Knowledge. Shared Blog

May 2020

Bridging the Gap: Credit Markets in the COVID Crisis

-

Jenna Barnard, CFA

Jenna Barnard, CFA

Co-Head of Strategic Fixed Income | Portfolio Manager -

Nicholas Ware

Nicholas Ware

Portfolio Manager

Jenna Barnard and Nicholas Ware, Portfolio Managers on the Strategic Fixed Income Team, provide an update on the shape of the recovery in corporate bond markets following the virtual “heart attack” experienced in March.

Key Takeaways

- Catalyzed by the actions of the U.S. Federal Reserve, the primary market for U.S. corporate bonds reopened quickly in this crisis. While the floodgates opened for investment-grade issuance in March, the high-yield market reopened with a bang in April.

- What has stood out to us in the credit market trenches is the exceptional willingness of corporate bond markets to provide access to liquidity to a variety of companies, which will likely dampen default rates relative to the decline in the economies going forward.

- The crisis has accentuated the bifurcation between quality names that have access to cheap capital and value/zombie sectors, which do not.

In this article, we provide an update on the shape of the recovery in the corporate bond markets following the virtual “heart attack” experienced in March. Specifically, we attempt to highlight the exceptional willingness of corporate bond markets in this crisis to provide access to liquidity to a variety of companies, which we believe may dampen default rates relative to the decline in gross domestic product.

In many respects, this has been a crash experienced at dizzying speed and ferocity, both in the collapse in financial market plumbing, as well as the subsequent recovery catalyzed by the Federal Reserve after the central bank announced plans to purchase investment-grade and fallen angel high-yield corporate bonds. What has stood out to us in the credit market trenches is the willingness of the corporate bond market to lend. This is shown by how quickly the market has reopened for primary issuance (i.e., new issues), the scale of the issuance being undertaken and the range of companies able to access this liquidity.

We will provide a few such examples here, along with statistics to highlight current developments. The shape of the recovery in cash flow and earnings will ultimately determine whether these companies can service and repay the additional debt they are taking on. However, the willingness of credit markets (and governments) to bridge the coming quarters is a salient feature, which makes this experience different from the past. It is worth noting that during the Global Financial Crisis (GFC), high-yield issuance outside the U.S. ground to a complete halt for close to 18 months, while U.S. high-yield issuance fell dramatically between July 2008 and March 2009.

What follows is a brief snapshot of what is happening now.

Investment-Grade Market: Floodgates Are Open

The whole of the $6.7 trillion U.S. investment-grade market is currently open to its constituents, with the only question being one of price. Beginning in mid‑March, high-quality issuers like Proctor & Gamble, Kimberly-Clark and Disney reopened to the primary market with new issues priced at exceptionally cheap levels relative to existing bond curves (which themselves had already been repriced aggressively in the sell-off).

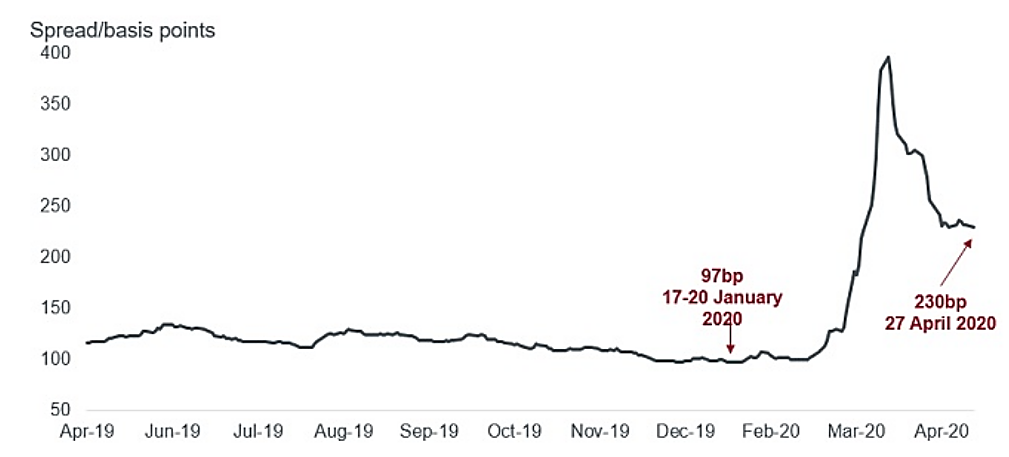

By late April, we found much smaller new issue premiums on offer and in select cases (e.g., Constellation Brands and Eli Lilly), new bonds were actually pricing at more expensive levels than their existing bonds as investors became more concerned about the ability to buy bonds than the price. This must, however, be considered in the context of the overall valuation of the market (see chart) in which investment-grade credit spreads traded at 230 basis points (bps) on April 27 versus a market that traded as tight as 97 bps in January.

Dramatic Movements in U.S. Investment-Grade Bond Spreads Since March

[caption id=”attachment_290464″ align=”alignnone” width=”1009″] Source: Bloomberg, ICE Bank of America, U.S. Corporate Index, as of 4/27/20. Credit Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating credit worthiness of corporate borrowers, narrowing spreads are a sign of improving creditworthiness.[/caption]

Source: Bloomberg, ICE Bank of America, U.S. Corporate Index, as of 4/27/20. Credit Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating credit worthiness of corporate borrowers, narrowing spreads are a sign of improving creditworthiness.[/caption]

This excess demand (with new issue over-subscription running at 4.3x year‑to‑date, versus 3.2x for the whole of 2019) has occurred despite a record‑breaking pace of supply, with investment-grade issuance elevated to $264 billion in March and $305 billion in April.1 (It is worth noting that a strong year in investment-grade issuance in the U.S. is approximately $1 trillion, so these monthly issuance numbers are quite extraordinary.) As of April 30, issuance year to date is running at $825 billion, which is up nearly 100% versus 2019 issuance and is on pace to be a record year of issuance, which we project could be as high as $1.5 trillion.2

In March, there was a greater share of high-quality companies – rated A or better – issuing, but encouragingly this has since migrated to BBB rated paper in April as risk appetite has returned. Reasons for issuing include a general bolstering of liquidity in the face of COVID-19 and oil‑related uncertainty, and a replacement of existing liquidity facilities following the breakdown of the U.S. commercial paper market and the subsequent drawing down on bank facilities in March, which are now being replaced with financing from the bond market.

High Yield: Which Companies Will Withstand the Storm?

Moving down the rating spectrum to high yield (U.S. market size: $1.2 trillion), the primary market has again reopened with a bang (the week of April 20 saw the second-highest week of issuance on record) but the picture is inevitably more selective in terms of who has access to this capital.

Indeed, the crisis has accentuated the bifurcation between quality names that have access to cheap capital and the value/zombie sectors that do not. There is a cohort of value plays that tend to be in cyclical legacy industries where this crisis could well be their last. Here it is not just a liquidity issue but also a solvency issue. We struggle, unlike a lot of market participants, to price that risk and to see a path for these businesses to get out of their predicament given they are burdened with debt, which means cash flows are diverted to servicing debt rather than improving the underlying business.

The ability to raise capital is inevitably seen on a case‑by‑case basis, with some businesses in the eye of the COVID-19 pandemic now able to approach the market, including theme park operator Merlin and hotel chains Marriot International and Hilton Hotels. Some quality businesses that were doing well pre-COVID-19 and that do not have a solvency issue are seeking to bridge a liquidity gap. These deals may be attractive provided they come with a sufficient coupon and the deals are structured well. In addition, these businesses, despite near‑term pandemic related weakness, could come out stronger after the crisis as some competition falls by the wayside.

Risk Assets Back on the Menu

For investors with cash to put to work, risk assets are back on the table. However, we must remember a core tenet of our sensible income philosophy: Does this business have a reason to exist? There have been a number of new bond issues by well‑known entities recently that we have not considered suitable investments because we foresee the companies having a challenging path forward, even without the coronavirus outbreak to contend with.

Then there is the last type of company, which we refer to as “The Walking Dead.” These were issuers that already faced challenges before the pandemic that are now being brought to the fore. We saw a surge of defaults and missed payments coming from the telecom, energy and retail sectors in April. These companies are taking the opportunity to right size their capital structure by wiping out debt and equity of current holders. In April, we saw Frontier – the U.S. telecommunications company with $15 billion of debt – voluntarily file for Chapter 11 as well as Intelsat – the satellite operator with $11.7 billion of debt – miss a coupon payment. The way we see it, before investors are willing to commit any further capital to these companies, they will want to see a capital structure where, if they do commit capital, they are not throwing good money after bad.

Abandon Your Doubts,

Not Your Goals

Learn More1Source: Bloomberg

2Source: Bloomberg

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe