Knowledge. Shared Blog

March 2020

Unusual or Unacceptable? Interpreting Portfolio Losses in Today’s Market

-

Adam Hetts, CFA

Adam Hetts, CFA

Head of Portfolio Construction and Strategy

Amid extreme market turmoil, investors may wonder: Is my portfolio broken, or are these normal losses? Adam Hetts from Janus Henderson’s Portfolio Construction and Strategy (PCS) team explains why investors may want to try to identify which losses in their portfolio could be merely unusual and which are unacceptable, given their risk tolerance.

Key Takeaways

- Overly risky fixed-income allocations are leading to drawdowns that likely are unacceptable for a wide range of investors.

- Drawing on our proprietary database of advisor portfolios, we see that in only a month’s time average portfolio losses are already within the range of the Global Financial Crisis.

- The PCS team has resources to help you identify and diagnose which portions of your portfolio are experiencing losses that are merely unusual and which are unacceptable.

While history tends not to repeat itself, the past contains facts that are invaluable for investors who are now trying to process the current market sell-off. Throughout the past decade’s bull market, which came to an abrupt end this month, we on the PCS team have focused on reminding our clients of the portfolio risks that the Global Financial Crisis (GFC) revealed. In fact, much of our award-winning1 proprietary portfolio risk analysis focuses on stress testing portfolio allocations through a litany of historical market environments.

During the GFC’s extreme market turmoil, many asset classes experienced losses inherent to their risk/reward profile (e.g., U.S. equities) and therefore, such losses may be expected to repeat during another market shock. The gravity of such losses is, then, merely unusual and arguably suitable within certain portfolio risk profiles.

On the other hand, some portfolio losses during the GFC were unacceptable for certain investors. These losses landed well outside the normal boundaries of expected returns – most often because of an inappropriately high level of risk within an investor’s fixed income allocation, normally meant to be the risk-managing piece of a diversified portfolio. This resulted in unexpectedly large total portfolio drawdowns, forced selling of long-term investments at market lows, delayed retirement and other unwelcome outcomes. Even worse, following the GFC, these fixed income miscalibrations only grew more common thanks to record-low rates and a decade-long historic bull market, leading to potentially disastrous and unacceptable outcomes, yet again.

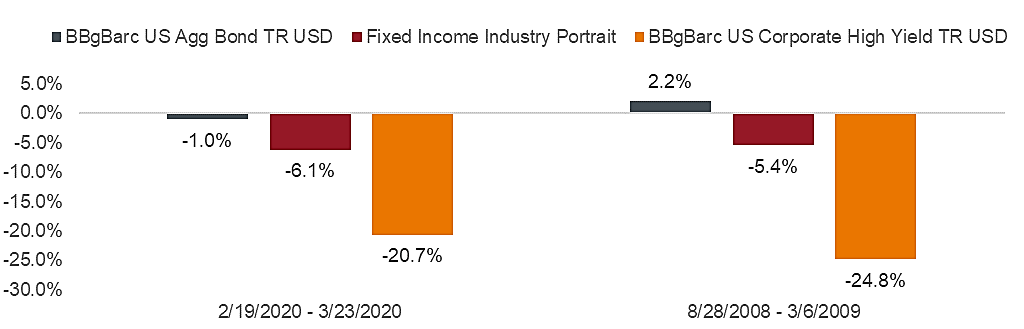

Let’s look at fixed income performance so far in the current crisis compared to the GFC. To do this, we’ll focus on the traditional benchmark of the Bloomberg Barclays U.S. Aggregate Index (U.S. Agg) compared to the Bloomberg Barclays U.S. Corporate High Yield Index (High Yield), as well as the average advisor fixed income allocation (Industry Portrait) in our proprietary database, which includes the thousands of advisor portfolios we have consulted on through our Portfolio Construction and Strategy work.

Fixed Income Crisis Performance: Current Compared to GFC

[caption id=”attachment_281106″ align=”alignnone” width=”1024″] Source: Morningstar, as of 3/24/2020. Past performance is no guarantee of future results.[/caption]

Source: Morningstar, as of 3/24/2020. Past performance is no guarantee of future results.[/caption]

In just a month’s time, the losses in High Yield compared to the U.S. Agg are already showing a double-digit difference while the Industry Portrait is showing average advisor fixed income losses slightly worse than the U.S. Agg. The Industry Portrait is only an average, and actual fixed income portfolio losses in our database cover the entire range of performance in the charts shown above – some of which, unfortunately, will prove unacceptable for investors.

When reassessing your asset allocation in a time of crisis, the first step is to identify and diagnose which portions of your portfolio are experiencing losses, which are merely unusual and which are unacceptable. For help, consider the customized proprietary portfolio risk analyses and other resources available from our Portfolio Construction and Strategy team.

Abandon Your Doubts,

Not Your Goals

Learn More1Best Analytics Initiative, 2019 American Financial Technology Awards

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe