Subscribe

Sign up for timely perspectives delivered to your inbox.

Guy Barnard, Tim Gibson and Greg Kuhl from the Global Property Equities Team discuss how COVID-19 is impacting the rental residential sector from both a landlord and tenant perspective and the longer-term investment case for the sector.

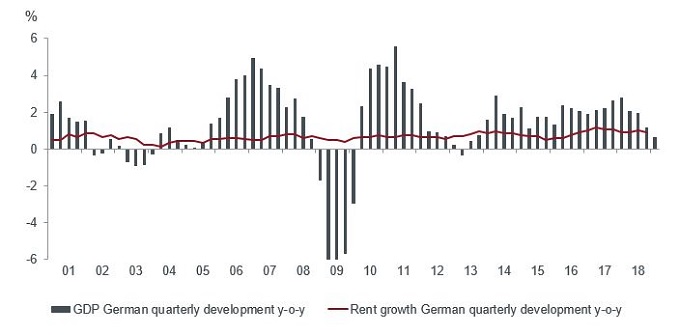

As the COVID-19 pandemic unfolds, the share prices of many property companies that are focused on rental residential housing have declined alongside other income-producing commercial real estate investment trusts (REITs) due to future concerns regarding tenant payment rates and the outlook for market rents. Global shelter-in-place/lockdown orders are leading to unprecedented economic disruption, yet significant government stimulus programmes seem to have provided funds to meet the basic needs for the majority of those experiencing hardship. In the US, data from the National Multifamily Housing Council Survey’s rent tracker shows that monthly residential rent collection levels at the end of April stood at 95% (close to the 98% in April 2019), and collection trends look to be improving through early May. This data appears to underscore the durability of the residential sector even during times of crisis. Likewise, in Germany listed residential landlords have noted little impact on rent collection and are still projecting rental growth this year, continuing a stable trend for many years, including through the Global Financial Crisis (see following chart).

Source: Statistisches Bundesamt, OECD, Morgan Stanley Research, as at 31 March 2020. Past performance is not a guide to future performance.

We have seen many apartment landlords commendably establish hardship relief programmes to aid tenants. This can be in the form of temporary rent deferral arrangements, flexible payment plans in the short term, as well as not raising rents. Furthermore, some companies are safely meeting the needs of prospective residents via technologically-enabled self-guided and virtual touring, and paperless contracts, facilitating contactless leasing. We have seen evidence that occupancy levels appear to be proving stable through the current economic downturn; several companies recently reported an increase in retention levels — more residents choosing to renew leases versus moving out, and an improvement in new leasing trends following a slowdown in early April2.

Although we remain constructive on the prospects of residential landlords, the regulatory environment warrants monitoring. Since late March, many countries have put in place eviction moratoriums, preventing landlords from evicting tenants even in the event of non-payment; the duration of which remains unclear. Additionally, we have seen the limited availability of moderately-priced housing become an issue in many cities around the world, with the current crisis further highlighting the importance of providing homes for key workers such as healthcare workers and teachers. This has led some cities to implement rent controls to restrict levels of rental growth. While the regulatory landscape will evolve and may prove unpredictable, the high levels of service and commitment to tenant welfare demonstrated during the crisis by professionally-managed landlords will, we hope, create a more balanced debate.

So, while many of us are eager to spend more time outside of our homes, the residential sector’s needs-driven characteristics, generally high levels of tenant retention, and technology-enabled operating platforms may warrant a longer- term ‘stay’ in homes for property investors.

Notes: