Knowledge. Shared Blog

April 2020

Rebalancing in a Time of Chaos

-

Adam Hetts, CFA

Adam Hetts, CFA

Global Head of Portfolio Construction and Strategy

Adam Hetts, Global Head of Janus Henderson’s Portfolio Construction and Strategy Team, shares strategies for reallocating in the current environment and offers suggestions for how investors can avoid making irrational decisions based on short-term market moves.

Key Takeaways

- The dramatic price swings that have occurred across asset classes in recent weeks have caused many investors to question their approach to rebalancing.

- In our view, the reallocation process in the current environment should be no different from what is followed in less volatile markets and should involve a rigorous assessment of both current portfolio positions and baseline asset allocation. Put another way, market-timing impulses should not to be the driving force behind portfolio reallocations.

- Additionally, we encourage investors to view sunk costs from a blank-slate perspective: barring special circumstances, incumbent losses are nothing more than sunk costs that should be ignored.

Since mid-February, we have experienced multiple days of extreme market price swings, many equivalent to an average year’s worth of returns, and virtually no asset class has been immune. With these types of dramatic moves occurring across investors’ entire portfolios, it is not surprising that the Portfolio Construction and Strategy (PCS) Team has received an unusually large volume of rebalancing inquiries.

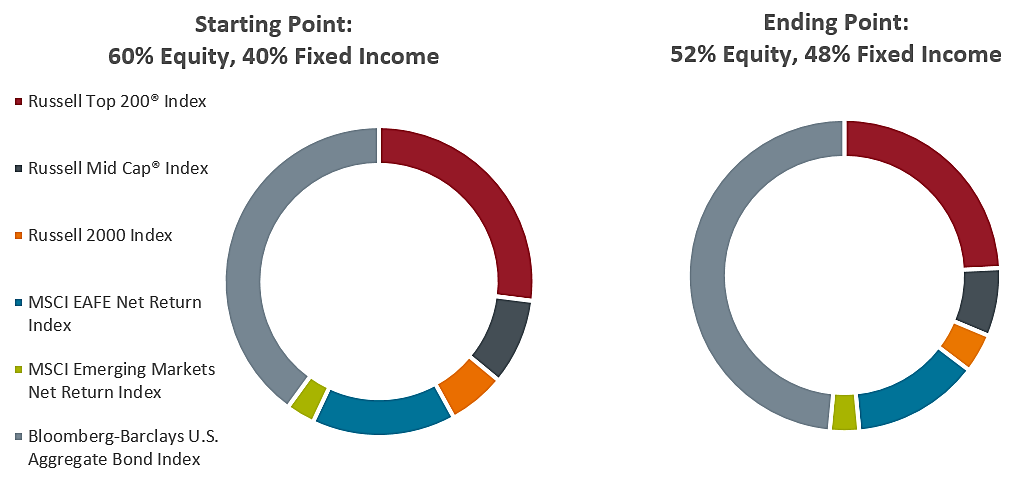

A quick glance at these market swings in the context of a typical 60/40 stock/bond portfolio shows an 8% shift from equities to fixed income since the market peak of February 19.

[caption id=”attachment_284440″ align=”alignnone” width=”1036″] Source: Morningstar. Starting point is 2/19/20 and ending point is 4/10/20. All returns are in USD. [/caption]

Source: Morningstar. Starting point is 2/19/20 and ending point is 4/10/20. All returns are in USD. [/caption]

To help investors navigate the current market volatility, we’d like to share a couple of concepts that have resonated with clients during recent consultations.

A Sell-Off Doesn’t Change Everything

Rebalancing, diversifying and/or reallocating during a downturn should follow the same process as during less volatile markets: Gauge performance against various benchmarks, assess drawdown potential versus investor suitability, identify intended and unintended concentrations and gaps, remedy as needed, rinse and repeat. The short-term environment should not allow market-timing impulses to be the driving force behind reallocation.

View Sunk Costs from a Blank-Slate Perspective

Extreme losses might lead to a “well, I can’t sell now” perspective. Going back to the general reallocation process outlined above, investors should examine these exposures by asking themselves, “If I were building a portfolio from a blank slate, would I buy this exposure at this price level at these levels of uncertainty?” This blank-slate approach can offer much-needed perspective and a reprieve from the regret that investors may be feeling in the wake of this sell-off. Barring special circumstances related to taxes (more common) and illiquidity (less common), incumbent losses are nothing more than sunk costs that should be ignored.

Amid extreme market turmoil, another helpful way to cut through the noise is to start at the beginning. The original target allocation set for an investor is what was determined to be that individual’s optimal, long-term asset allocation. A portfolio drifted by market movement is, by definition, suboptimal, being underweight recent losers and overweight recent winners and adding, essentially, a “momentum” trade to the portfolio.

Is this momentum trade part of the original plan? If not, is it worth the cost to rebalance? These dilemmas are not specific to rebalancing – they are what any investor faces when making asset allocation decisions.

In our view, the framework used to analyze portfolio moves – large or small – is always the same. Our team has developed proprietary tools that can help articulate:

- Your target compared to current asset allocation weights

- Long-term risk, return and scenario analysis to inform pros/cons of target vs. current weights

- Return attribution, highlighting the largest contributors and detractors

- Portions of the portfolio creating the largest variances between target and current allocations

Rebalancing is not a generic question with a universal answer; it depends on specific asset allocations and portfolio goals. Our proprietary portfolio risk analytics are designed to help you drive toward an answer tailored to an investor’s specific situation. For help, consider engaging our PCS team so that we can extend these tools to you.

Abandon Your Doubts,

Not Your Goals

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe