Subscribe

Sign up for timely perspectives delivered to your inbox.

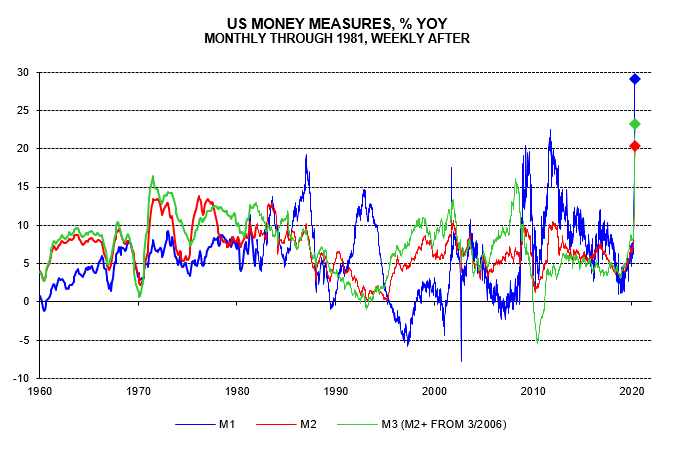

US money measures continued to explode into late April: annual growth rates of M1 and a proxy for the old M3 measure (“M2+”) rose to new post-WW2 highs of 29.1% and 23.3% in the week ending 27 April – see first chart.

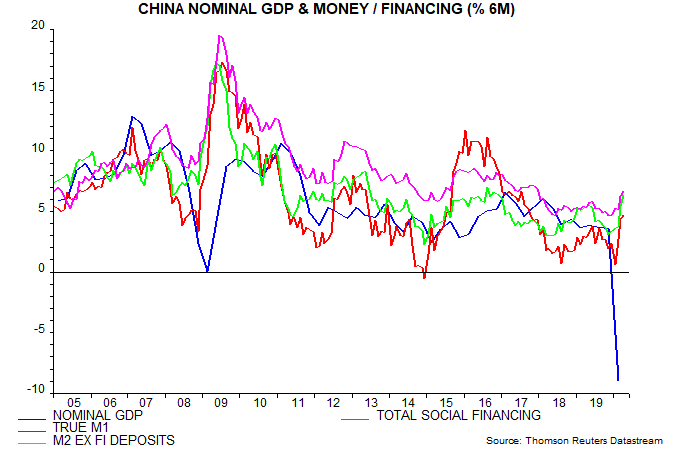

Chinese April data released today, meanwhile, showed further rises in annual and six-month growth rates of narrow and broad money as well as the “total social financing” credit measure – second chart. The Chinese pick-up, however, is of garden variety and pales next to US trends.

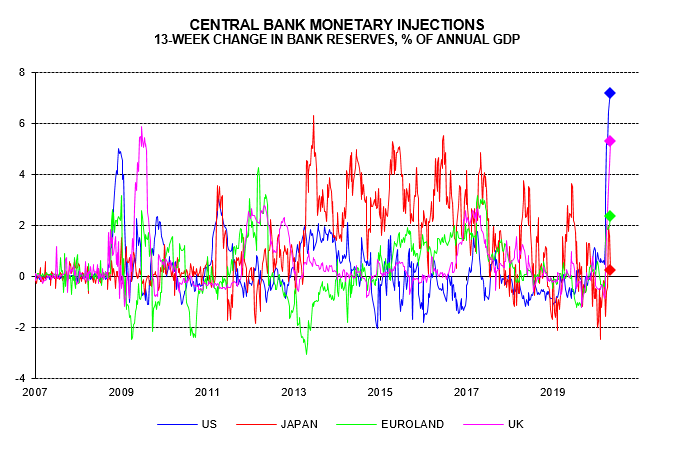

The US surge partly reflects the scale of Fed intervention: the boost to bank reserves from QE and various lending / liquidity support programmes has amounted to 7.2% of annual GDP over the last 13 weeks. The Bank of England has moved ahead of the ECB in the stimulus stakes, with an injection of 5.3% – third chart.

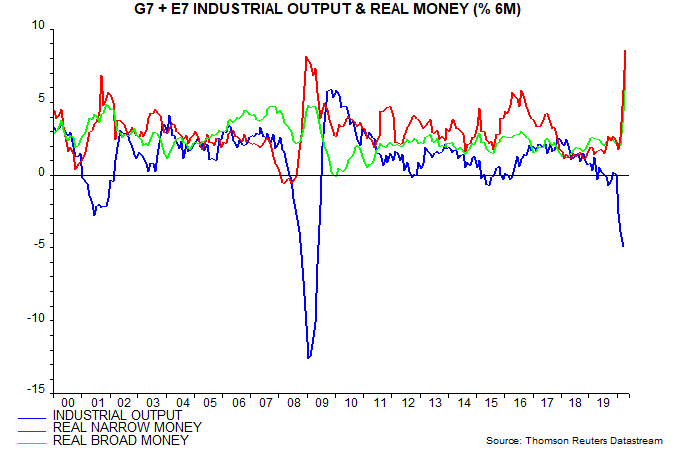

Based on April monetary data for the US, China and India and an expected plunge in consumer price momentum, six-month growth rates of global real narrow and broad money are estimated to have breached the highs reached ahead of the post-GFC economic recovery, implying the fastest expansion since the early 1970s – fourth chart. The estimates will be refined as additional April money numbers are released, starting with Japan and Brazil this week, but the above characterisation is unlikely to change.

Pessimists argue that the monetary surge is being offset by an even larger fall in velocity. This is trivially true currently but the velocity collapse is likely to prove temporary – it mainly reflects, after all, physical limitations on demand and production due to the shutdowns – while the monetary addition will almost certainly prove permanent: does anyone seriously believe that the current crop of “independent” central bankers will be prepared to argue for a reversal of QE, or even its cessation, as the crisis starts to abate?

An epic battle is continuing between monetary and economic / earnings theories of risk asset pricing. The monetary theory, so far, is winning: who would have imagined that global equity indices would be little changed from a year ago despite collapsed GDP and profits?