in market weakness. This spread like the virus to the rest of the region and globally, as the full economic impact of COVID-19 started to become apparent. We have witnessed an unprecedented fiscal response to the crisis in the US, and while Asia too has seen significant monetary* and fiscal response, it has not been of the same magnitude as seen in some larger developed countries.

There have been some success stories in containing the virus but there are also signs of a ‘second wave’ in countries like China and South Korea. Clearly the overall impact on the economy of certain countries is likely to be more pronounced. The evidence so far suggests that social distancing and changes in pre-virus behaviour and consumption patterns may lead to longer recoveries for some sectors. In our view, while the overall economic impact may be temporary, the longer-term trends should return to normal. In other words, Asia has the potential to continue its strong economic growth in the coming years after significantly lower gross domestic product (GDP) growth, including contractions, in 2020. We believe the same is true of corporate earnings; while they will likely weaken in 2020 and some sectors may take longer to recover, we are confident that a return to superior earnings growth for many Asian businesses is likely.

Winners and losers – the importance of balance sheet health

In the short term, the virus has had a significant impact on some structural* areas of growth in Asia, particularly travel and tourism-related sectors, but also other consumer discretionary areas. Some of these will recover relatively quickly but others may take longer to return to pre-COVID-19 levels and valuations will need to adjust to that.

Social distancing means that seating capacities will be reduced within offices, restaurants and entertainment venues, while modes of travel will also be affected. Many businesses providing online services have extended their leadership during the crisis and look set to continue to thrive, provided their competitive advantages (and barriers to entry) are maintained.

Similarly, a number of Asian companies that supply vital components to the global technology supply chain have proven resilient during the crisis, and also look well positioned for the future. The tougher conditions are highlighting the strengths and weaknesses of corporate balance sheets; companies with less debt and strong cash positions are ever more likely to command premium valuations in the current environment and that of the foreseeable future.

Investment themes remain, with the younger population key to growth

We do not see significant shifts in terms of the investment themes that will prevail after the crisis. COVID-19 has, however, resulted in heightened macroeconomic risks, which vary greatly from country to country within the region. As a result, we see more compelling opportunities in developed Asia and North Asia, including China, Taiwan and South Korea. We are less positive on Southeast Asia and see the previously strong case for allocations to India weakening to a degree as a result of the crisis. While the crisis has led to a shakeout of markets globally, we believe the most compelling structural growth opportunities in Asia remain intact and can be found within the technology and consumer sectors. With Asia benefiting from its huge younger population with rising incomes, this demographic is generally more willing to adopt new technologies and adapt their ways of life. This is an attribute that will prove as important as ever in the post COVID-19 world.

*Fiscal policy/response: steps taken by a government to influence economic conditions by reducing/increasing government spending and/or raising/reducing taxes.

*Monetary policy/response: the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It involves controlling interest rates and the supply of money.

*Structural growth: a more permanent significant shift in the way a country, industry, or market functions, generally driven by major developments such as technological innovation, supply and demand of resources.

EQUITY

PERSPECTIVES Back to main

Related products

More Equity Perspectives

PREVIOUS ARTICLE

Sustainability and digitalisation: speeding the transition to a low carbon world

Hamish Chamberlayne explores the advancements made in the digital space and how this is closely linked with a sustainable future.

NEXT ARTICLE

Emerging Markets: ‘a rising tide will not lift all boats’

Daniel Graña argues that a large disparity is likely between the success stories of certain emerging market countries and the failures of others.