Subscribe

Sign up for timely perspectives delivered to your inbox.

Key takeaways

This week’s hair-raising price falls in the oil market seems to have put the brakes on the month-old rally in equities and other areas considered more sensitive to the economic backdrop (such as commodities). While battle-hardened investors have come to terms with many unusual and unprecedented market phenomena in recent weeks, negative oil prices appear to have been just one novelty too many, for now. Still, Monday’s plunge in the May contract for US West Texas Intermediate crude oil, to an intraday low below -US$40 per barrel, was probably as good a time as any for investors to take a pause for thought.

Coming into this week, the world’s major equity markets had rallied by over 26% from the March lows, recovering 50% of the preceding sell-off[1]. Technical analysts see this sort of point as where they would expect to see a post-fall rally typically level off into a period of reflection. We see fundamental reasons to come to the same conclusion. In broad terms, we believe that the factors that drove the market rebound are now well understood and priced in, and the relative strength of positive and negative market themes are now fairly well balanced.

While improving news on both government policy and the coronavirus fronts propelled markets out of the deep gloom of mid-March, we believe that the next major battle for market sentiment will be fought over the outlook for the world economy in the second half of the year. One cautious view that must be respected here is that investors have very little visibility on this outlook right now, given the uncertainty surrounding the coronavirus and the economic restrictions associated with it. The continued slide in consensus estimates of economic growth and corporate earnings suggests that neither economists nor equity analysts have yet fully factored in the scale of the COVID-19 slump.

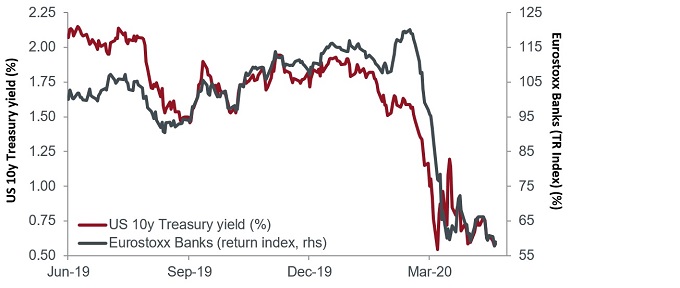

Although much of the recent volatility in the oil market reflects industry-specific supply concerns, it also reflects significant uncertainty over how much demand there will be from businesses and consumers. It is worth noting that weakness in economically sensitive (cyclical) commodity prices is not just an oil story. For example, the Commodity Research Bureau (CRB)’s Raw Industrials Index, a broad index covering raw material prices which tends to reflect real industrial demand, is also making a new low. The continued softening in growth expectations remains a global phenomenon and one that is evident in most sectors of the economy. This theme is also clearly expressed in government bond markets, where inflation expectations remain weak and where US 10-year Treasury yields remain very close to March’s all-time low (indicating a demand for investments perceived as ‘safer’). Exhibit 1 shows how this theme has been reflected in the synchronised movement between different areas of the market.

Source: Bloomberg, Janus Henderson Investors, 3 June 2019 to 22 April 2020.

Source: Bloomberg, Janus Henderson Investors, 3 June 2019 to 22 April 2020.

Note: EURO STOXX Banks Index EUR index rebased to 100 at start date. Generic 10‑year US government bond yields. Yields may vary and are not guaranteed. Past performance is not a guide to future performance.

While forceful government and central bank intervention and a belief that the first wave of the pandemic is peaking have fuelled a strong rebound in across equity markets in recent weeks, we would be wary of extrapolating the uptrend too much further for now. These positive themes have now gained widespread acceptance, which means that their ability to influence financial markets is likely to be fading. Accordingly, we believe that a period of market consolidation is more likely than a continued strong rally in risk assets for now. While cautious investor positioning and the extraordinary support from central banks should help limit the downside for investors, meaningful upside will probably require greater conviction in the strength of the global recovery in the second half of the year. This may take some time to emerge.

[1] MSCI World Index (USD), total return, 23 March 2020 to 17 April 2020.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.