Subscribe

Sign up for timely perspectives delivered to your inbox.

Chinese February money / credit numbers are hopeful, signalling stable monetary conditions despite the coronavirus shock. Policy easing, including state-directed bank lending, is expected to lift money growth significantly by mid 2020, with real growth boosted further by a moderation of food inflation.

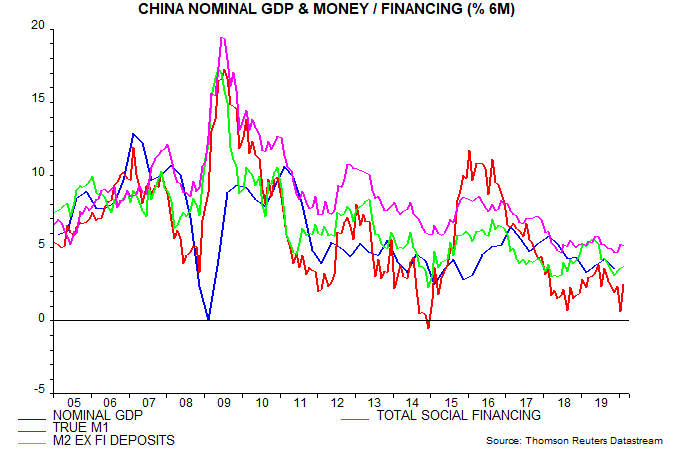

Annual growth of the official M1 measure bounced back from zero in January to 4.8% in February, the highest since July 2018 (the January spike down reflected a lunar new year timing effect but was wrongly interpreted by some as a negative signal). M2 growth also firmed, to 8.8%, while growth of total social financing (TSF) was stable at 10.7%.

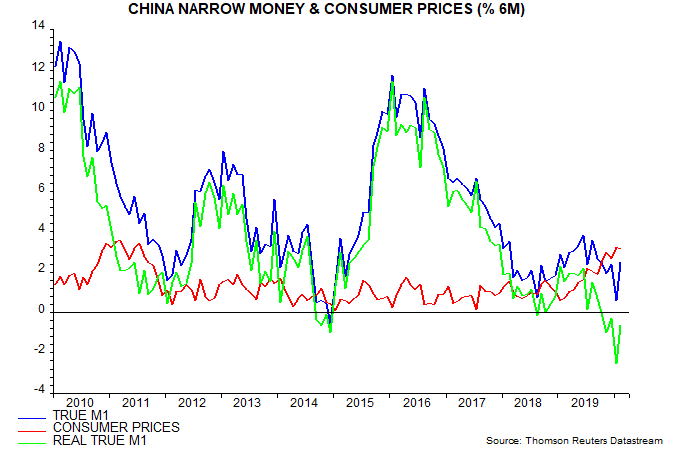

The preferred money measures here are “true” M1 and non-financial M2, with six-month rather than annual growth rates emphasised. True M1 adds household deposits to the official M1 measure; non-financial M2 strips out deposits of non-bank financial institutions, which are less relevant for assessing economic prospects.

The first chart incorporates February estimates of these measures; the final numbers – usually available within a week of the headline release – are unlikely to change the story. Six-month growth of the money measures, as well as of TSF, appears to have bottomed out in late 2019 / early 2020. Nominal GDP will plunge in Q1 but monetary stability suggests a rapid rebound.

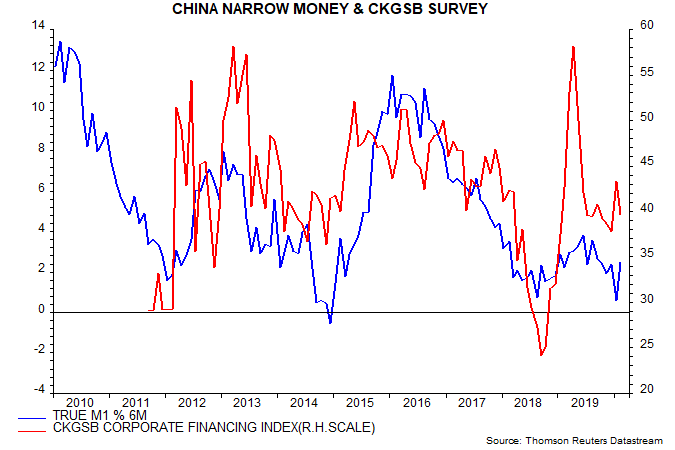

The monetary numbers are consistent with other evidence that the policy response to the coronavirus shock has prevented a follow-on tightening of credit supply. The credit conditions index in the Cheung Kong Graduate School of Business survey of private sector firms was higher in February than December – second chart – while commentary accompanying the manufacturing PMI report noted a positive impact of policy measures to support SMEs.

The six-month change in real true M1 remained negative in February, with the coronavirus shock serving to sustain high food inflation – third chart. An eventual normalisation of food prices will give a big boost to real money growth.