Knowledge. Shared Blog

May 2020

Know What You Own: Small-Cap Investing through a Market Shock

Craig Kempler, CFA

Craig Kempler, CFA

Portfolio Manager

Portfolio Manager Craig Kempler discusses how small-cap company characteristics within an index can vary widely, creating hidden risks and often making what you don’t own as important as what you own.

Key Takeaways

- Illiquidity, debt and negative earnings – particularly in smaller capitalization stocks – can create significant risks during a market downturn.

- In the face of unexpected investment shocks like we are currently experiencing, not owning these lower-quality, highly levered non-profitable companies can have as much of an impact on portfolio returns as what an investor owns.

- Index fund investors who do not consider these factors may be taking on more risk than they realize.

Why Active Management, and Why Today?

While what you own drives investment results, what you don’t own can be just as important to the total return of your portfolio. Active management can potentially help investors not only own high-quality companies, but also avoid lower-quality, highly levered money-losing companies. Said another way, a focus on avoiding significant investment losses goes a long way toward pursuing market-beating returns. We believe it is important to consider risk and how portfolios will fare in the face of unexpected investment shocks, with the current COVID-19 pandemic as the most recent example.

Small-Cap Liquidity and Financial Risk

From that perspective, we believe there are inherent risks – both from a liquidity and financial standpoint – when one chooses to invest in an index fund. From a liquidity standpoint, especially as market capitalizations get smaller, if passive investments have large outflows, they must sell positions in illiquid companies regardless of market price or future investment potential. The reason for this is simple: Index funds cannot deviate significantly from the total return of the underlying index they track. Active management does not have that constraint. On the contrary, managers are expected to act differently than the benchmark, especially during periods of weakness. Hence, during periods of sharp liquidity-led selling like what we recently witnessed due to COVID-19 concerns, an active manager can choose to use market dips to buy stocks that are being sold for liquidity reasons.

Debt and Negative Earnings in a Small-Cap Index

Fundamentally, how risky are the companies that make up the Russell 2000® Value Index? Let’s look at two metrics that may cause large investment losses: debt and negative earnings. Companies that have high leverage and/or are losing money are the most at risk during a down period. Since we never know when a downturn could occur, it is important to consider leverage and earnings stability when constructing an investment portfolio.

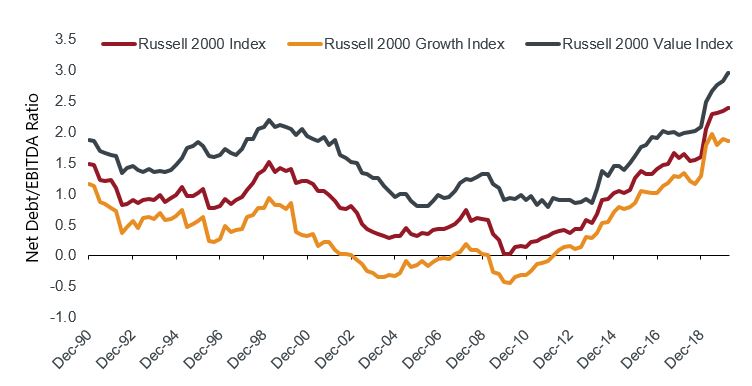

As of April 2020, the Russell 2000 Value Index had a net debt-to-earnings before interest, tax, depreciation and amortization (EBITDA) ratio, excluding financial and real estate companies, of 2.9x (see chart below). An active portfolio has the ability to reduce this ratio by holding companies with significantly less debt and positive net cash on their balance sheets.

Regarding earnings, or the lack thereof, more than 30% of the companies in the Russell 2000 Value Index were losing money as of April 2020 (Source: Jefferies). So, to answer the original question, we believe that, from a financial standpoint, the composition of the index has some significant risks as it relates to company fundamentals – most notably high debt levels and a lack of companies generating positive earnings. Wouldn’t it be great as a small-cap investor to not own those companies? While an active manger can choose to not own those riskier companies, this is a luxury index funds do not have.

Net Debt/EBITDA Ratio- Russell 2000® Indices (1990 – 2020)

[caption id=”attachment_292235″ align=”alignnone” width=”752″] Sources: FactSet; FTSE Russell; Jefferies[/caption]

Sources: FactSet; FTSE Russell; Jefferies[/caption]

A Focus on Risk First

We believe it is essential to stick to a disciplined investment process that, at its core, seeks to identify companies with limited downside risk and attractive upside potential. We also think it is crucial to build portfolios with the goal of having less risk than passive indices, regardless of the market environment, simply because it is impossible to predict when the next market downturn will occur. We do know, however, that if investors can lose less than the benchmark during periods of market stress, it can give them a head start for the next upturn. As such, it is important to understand the limitations of indexing. Investors who do not recognize this may be taking on more risk than they realize.

Abandon Your Doubts,

Not Your Goals

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox