Subscribe

Sign up for timely perspectives delivered to your inbox.

Key takeaways:

The Global Equity Market Neutral Strategy is a pure equity play, focusing on the delivery of alpha from long and short positions, irrespective of short-term market direction. Through these ideas we build a portfolio where we aim to be directionally neutral to the broader market, while also minimising bias to specific factors that we have identified as a potential risk.

The strategy is built around investing in a range of ‘best ideas’ sourced from selected teams across Janus Henderson that are actively involved in running money in the market. These ideas are typically put to work by using ‘paired’ investments, which involves combining short and long positions to achieve a particular outcome, or on the basis of relative value. This thematic approach may occasionally involve more than one stock on either the short or long side of a trade, or even Exchange-Traded Funds (ETFs) or indices. We utilise an approach based on risk parity when constructing the portfolio, with the volatility of the ideas risk-weighted to ensure equal risk contribution on both the short and long side. By risk weighting the ideas in this way, all ideas can have an influence on the return of the portfolio with no one idea being favoured above another.

Fundamental analysis and stock picking is at the heart of the investment selection process, while construction of the portfolio is a quantitative approach independent of this. Essentially, we allocate capital based on balancing the amount of risk that our models see each idea adding to the portfolio.

From there, we look to adjust capital allocated, based on our qualitative assessment on a range of other risk factors such as liquidity, style bias or beta.

Ideas for the strategy are contributed by a selection of underlying portfolio managers. Each manager is a specialist stock picker in their field, giving us coverage of most of the main global markets, with a blend of different investment styles. One of the most exciting aspects of running a global in-house ‘best ideas’ strategy is the flexibility to add capacity where we see potential value. The quantitative approach we take to constructing a portfolio allows all managers and their ideas to have an influence, balancing out the risks from one approach to another. Additionally, allocation within the portfolio on a regional or sectoral basis is driven solely by where we see the best opportunities. Overall, we aim to minimise any directional exposure in the portfolio within a framework we are comfortable with.

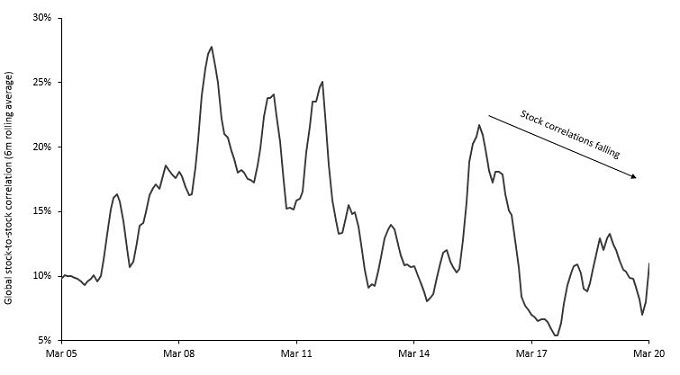

We model shorter-term volatility as part of our risk parity approach to help guide position sizing and overall risk across the strategy. The purpose is to ensure that all contributing factors are well balanced, to avoid any specific ideas influencing the portfolio more than others. Stock-to-stock pricing correlation has been on a sustained downtrend, with exceptions, since reaching a peak at the start of 2009 (see chart 1), in the early days of the global financial crisis. However, it has been no surprise to see a lot of cross-sectional volatility over the first few weeks of the COVID-19 pandemic.

Source: Bank of America Merrill Lynch, 31 March 2005 to 31 March 2020. Indicates the 6-month rolling average of global stock-to-stock correlation.

The imposition of social distancing measures, business lockdowns and restrictions on movement, as part of a raft of measures aimed at reducing the spread of COVID-19 has put a lot of pressure on certain sectors. During March we saw a lot of gapping in prices (where a stock opens the day at a different price to the previous day’s close, without any overnight trading activity), reflective of the level of investor uncertainty at the time.

Sentiment has been particularly negative towards areas like leisure activities — entertainment and travel, for example — where business activity has largely ground to a halt. Conversely, areas such as healthcare and information technology have proven very resilient thus far in 2020 (to 30 April 2020). This is the kind of environment where stock pickers can identify interesting plays on both the short and long side of a pair trade. But it is also one where great care is required to ensure that the strategy is not caught out at a structural level.

A raft of measures deployed by governments and central banks worldwide have helped to protect companies and workers, preventing a domino effect across stock markets. The US Federal Reserve’s unlimited bond purchase scheme, designed to protect the economy through the peak of the pandemic, which included the unprecedented step of purchasing corporate debt, has contributed to the scale of the rebound in asset prices. However, investors remain acutely aware that the bounce in valuations due to this financial liquidity does not discount the risks of further economic pain ahead.

With rates of infection in decline in many countries, the focus in some regions has now shifted to safely reducing the restrictions placed on populations, without causing cases to spike once more (a ‘second wave’). Investors are now paying a great deal of attention to the recovery potential across many parts of the market. While it was possible to quickly mothball non-essential services, the process of reopening is likely to pose greater challenges – from worker safety to reconnecting supply chains.

The economic impact to businesses of the COVID-19 pandemic has been significant across the global economy. In this environment, a global market neutral strategy has many tools to deploy. For example, it is possible to remove ideas where conviction drops, to switch either part of a pair if it falls short of expectations, or if the investment rationale has run its course. Keeping a constant dialogue with the underlying portfolio managers can also provide insight into ideas that may work well as a suitable pair; or provide the flexibility to tilt towards areas or investment styles that may be more suitable for the prevailing market environment.