Subscribe

Sign up for timely perspectives delivered to your inbox.

Global six-month real narrow money growth bounced back in February but remained below the 3% level cited in previous posts as a necessary condition for adopting an economic recovery forecast. This level is judged likely to be exceeded in March, partly reflecting a surge in US money data. Global annual real narrow money growth, meanwhile, may rise above 5.5% in March, which would result in the conservative equities / cash switching rule followed here recommending a move back into markets at end-April.

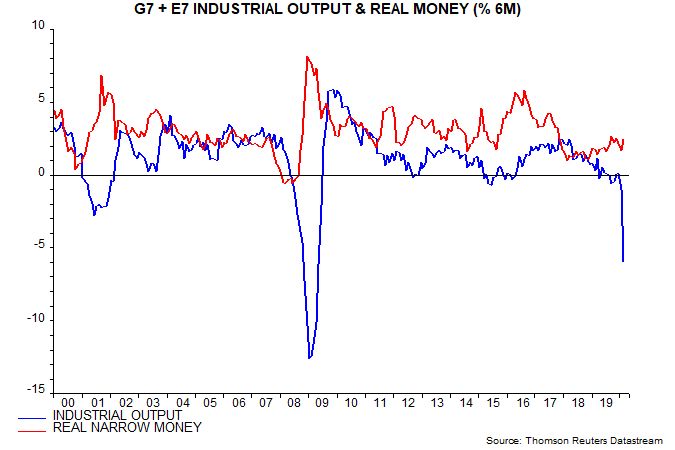

The first chart shows six-month rates of change of industrial output and real narrow money in the G7 economies and seven large emerging economies. The latest data points are for February, with the output series partly estimated. The February output slump was driven by China. Shutdowns elsewhere will be reflected in March data and are likely to result in the six-month output decline matching or exceeding the GFC peak of 12.6% (not annualised) in January 2009.

Six-month real narrow money growth rebounded from 1.7% in January to 2.4% in February. The fall from a peak of 2.6% in September 2019 was the main reason for the view here at the start of 2020 that economic recovery hopes were premature. Monetary trends, however, were not signalling a recession – real money growth was well above levels reached before prior contractions in output.

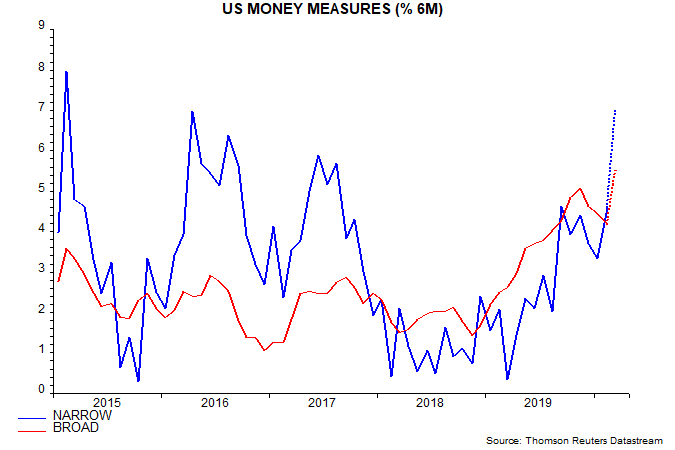

Global economic upswings starting in 2001, 2003, 2009, 2012 and 2016 were preceded by a rise in six-month real narrow money growth above 3%. This level is likely to be reached in March. Weekly US data suggest that six-month nominal narrow money growth will rise by about 2 percentage points (pp), which would add 0.6 pp to the global measure – second chart. Falls in oil and other commodity prices, meanwhile, are likely to cut six-month consumer price inflation by over 1 pp, with the impact spread over March / April.

A conservative equities / cash switching rule discussed in previous posts recommends equities only if 1) the six-month rate of change of global real narrow money exceeds that of industrial output and 2) the annual rate of change of real money exceeds a long-term moving average, currently at 5.5%. The latter condition remains unfulfilled, with annual growth at 4.6% in February. A rise above 5.5% is possible in March and would trigger a switch into equities at end-April – the rule allows for data publication lags. For background, the rule has recommended cash since end-February 2018 and would have outperformed a buy and hold strategy by 3.6 pp per annum on average over 1970-2019.