Knowledge. Shared Blog

May 2020

Staying the Course through Market Volatility

-

Lara Reinhard, CFA

Lara Reinhard, CFA

Portfolio Strategist

For financial professionals, helping clients overcome statement shock and the temptation to market time can be critical for meeting long-term goals. One solution: the 60/40 portfolio, says Portfolio Strategist Lara Reinhard.

Key Takeaways

- For many financial professionals, this year’s market volatility may mean working with clients who want to reconsider portfolio allocations to try to make up for negative returns.

- However, history shows that one strategy that can help reduce losses is to stay invested throughout market cycles in a 60/40 stock/bond portfolio.

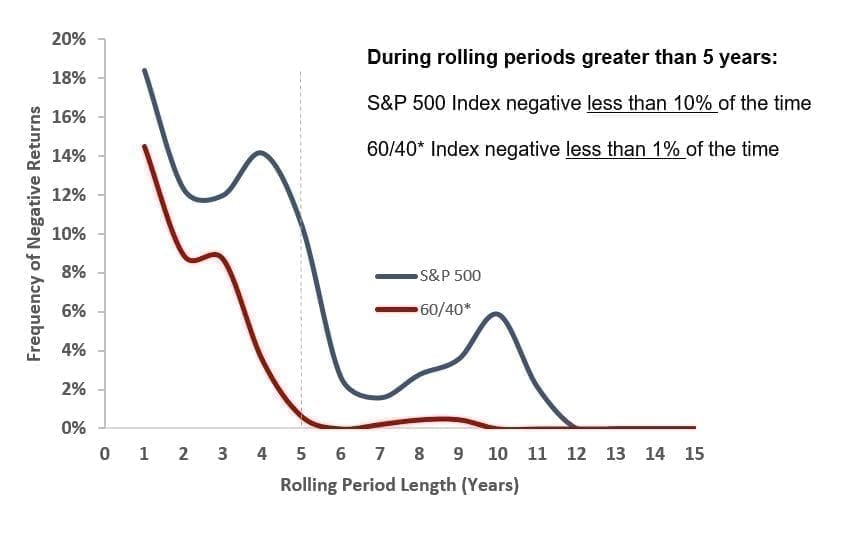

- Since 1976, a hypothetical 60/40 portfolio would have experienced a negative return less than 1% of the time on a rolling five-year basis, versus 10% of the time in a pure equity strategy.

March’s breakneck volatility caught many investors off guard, leading them to reconsider their portfolio allocations. Several conversations between our Portfolio Construction and Strategy (PCS) Team and financial professionals have focused on this recent volatility and the impact on performance for client portfolios. For long-term wealth generation, we have been taught to stay invested throughout all market cycles and maintain our eye on the long-term prize. However, as we experience this volatility, we know that two very strong emotions can get in the way of clients staying the course:

- Fear, and the fear of missing out

- Statement shock

As a team of Portfolio Strategists, we see multi-asset allocation strategies – blended stock/bond strategies – as a valuable tool to help keep clients focused on their long-term goals and manage their emotional reaction to short-term market moves.

Fear, and Fear of Missing Out

In a volatile market like the one we are experiencing, it is extremely difficult to correctly time market highs and lows. Consider that the S&P 500 Index’s 9.3% gain on Friday, March 13, was the best day since October 2008, while the 9.5% loss the day before was the worst day since Black Monday in 1987. With markets making a year’s worth of movement in a single day, the trading penalty for a mistake is massive. Unless we have access to the magic crystal ball, the best option is often to stay invested.

As you can see in the chart below, riding the storm out with a blended 60/40 stock/bond strategy has historically resulted in fewer periods with negative returns. Since 1976, a hypothetical 60/40 portfolio would have experienced a negative return less than 1% of the time on a rolling five-year basis versus 10% of the time in a pure equity strategy. The smoother performance of a blended 60/40 allocation may be no surprise to those who study markets, but it can help clients manage their emotions – and make all the difference in their ability to meet long-term financial goals.

Percent of Rolling Periods with Negative Returns (1976-2019)

[caption id=”attachment_307748″ align=”alignnone” width=”852″] Source: Janus Henderson Analytics; Morningstar. *60/40 Index is 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. Past performance is no guarantee of future results. [/caption]

Source: Janus Henderson Analytics; Morningstar. *60/40 Index is 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. Past performance is no guarantee of future results. [/caption]

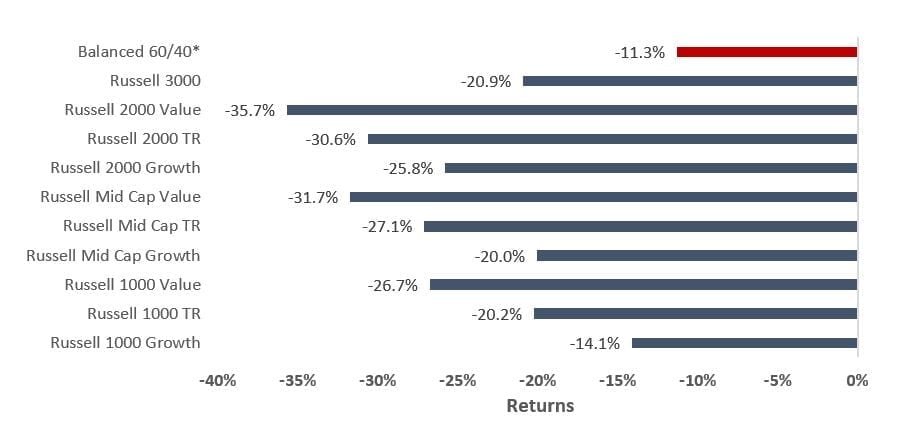

Statement Shock

Imagine your clients today looking at their year-to-date statements through March 31. In the chart below, you can see the performance of major asset categories for that period. Your clients likely own several of these line items as part of their asset allocation and, therefore, could see returns of -20% or worse. That’s a harsh reality made even more shocking after years of subdued volatility.

First Quarter Index Performance

[caption id=”attachment_307759″ align=”alignnone” width=”919″] Source: Morningstar, data from 1/1/20 to 3/31/20. The S&P 500 Index returned -19.60% and the Bloomberg Barclays U.S. Aggregate Bond Index returned 3.15% over this period. Past performance is no guarantee of future results. [/caption]

Source: Morningstar, data from 1/1/20 to 3/31/20. The S&P 500 Index returned -19.60% and the Bloomberg Barclays U.S. Aggregate Bond Index returned 3.15% over this period. Past performance is no guarantee of future results. [/caption]

Most of your clients likely own both fixed income and equities. When combined, the overall result – while still unforgiving – should be less of a shock to the system and hopefully deter the penalizing action of selling low. However, the problem, again, is an emotional loss-aversion bias that can lead clients to focus on those individual line items with big negative numbers. As financial professionals, you’re also probably stuck wondering how best to reallocate, leading to analysis paralysis. A 60/40 strategy may not be suitable for all investors, depending on their time horizon, risk tolerance and other factors. However, based on our research, funding a blended 60/40 strategy from some of these individual allocations may help produce a diversified and more palatable result at the end of turbulent times.

As we continue to face uncertainty in today’s global environment, we understand the importance of helping navigate the emotions that follow. Our proprietary portfolio risk analytics are designed to help financial professionals determine the most suitable solutions for investors’ specific circumstances. We encourage financial professionals to consider engaging our PCS team for help and access to these tools.

Abandon Your Doubts,

Not Your Goals

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe