Subscribe

Sign up for timely perspectives delivered to your inbox.

Citing downward earnings revisions and bearish signals gleaned from options markets, Head of Global Asset Allocation Ashwin Alankar expresses concern that the recent rally in riskier assets ignores potential headwinds facing the U.S. economy due to lower consumption.

The unprecedented pace of the financial markets collapse and ensuing recovery has left investors questioning where the intrinsic value of riskier assets really lies. While progress has been made in combatting the COVID-19 pandemic and authorities have provided massive support for the economy and financial markets, we still cannot look at the pronounced rise in the S&P 500® Index since its March nadir and deduce that only sunny days are ahead.

Rather, to determine whether the recovery in asset prices is sustainable or is largely driven by transient factors, we need to apply other perspectives: What does history tell us about such rebounds? What hints do forward-looking indicators provide? And what are the conditions in the underlying economy that, ultimately, should dictate the value of equities and other asset classes.

When viewed through these lenses, the early-spring rally, in our view, appears tenuous.

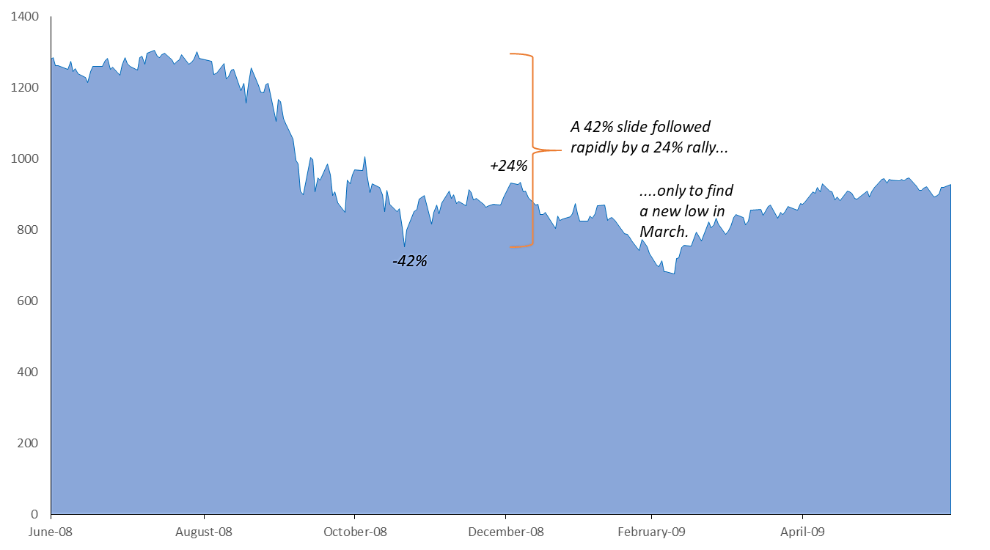

Short-lived bounces in stock prices even while markets establish new lows are not unheard of. In late 2008, equities rallied in response to the Federal Reserve’s (Fed) first round of quantitative easing and other programs aimed at supporting the economy. While investors welcomed these moves, it can be argued that some took their eye off the ball and didn’t fully grasp the harm being wrought on the real economy. Other parts of the market, however, tend to be relatively reliable forward indicators. At that time, two of these – corporate earnings revisions and options prices – continued to signal caution. Alas, as the magnitude of the housing crisis became apparent, the equities rally proved ephemeral and the market plunged to new lows the following March.

[caption id=”attachment_291550″ align=”alignnone” width=”990″] Bloomberg, data from 6/30/08 – 6/30/09.[/caption]

Bloomberg, data from 6/30/08 – 6/30/09.[/caption]

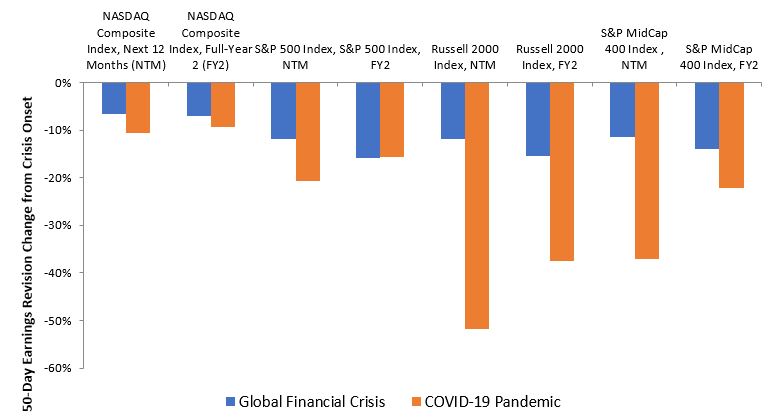

What do earnings revisions and options markets tell us now? Much like in 2008, they sound a more cautious tone than what’s reflected in equity prices. Analysts’ earnings expectations can be powerful signals as they reflect the view of the experts who most closely follow individual companies and sectors. Since the beginning of the year, full-year 2020 earnings have been revised downward at a pace faster than during the depths of 2008 as analysts take into account the near shuttering of the global economy. It can be argued that the pandemic is a one-off crisis – implying it’s isolated to this year – but following year (in this case 2021) earnings revisions for major indices have been just as torrid as what was registered in 2008.This sends a dire message that the impact of the virus could have much longer-lasting consequences for the economy and corporate prospects.

Comparison of analyst consensus earnings revisions from September 1, 2008, preceding the Lehman bankruptcy, and from March 1, 2020, just before the global spread of the COVID-19 pandemic.

[caption id=”attachment_291561″ align=”alignnone” width=”775″] Source: Bloomberg, as of 4/30/20.[/caption]

Source: Bloomberg, as of 4/30/20.[/caption]

Similarly, options markets see more downside than upside for riskier assets. As these instruments are often deployed by sophisticated investors to manage portfolio risk, the signals reflected in their relative bullishness and bearishness can provide hints on the direction of asset prices over the near- to mid-term.

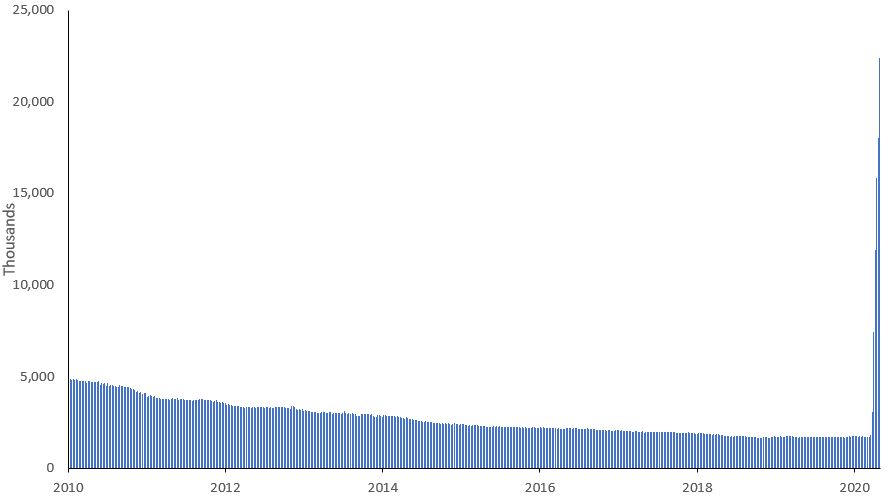

We believe that the prevailing economic conditions back up this wary view. What started as a public health crisis quickly morphed into a financial shock and now has become an economic crisis. Since late March, weekly initial jobless claims have averaged 4.8 million compared to 306,000 over the previous decade1. Continuous claims stand at nearly 23 million1. April’s change in nonfarm payrolls of a staggering 20.5 million2 was unlike anything experienced before.

[caption id=”attachment_291602″ align=”alignnone” width=”890″] Source: Bloomberg, as of 5/7/20.[/caption]

Source: Bloomberg, as of 5/7/20.[/caption]

Not all of these lost positions will come back. This is especially true in industries such as retail, travel and hospitality that have been acutely affected by COVID-19. Many small businesses – a key source of employment – will disappear due to lack of liquidity. Individuals fortunate enough to remain employed, may seek to boost their savings after having had their finances severely stretched. As John Maynard Keynes reflected nearly a century ago, household savings may be beneficial to the individual, but bad for aggregate economic growth.

Rising joblessness and potentially newfound thrift matters considerably in a country where personal consumption accounts for roughly 70% of GDP3. And still undetermined are the inevitable changes in consumer behavior brought about by the pandemic that will further impact corporate earnings.

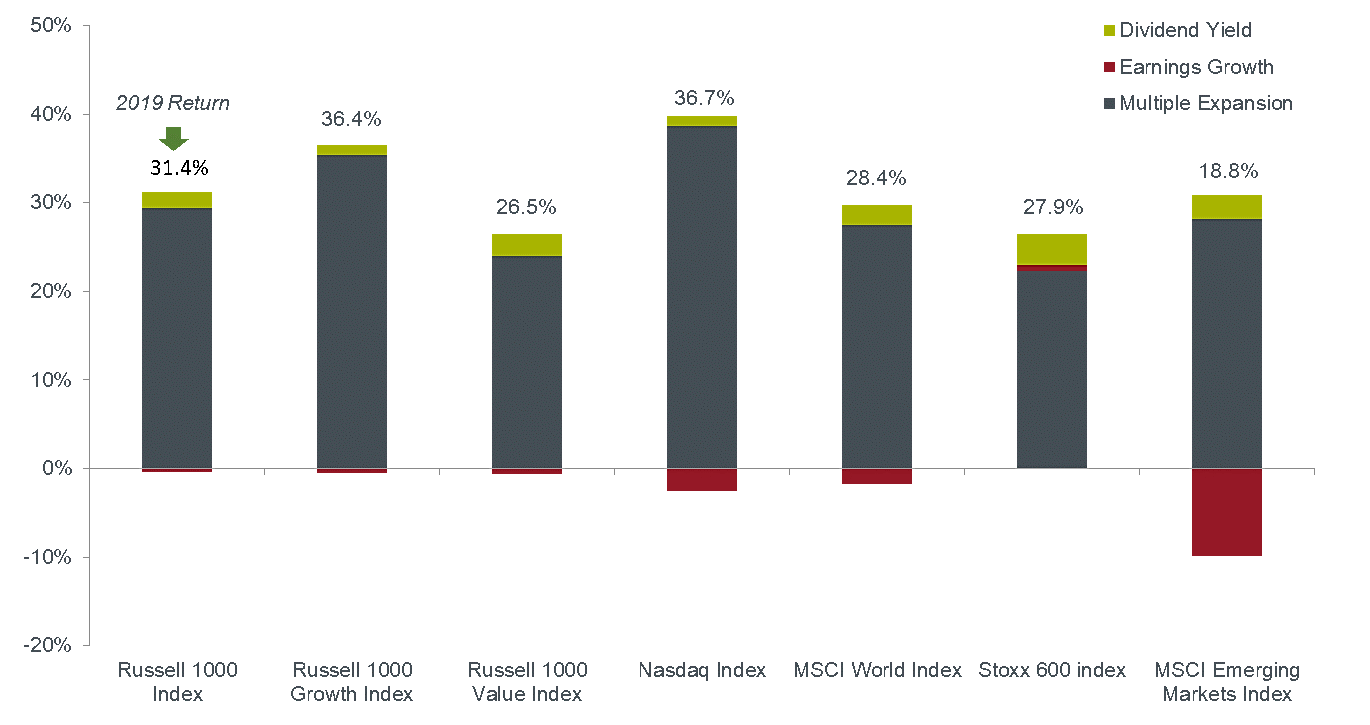

Lest we forget, U.S. stocks achieved record highs only in February. Driving the latter stages of the decade-long rally was P/E expansion and share buybacks. The latter is likely over, especially for companies that have gone hat-in-hand to the government for support. As evidenced by the torrent of earnings downgrades, robust corporate performance is also likely out of the equation.

Much of last year’s equity gains were driven by multiple expansion; investors priced in continuing share buybacks and a reduction in the trade impasse.

[caption id=”attachment_291583″ align=”alignnone” width=”1370″] Source: Bloomberg, as at 31 December 2019. Past performance cannot guarantee future results.[/caption]

Source: Bloomberg, as at 31 December 2019. Past performance cannot guarantee future results.[/caption]

That leaves multiple expansion as the sole candidate for rising markets. We are doubtful the justification for higher multiples exists. Price/earnings ratios tend to rise with lower interest rates, which we have in place thanks to the Fed. But we also know that they fall as risk premiums increase and growth rates decline. While companies capable of generating secular growth will continue to command a premium, and rock-bottom interest rates lowers the cost of capital for corporations, we find it a hard sell that unemployment resetting at a higher level, skittish consumers and increased savings won’t force investors to dial back the optimism that has fueled the equities rally. The resulting decline in earnings growth along with an historic level of uncertainty, in our view, will ultimately cause investors to command risk premiums on stocks greater than what is presently priced into the market.

When considering this backdrop, the expansion of forward P/E ratios across a range of indices by more than 50% since late March becomes all the more difficult to swallow4.

Notes: