Subscribe

Sign up for timely perspectives delivered to your inbox.

Portfolio Manager Andy Acker discusses how advances in healthcare have come into focus during the coronavirus pandemic and what that could mean for the sector in the long term.

The equity sell-off amid the COVID-19 coronavirus outbreak has been remarkable for its speed and severity, with all sectors negatively impacted. But as in previous downturns, healthcare is showing some resilience. For example in the US, the S&P 500 Index was down 32% from its February peak, while the S&P 500 Health Care sector declined only 24%, as at 20 March 2020.1

Conventional wisdom says healthcare stocks tend to act more defensively during an economic contraction, as individuals continue to seek and/or need medical care. This time, it is not a steady stream of surgeries or doctor’s visits that are helping prop up healthcare companies. On the contrary, social distancing and preparations for a surge of coronavirus patients have sidelined many of these routine activities.

Rather, investors are rewarding those companies using innovation to aggressively develop vaccines or treatments for COVID-19, while firms helping to facilitate remote medical care are also gaining favour. Investor focus on these trends has accelerated due to the crisis but could last long after the pandemic ends, in our view.

Source: Bloomberg, S&P 500 Index and S&P 500 sub-sector indices daily data from 19 February 2020 to 20 March 2020. Past performance is not a guide to future performance.

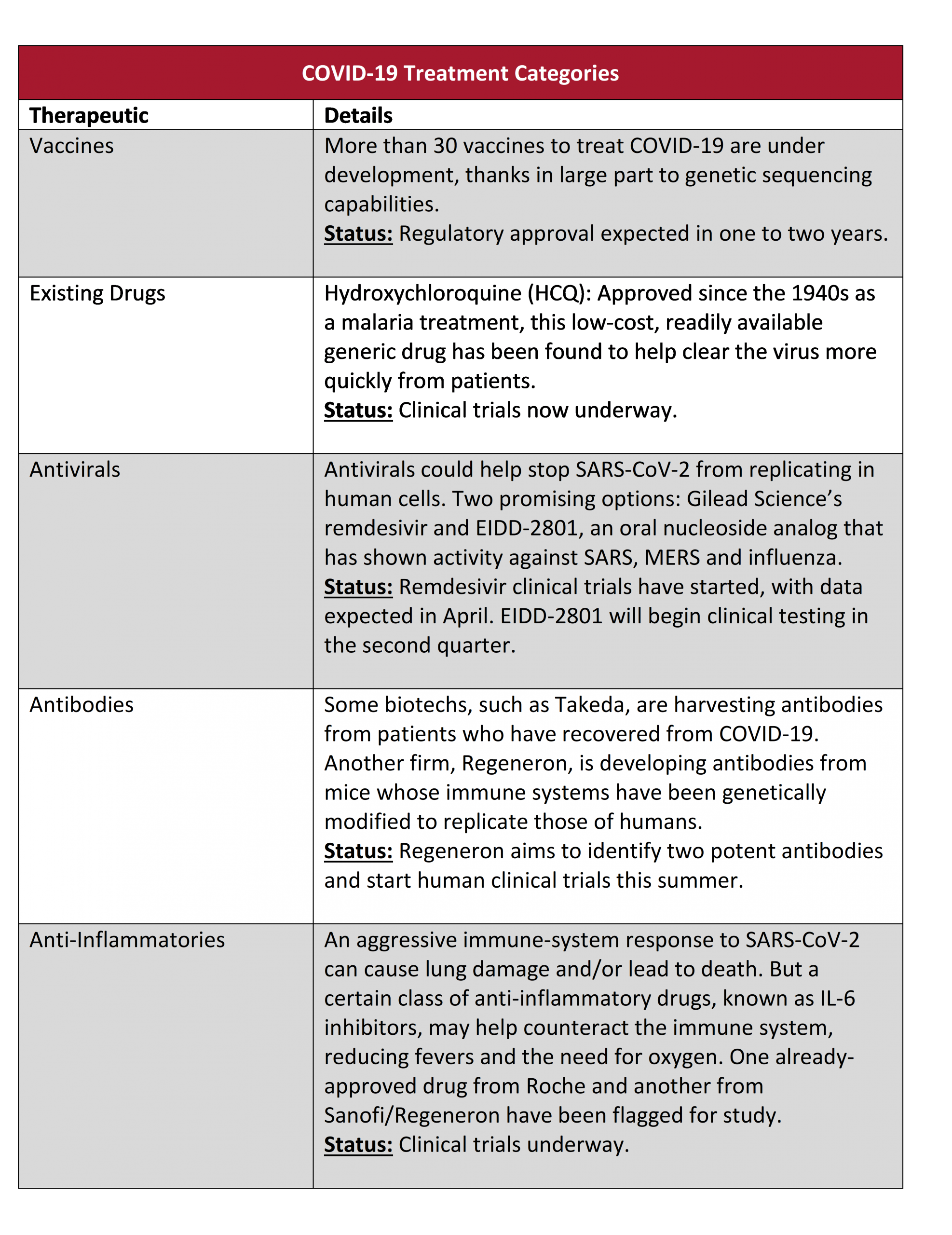

The scramble to develop treatments for SARS-CoV-2, the virus that causes COVID-19, has been remarkable for both its speed and global scale. So far, dozens of companies, scientific groups and institutions in the US, Europe, China and Japan have announced efforts to address the novel coronavirus.

One approach is to identify whether existing drugs could be effective against COVID-19. One candidate gathering significant attention is hydroxychloroquine (HCQ), a generic compound used since the 1940s for malaria. In a small clinical study in France, HCQ significantly shortened the course of the disease in coronavirus patients who received the drug. China and South Korea have also included HCQ in their COVID-19 treatment guidelines. Clinical trials are now underway to see whether the drug can deliver results consistently and safely. If the data are borne out, HCQ could have an enormous impact by helping to reduce the death rate for patients with severe cases, eliminate the virus more rapidly (and reduce its spread) and potentially work as a preventative agent for high-risk populations, such as doctors on the front lines.

Clinical trials are also underway for select antiviral drugs. One, Remdesivir, was originally developed by US biotechnology firm Gilead Sciences as a treatment for Ebola. So far, a handful of compassionate-use cases have delivered promising results, with larger clinical trials expected to report in April. Favipiravir, an influenza drug developed by FUJIFILM Toyama Chemical in Japan, showed an improvement in virus clearance during clinical trials – though results were most meaningful if the drug was administered soon after the onset of symptoms (data from trials using an existing HIV therapy, which showed no material improvement for severely sick coronavirus patients, also suggest that timing could be critical).

Meanwhile, the hunt for a vaccine is advancing at a breakneck pace. In February, US biotechnology firm Moderna announced that it had sent a potential vaccine, mRNA-1273, for testing. The compound was developed in record time – six weeks – using the firm’s messenger ribonucleic acid (mRNA) technology platform, which directs a cell’s mRNA to produce disease-fighting proteins. Germany-based BioNTech is also pursuing a similar mRNA-based strategy in partnership with Pfizer. Meanwhile, several other biopharmaceuticals are quickly advancing vaccine research and/or initiating clinical trials.

Source: Company reports, Janus Henderson Investors. Data as at 20 March 2020.

It is important to remember that should a drug or vaccine get regulatory approval, the impact to a firm’s bottom line will depend on several factors, including the persistence of COVID-19. Will the virus fade away, as SARS did, or will it recur each year like the flu? The influenza virus has two key proteins on its cell surface that tend to re-assort each year, making it difficult for our immune systems to fully recognise them, resulting in annual outbreaks. In contrast, the coronavirus has one key surface protein and, so far, has not mutated meaningfully. For this reason, we believe the coronavirus is more likely to be a one-time event.

As such, we remain sceptical of the rapid surge that some biotechnology stocks have experienced lately on news that they are pursuing the virus. Longer term, however, the COVID-19 crisis could help bring attention to innovative drug platforms, which, in our view, could amplify investor interest in these areas.

Meanwhile, telemedicine services are taking off. Both government and insurers are encouraging the technology’s use as an efficient and safe means to treat influenza and potential COVID-19 infections, easing the burden on the healthcare system. To that end, the Trump administration recently announced that Medicare would cover the cost of telemedicine services for the duration of the COVID-19 national emergency declaration. Similarly, health insurers are offering zero-dollar co-payments for telehealth visits whereby beneficiaries do not have to pay any of the upfront cost for treatment. These steps should help drive up the number of telemedicine users and could change how consumers and insurers approach telehealth in the long term.

As encouraging as these advances are, it is important to keep perspective. Although research is advancing quickly, human clinical testing cannot be rushed. A vaccine must be tested in thousands of patients to prove that it can be safe and effective for potentially millions of patients. Thus, it is likely that we will not have a vaccine for the general population for at least 12 to 18 months.

Meanwhile, the number of confirmed COVID-19 cases is rising rapidly, with strict social distancing and aggressive testing the best near-term solutions to slow the spread of infection. The US has conducted nearly 290,000 diagnostic tests, but we think this is still inadequate.2 In our opinion, we need to be testing the population widely for surveillance (not just highly symptomatic patients), and we need faster response times – most exposed patients are still waiting days for results. A rapid-response test developed by Danaher-owned Cepheid, which can deliver a diagnosis at the point of care in 45 minutes, was recently approved and this should help.

Social distancing, for its part, is having significant economic ramifications, and we expect a severe economic contraction in the coming months. Although somewhat resilient, healthcare companies will not be completely spared. For example, elective procedures are increasingly being cancelled, weighing on the bottom lines of hospitals and medical technology companies. For biopharmaceutical companies, new drug launches will be slowed as sales reps cannot make direct contact with physicians. Finally, steps to curtail the spread of the virus could have a near-term impact on clinical trial enrolment and delay some drug approvals.

In other words, we think investors should expect continued volatility in the coming months. However, we believe the rapid pullback of equity prices has created some compelling opportunities. Longer term, we feel that the sector’s unprecedented innovation addressing unmet medical needs will lead to attractive growth – a point we think is now being driven home by the global race for a coronavirus cure.

1Source: Bloomberg, data from 19 February 2020 to 20 March 2020. Past performance is not a guide to future performance.

2Source: The COVID Tracking Project, as at 24 March 2020