Subscribe

Sign up for timely perspectives delivered to your inbox.

Monday’s post argued that global six-month real money growth was on course to approach (narrow definition) or exceed (broad definition) the highs reached before the post-GFC economic recovery. New information from Euroland and China necessitates a further upgrade to the assessment. Global money growth – whether nominal / real, narrow / broad or six-month / year-on-year – may soon be the highest since the 1970s. This suggests an economic boom when pandemic containment measures are relaxed, with attendant risk of an inflationary upsurge unless the monetary overshoot is corrected early in the recovery phase – implausible given likely pressure on monetary authorities to maintain super-low rates, finance fiscal deficits and promote bank lending.

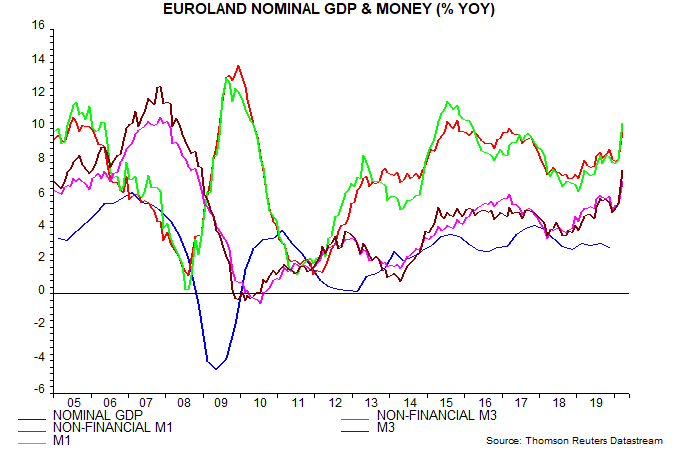

Euroland narrow and broad money (non-financial M1 / M3) rose by 2.5% and 1.8% respectively between February and March, pushing year-on-year growth rates up to 9.9% and 6.8%, the latter being the highest since 2008 – see first chart. The broad money surge was driven by a 1.5% rise in (adjusted) loans to the private sector – mainly non-financial corporations – supplemented by strong bank buying of government bonds. The latter may partly reflect front-running of ECB purchases, which were still stepping up and had a smaller monetary impact.

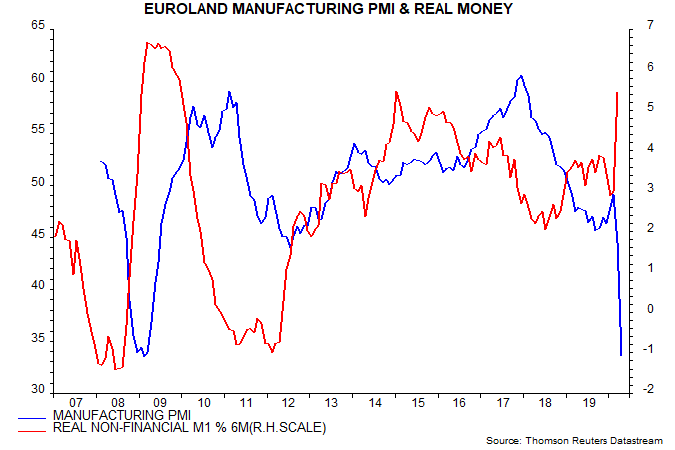

Six-month real narrow money growth matched a high reached in 2015, with the divergence with the manufacturing PMI comparable with early 2009 – second chart.

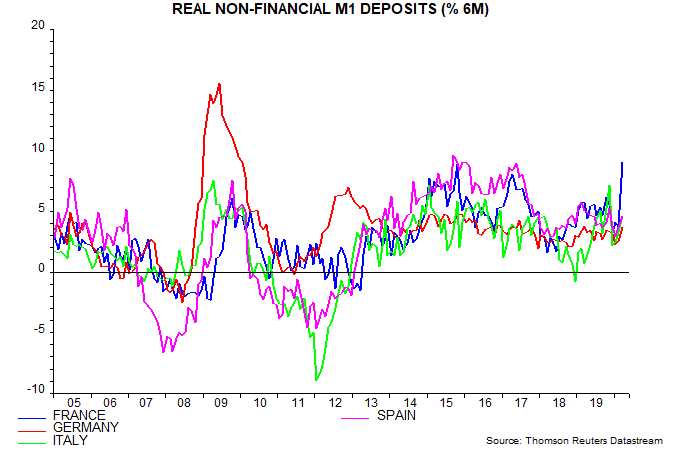

The money / lending pick-up was particularly strong in France, suggesting that the policy / banking sector response to the crisis has been more effective than elsewhere: M1 deposits of French non-financial corporations rose by €49 billion or 9.1% in March alone – third chart.

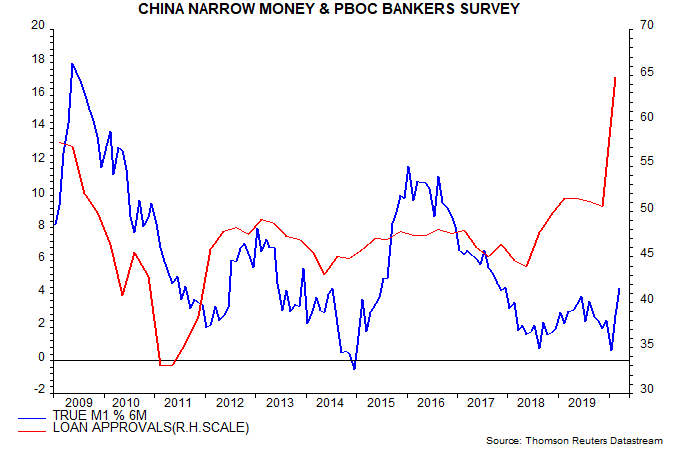

The good news in China was in the form of a sharp rise to a record level in the loan approvals index of the PBoC’s quarterly survey of bankers: this index leads credit and money trends – fourth chart.