Knowledge. Shared Blog

April 2020

Keep an Eye on the Real Economy

-

Nick Maroutsos

Nick Maroutsos

Co-Head of Global Bonds | Portfolio Manager

Co-Head of Global Bonds Nick Maroutsos expresses concerns that the recent rally in riskier assets does not reflect the acute stress felt by small businesses and households during this economic crisis.

Key Takeaways

- We believe that the recent bounce in corporate credit and equity prices was largely driven by optimism surrounding forceful action by policy makers.

- In a consumption-driven economy, the prospects of households ultimately dictate broader economic health, and we believe investors may be overlooking the financial stress placed on small businesses and households.

- Despite policy makers’ efforts, corporate defaults will occur, meaning investors cannot blindly buy the rally. At the same time, low Treasury yields may limit these securities’ diversification benefits to riskier assets.

The past two months have been unprecedented in the degree to which the COVID-19 pandemic has slashed economic activity and in financial markets’ reaction to both the crisis and the policy response it provoked. Despite the virus still spreading, testing likely inadequate and a vaccine at least months away, judging by the recovery in risk assets, one may be tempted to sound the all clear. As of Friday, April 17, U.S. stocks as measured by the S&P 500® Index were 28% above their recent lows and the premium commanded for holding investment-grade corporate bonds over benchmark 10-year U.S. Treasuries declined by 45%. We believe that much of the optimism expressed by this meteoric price appreciation is premature.

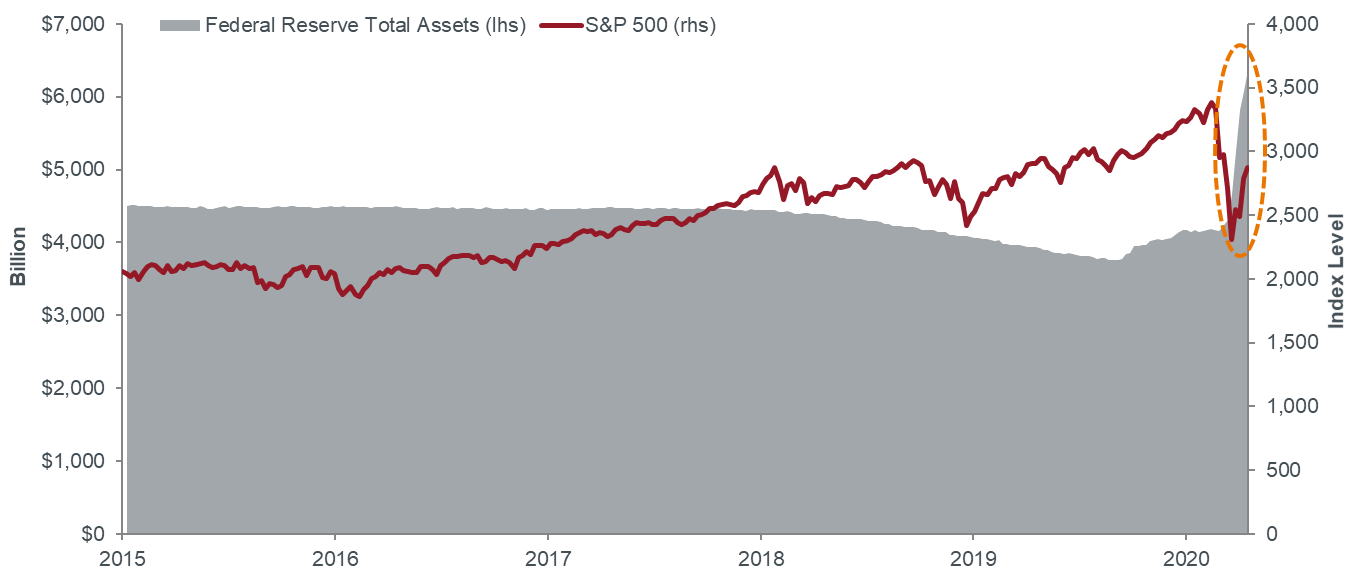

Riskier Assets Welcome Fed Balance Sheet Expansion

[caption id=”attachment_287287″ align=”alignnone” width=”1351″] Source: Bloomberg, As of 4/17/20[/caption]

Source: Bloomberg, As of 4/17/20[/caption]

Fed to Panicked Markets: Help “In the Amount Needed”

While we believe that policy makers have made the right moves in restoring market liquidity, buttressing access to credit and – on the fiscal side – offering support to households and small businesses, the rebound in U.S. stocks and narrowing of credit spreads assume that the global economy may swiftly return to the pre-COVID-19 status quo. We consider this unlikely, especially for an economy like the U.S. whose growth is dependent upon personal consumption. And with the global economy likely staring at a synchronized recession, trade flows are likely to provide even less of a boost than usual.

Which Street do You Live On?

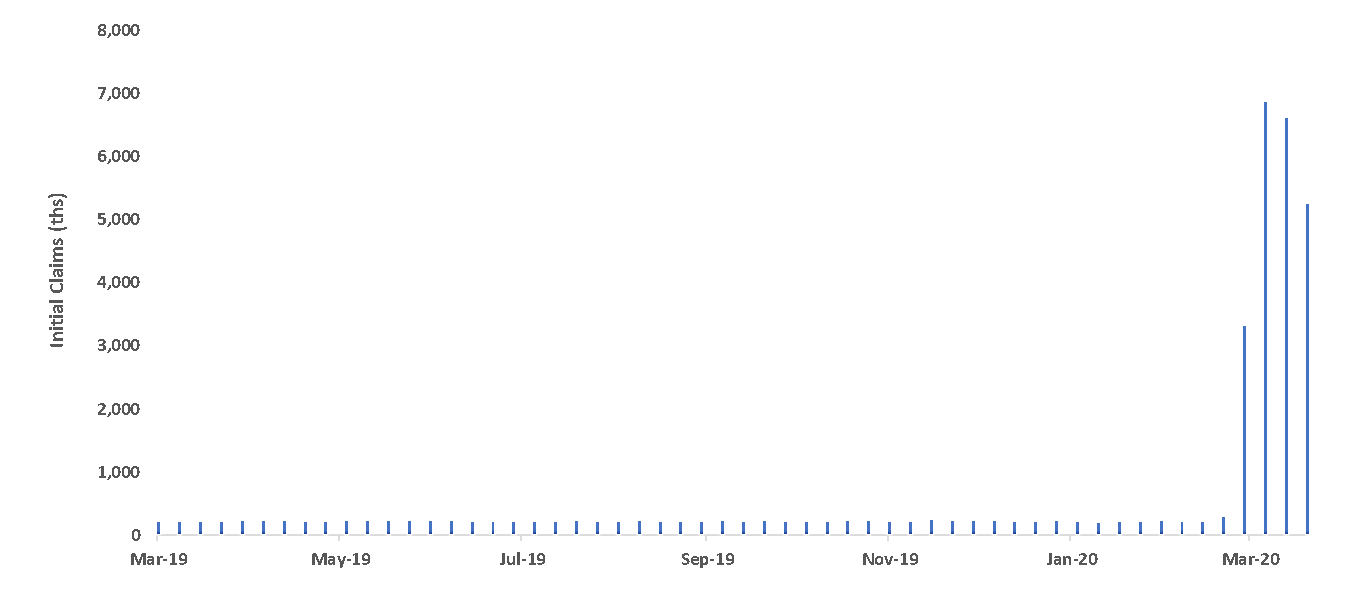

One often hears of the Wall Street vs. Main Street disconnect. Lost in the argument is that the prospects of the former tend to reflect those of the latter – especially in a consumption-driven economy. It’s the outlook for the real economy that concerns us. Over the past four weeks, 22 million workers have filed for initial jobless claims; this compares to a weekly average of 217,000 over the preceding year. Equally alarming, retail sales, including the hard-hit restaurant industry, fell 8.7% month over month in March – a period in which the country was only beginning to issue shelter-in-place orders. April data are likely to be far starker.

U.S. Weekly Initial Jobless Claims

[caption id=”attachment_287359″ align=”alignnone” width=”1350″] Source: Bloomberg, data from 3/22/19 – 4/10/20[/caption]

Source: Bloomberg, data from 3/22/19 – 4/10/20[/caption]

Markets are at risk of downplaying the stress this curtailment of economic activity will place on near-term corporate earnings. Furthermore, there is a big difference in the economic hit incurred by a three-month, six-month or even nine-month lockdown. Another potential miscalculation is to underestimate the degree to which consumer behavior will change once the worst of the storm passes. Some activity will simply transition from one medium to another. Don’t be surprised if recent adopters of e-commerce are reluctant to return to the status quo of fighting for a parking spot at the grocers. Other behaviors may disappear for the foreseeable future. Despite humans’ social nature, it may take a while before people once again are comfortable in crowded restaurants, cinemas, airports and amusement parks.

Expect Defaults

The Federal Reserve (Fed) wading into corporate credit markets – including purchasing debt from so-called fallen angels that have recently lost their investment-grade rating – may throw issuers a lifeline, but it won’t stop defaults. Some industries already face secular challenges, which have likely been exacerbated by this economic disruption. We see greater risk of defaults, however, for small businesses. With these organizations comprising close to half of the U.S. economy and notoriously having limited liquidity, many of these businesses may not make it out the other side. Given the number of Americans employed by small businesses, a surge in their unemployment would quickly transmit pain to other parts of the economy. Punctuating the magnitude of this risk is how quickly initial funding for the Payroll Protection Program ran dry. Accordingly, we expect to see additional upsizing on the already announced monetary and fiscal packages.

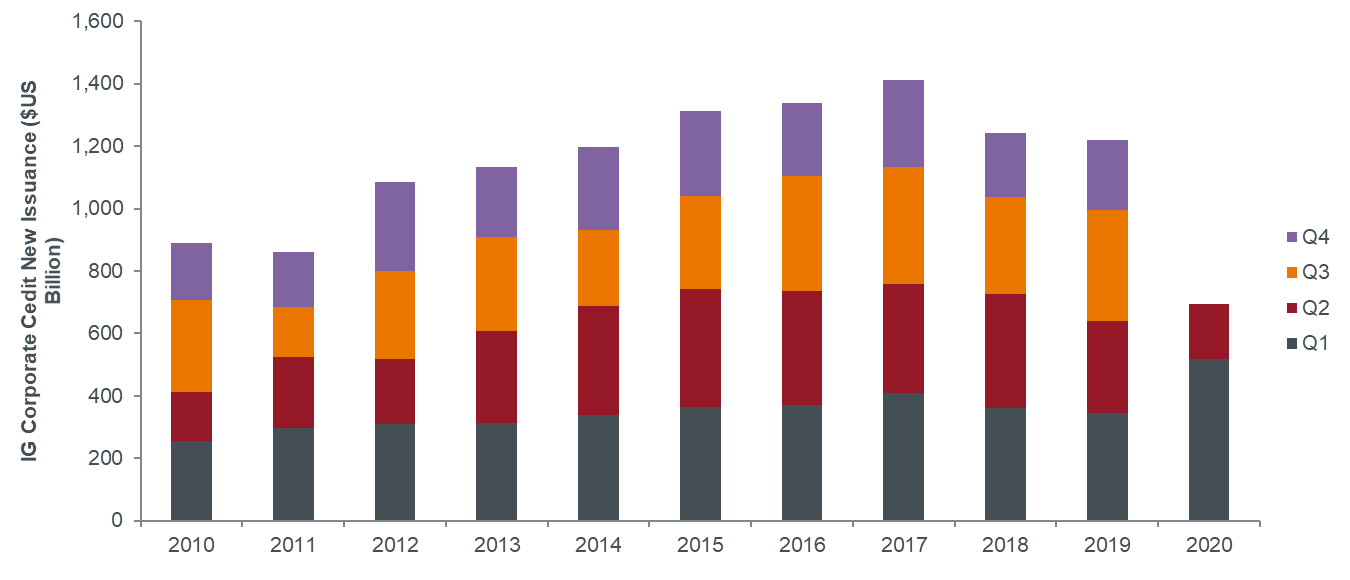

Catchy Phrases are not an Investment Strategy

Fed Chairman Jerome Powell validated the maxim “don’t fight the Fed” with his recent actions. Another popular investment adage is, “buy what the Fed is buying.” Looking forward, that appears to be a host of riskier assets. This may appear to be a win/win proposition, where corporations issue new bonds on favorable terms and investors buy securities at still wider-than-average spreads. One cannot presume, however, that there won’t be a divergence between parts of the market the Fed is supporting and parts it is not. While bond markets have rallied on the Fed’s largesse, eventually companies will again be judged on their ability to generate sufficient cash flow to cover their liabilities and to prudently manage their balance sheets.

U.S. Investment-Grade Corporate Debt Issuance

[caption id=”attachment_287309″ align=”alignnone” width=”1350″] Source: Bloomberg, As of 4/17/20[/caption]

Source: Bloomberg, As of 4/17/20[/caption]

One sector that faces acute challenges in maintaining financial strength is travel and tourism. We expect that the near-term stress placed on the sector from lockdowns won’t entirely subside given likely changes in consumer behavior. For that reason, we’d suggest investors heed our recent contribution to the market lexicon: Be wary of trips to the BEACH – Booking agencies, Energy, Airlines and Autos, Cruises and Hospitality.

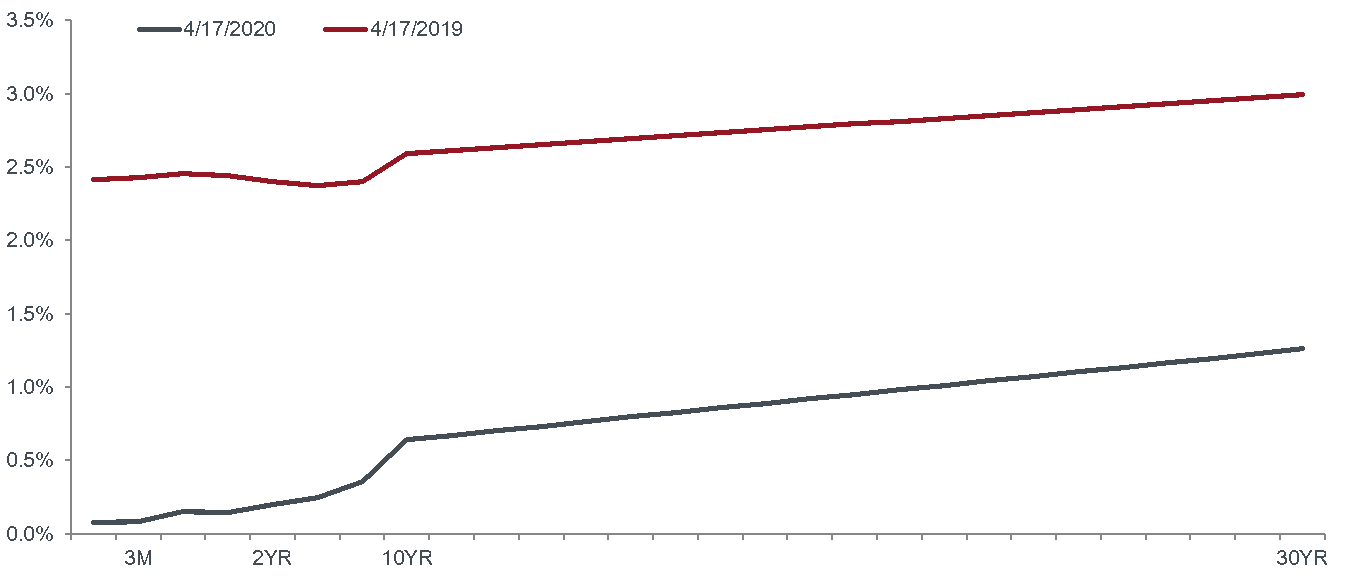

Correlation Breakdown

Similarly, the Fed’s activity in Treasury markets does not make these securities a sure thing. Far from it. In the past month, Fed holdings of Treasuries have risen by 45%. That – coupled with the policy rate at the zero bound and the Fed unwilling to go negative – results in very limited upside across much of the yield curve and likely a breakdown in the negative correlation between Treasuries and riskier assets. In fact, the unprecedented balance sheet expansion has injected a steepness in the yield curve that had been lacking for much of 2019. While definitely not our base-case scenario, the Fed’s commitment to hold policy rates low along with trillions of newly minted dollars could naturally be construed by some as inflationary. Given this risk, along with the limited upside for intermediate-dated bonds, we believe cautious investors have little choice but to hide in the front-end of bond markets.

U.S. Treasuries Yield Curve

[caption id=”attachment_287320″ align=”alignnone” width=”1350″] Source: Bloomberg, As of 4/17/20[/caption]

Source: Bloomberg, As of 4/17/20[/caption]

Abandon Your Doubts,

Not Your Goals

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe