Subscribe

Sign up for timely perspectives delivered to your inbox.

Diversified Alternatives Portfolio Manager John Fujiwara discusses why investors were poorly positioned going into the coronavirus outbreak given their concentration in mega-cap tech stocks and, more broadly, U.S. equities, thus sacrificing the diversification that could dampen market downturns.

The market’s reaction to the spread of the COVID-19 coronavirus reflects concerns about how the outbreak is impacting supply chains, consumer demand, corporate profitability and overall economic growth. Aggravating the situation, in our view, was how investors were positioned going into the episode. Over the past year, we have noted that investors were crowded into specific pockets of the market to a degree that we have rarely seen. A casualty of such concentration is the jettisoning of any potential benefits achieved by holding a diversified basket of relatively uncorrelated assets. In the face of an exogenous, market-moving event – such as what we have just experienced – a concentrated market can lead to a mass exodus of similar securities with the ensuing mismatch of sellers and buyers magnifying the downward lurch in prices.

With the specter of the trade war, weak manufacturing surveys and flat corporate profitability, investors spent much of 2019 seeking growth where they could find it. The preferred destinations were largely mega-cap tech stocks over other sectors and U.S. listings over international equities. With tech shares promising secular growth and the U.S. weathering rough economic waters better than other regions, this positioning appeared justified. As these segments of the market outperformed, they became even more incorporated into a range of strategies including momentum, growth and low volatility. In this respect, the resilience of U.S. growth stocks caused them to exhibit the characteristics typically associated with defensive pockets of the market.

This was the market backdrop heading into the COVID-19 outbreak. By some measures, only two weeks ago – as U.S. equities were reaching new highs – trend-following strategies had exceptionally long exposure to U.S. shares. We know how last week turned out. What has yet to be fully understood is where markets go from here. There are hints, however. Many of them are imbedded in the risk premia that investors tend to expect in certain asset classes relative to other securities. And just as movements within risk premia indicated how one-sided markets had become during last year’s rally, they may now shed light on investor behavior during the sell-off and what may be in store over the coming months.

To be sure, the dust has nowhere near settled. Still, some observations can be made. Foremost, the sell-off in riskier assets was indiscriminate. When looking at the dispersion of returns, the relative uniformity of the drawdowns is noteworthy. Unsurprisingly, technology was among the worst-performing equity sectors, given that investors sell what they own, and they owned a lot of tech. The U.S. proved to be no safe harbor as its benchmarks moved down in lockstep with other developed markets. What we did not see was evidence of a marked rotation into heretofore out-of-favor pockets of the market. Rather, investors flocked to the safety of government bonds, namely U.S. Treasuries.

On a more granular level, the story becomes more nuanced. It is here that risk premia can offer possible insight into how these events could play out. Broadly speaking, two potential outcomes emerge: additional turbulence or markets beginning to show signs of stabilization.

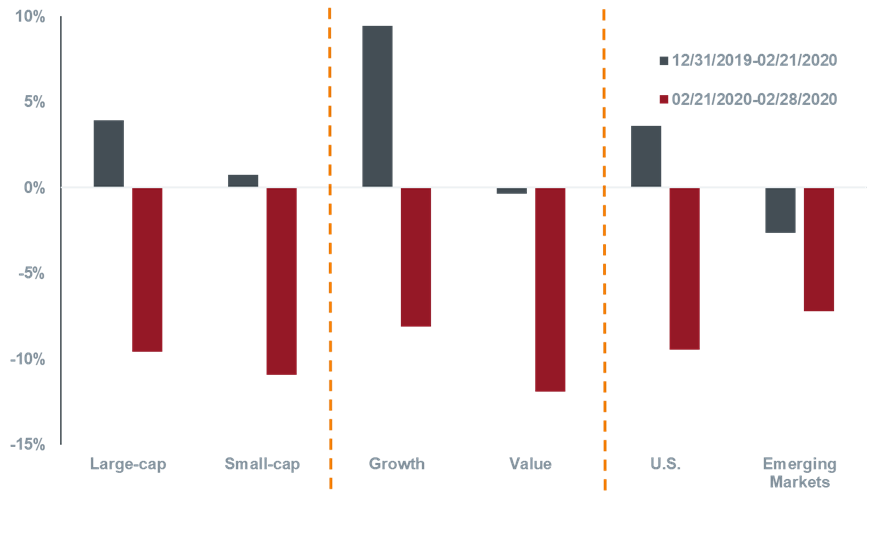

While small caps and emerging markets held their own relative to large caps and U.S. equities, respectively, during the downturn – offering potential signs of optimism – value stocks have continued their streak of underperformance, hinting at additional uncertainty.

[caption id=”attachment_275109″ align=”alignnone” width=”883″] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

Year to date through February 21, U.S. large-cap stocks continued to outpace small caps. During the last week of February, however, both segments slid roughly the same degree. Small caps holding their own – albeit during a drawdown – indicate investors not only selling what they held (large caps), but also that small caps, with their beaten-down valuations, are possibly becoming more attractive should this volatile period subside and economic growth resume.

Similarly, emerging market (EM) stocks spent much of early 2020 on the back foot as Asia was the first region to be impacted by COVID-19. Yet in last week’s sell-off, EM stocks slid far less than U.S. shares. While the staggered move likely reflects the migration of the virus, EM’s relative outperformance, in our view, would not have occurred if investors were expecting additional economic disruptions in these regions. Rather, investors may have reached the conclusion that valuations fully reflect the real economic damage inflicted by the virus and, at these prices, EM stocks may offer an attractive risk/reward proposition.

So far, value stocks have shown less promise. After vastly underperforming growth stocks over the first seven weeks of 2020, value’s losses eclipsed those of growth during the last week of February. This not only signals that investors weren’t looking to rotate within stocks, but also speaks to the current composition of the value segment. Cheaply priced energy producers and banks would be highly susceptible to a prolonged decline in global growth. As such, value’s underperformance may imply that investors have yet to rule out additional economic disruptions caused by COVID-19.

While banks and energy may be keeping investors away from value at present, low-multiple stocks merit monitoring as we believe there is a chance for them to rebound later in the year. For that to occur, not only will the acute threat COVID-19 poses to economic growth need to subside, but any pent-up demand caused by delayed economic activity would have to materialize during the latter half of 2020. Furthermore, with the increasing odds of the Federal Reserve cutting interest rates at least twice more this year – in addition to the early March cut – conditions may set up favorably for underperforming companies to deliver earnings growth. The combination of lower rates and a return to growth could potentially push up inflation – something further catalyzed by supply disruptions – and the ensuing steepening of the yield curve would likely translate to improved margins for banks.

The relationship between stocks that tend to exhibit low volatility and those with larger price swings also merits our attention. Typically, one would expect lower-volatility stocks to outperform higher-volatility names in market downturns as investors seek relative stability. The opposite occurred last week, as a widely followed basket of lower-volatility stocks sold off more than the corresponding higher-volatility basket. One explanation may be investors exiting concentrated positions in lower-volatility names – again, selling what you own. Another possibility is that investors expect a rebound in economic and earnings growth later in the year and the value and cyclical names presently associated with higher volatility should, therefore, not be completely abandoned.

Our foremost concern is for the victims of COVID-19 and our hope is that this outbreak is rapidly contained. Given the forward-looking nature of financial markets capable of processing thousands of complex data points, any stabilization could be interpreted as a sign of optimism. These next few weeks will prove critical, especially as cases rise in Europe, the U.S. and the Middle East. The magnitude of the price action resulting from this coronavirus serves as a reminder that there is always something lurking that can upend markets. Absorbing downgrades to economic growth and coping with uncertainty is daunting enough. Investors, having spent much of the past year piling into pro-growth “beta” positions and abandoning diversification, only aggravated the market’s natural response to such an exogenous event.