Knowledge. Shared Blog

March 2020

Why Growth Has Outperformed Value in a Turbulent Market

-

Kevin Preloger

Kevin Preloger

Portfolio Manager

Growth stocks have outperformed in the violent market sell-off despite many factors that would indicate a preference for value. Perkins Portfolio Manager Kevin Preloger explains why and discusses how the recent turbulence could affect value versus growth leadership going forward.

Key Takeaways

- Multiple factors – including stretched valuations, slower earnings growth, the late phase of the economic cycle and expected reversion to the mean in terms of market leadership – all led us to believe that value would outperform growth in the recent sell-off.

- However, growth stocks have continued to lead for several reasons, including investor behavioral bias and the dual shocks to cyclical industries caused by significantly lower oil prices and interest rates.

- We still expect a leadership change from growth to value, and this market environment may present opportunity by allowing investors to sell holdings with unattractive reward-to-risk ratios and add to holdings with more attractive ones.

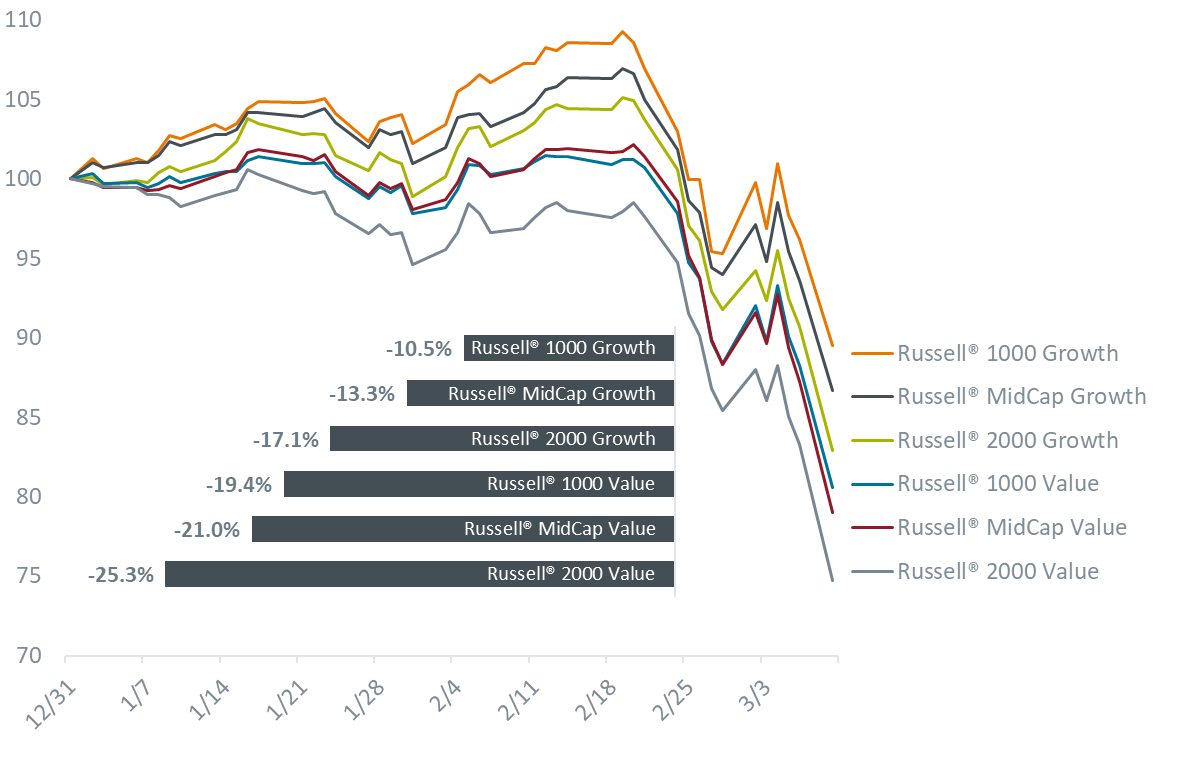

Somewhat counterintuitively, growth stocks have outperformed during the recent market sell-off despite conditions that seem to favor value: stretched valuations for growth stocks, slowing earnings growth, the historical tendency for value to outperform growth in the late stages of the economic cycle and, finally, an anticipated reversion to the mean where value leads following an extended period of growth outperformance. Yet year to date, and more recently since markets peaked in February, value indices are lagging their growth counterparts across all market capitalizations, as seen in the chart below.

U.S. Stock Performance Year to Date

[caption id=”attachment_278195″ align=”alignnone” width=”1192″] Source: Bloomberg, data 12/31/2019 through 3/09/2020.[/caption]

Source: Bloomberg, data 12/31/2019 through 3/09/2020.[/caption]

Why Growth Has Outperformed

So, why has growth outperformed? It has been our opinion for some time that the valuation of the overall market was stretched. Growth stocks still appear expensive, but some value stocks with a bias to defensive characteristics trade at a slight discount to the market, offering a margin of safety. Investors, perhaps biased toward the long-running outperformance of growth stocks in the bull market, have seemed to stick with what has been working and ignored the risk of extended price-to-earnings (P/E) multiples. Health care is a good example of a sector where valuations have remained elevated, particularly for medical-device and smaller-cap biotechnology stocks. While many health care-related areas are recession resistant, the P/E multiples are still relatively rich, leading to unattractive reward-to-risk ratios. Large-cap pharmaceuticals, where valuations are more appealing, are an exception, but we believe political policy risk remains.

Given the negative impact of the COVID-19 coronavirus, it now appears that earnings for the S&P 500® Index could be flat, at best, in 2020, which could result in the second consecutive year of zero growth. Earnings estimate cuts have been made in these early stages of the virus pandemic, so it would seem plausible that more could follow given the impacts spreading to more countries and supply chains. Much of the return in stocks for 2019 and earlier this year had been due to multiple expansion, whereby stock prices rose faster than earnings, leading to higher P/Es. As earnings pressure becomes more evident throughout this year, multiples could compress and lead to further pain, especially from high-multiple growth stocks, particularly in the information technology sector.

Bucking Historical Trends

Typically, we would expect value to outperform in the late-cycle environment where we see a slowing of growth. However, the violent nature and speed of the recent sell-off coupled with new headwinds for traditional value sectors like financials, energy and other cyclicals seem to have changed the historical pattern. Cyclical areas, such as banks, industrials and materials, which tend to be overly indexed to value benchmarks, have been punished materially year to date as investors calculate the consequences of a slowing economy due to the coronavirus.

In addition, two new variables – significantly lower oil prices and interest rates – are likely to have a material negative impact on the earnings of banks and energy companies in the near term. The good news, at least for banks, is that we believe the impact of the coronavirus on the global economy could be transitory, resulting in the potential for significant bargains in the beaten-down sector.

The energy sector is more challenging given there are issues on both the supply and demand side. On the supply side, prices have collapsed as rival Organization of the Petroleum Exporting Countries (OPEC) member countries flood the market with crude, resulting in an untenable situation for many exploration and production companies. On the demand side, wide swaths of the globe are under temporary quarantine or travel restrictions, resulting in less demand for refined products. While the energy sector is currently out of favor, the balance sheets of many of these energy companies represent a “no-go” zone for defensive value investors. On the positive side, consumers should see much lower prices at the pump and large industrial users should benefit from a significant reduction in input costs. Stocks that are beneficiaries of lower energy prices may be more appealing for investors.

Potential Opportunity

The narrow leadership of favored growth stocks suggests that in this market environment investors have stuck with what has been working. Rather than reverting to the mean, the growth bias has continued. However, given growth’s extended period of outperformance, we still expect a leadership change from growth to value. We think investors will eventually look to cheaper offerings that have been marked significantly lower, making value stocks much more appealing.

The violent nature of this sell-off is vastly different than other market drops we have experienced, whether it was the 2000 dot-com bubble, post-9/11, the Global Financial Crisis or other volatility-producing events. In this environment, we believe a long-term perspective and a focus on high-quality stocks with defensive characteristics is prudent given the potential for downside protection. This market drop may present the opportunity to reassess reward-to-risk ratios and uncover high-quality companies on sale.

Abandon Your Doubts,

Not Your Goals

Learn MoreKnowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe