Subscribe

Sign up for timely perspectives delivered to your inbox.

Diversified Alternatives Portfolio Managers Aneet Chachra and Steve Cain discuss key components of a low-cost, long volatility strategy designed to pay off strongly in a crisis and carry better than other hedges during non-crisis periods.

Multi Strategy portfolios combine a number of strategies within a single portfolio. This approach is designed to aggregate alpha and provide diversification benefits to reduce portfolio volatility.

The Janus Henderson Multi Strat portfolio also includes an explicit portfolio protection strategy. We believe such a strategy is integral in diversifying Multi Strategy portfolios, to help neutralize market beta as well as provide countercyclical hedges.

The Protection strategy uses a variety of approaches including systematic and discretionary stock/FX option hedges and an internal CTA allocation with the aim to generate returns during market downturns, while mitigating the negative drag of conventional hedging approaches.

In this note, we first discuss conventional hedging methods and then explain our systematic low-cost, long volatility strategy that we added to Protection in October 2017. This strategy targets a positive payoff when a large volatility spike occurs, with relatively low negative carry in other circumstances. We then present a case study of performance during the February 2018 volatility spike, which was in line with expectations.

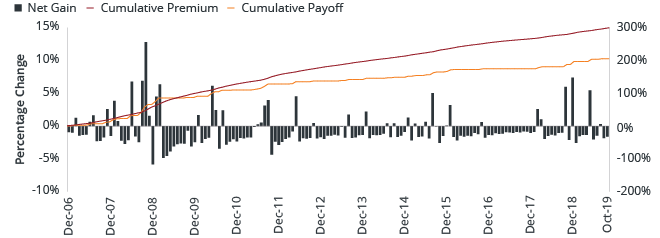

The simplest hedging approach is to buy puts on an index. This is expensive and likely to lead to poor results. For example, imagine a basic strategy that hedges a long S&P 500® Index exposure every month by purchasing a one-month at-the-money put on the S&P 500 and holding until expiration (i.e., one month later). Exhibit 1 shows the cumulative premium paid, payoff, and monthly net gain (payoff minus premium) of such a hypothetical strategy since the start of 2007.

Although such a strategy of buying S&P 500 puts would have provided a positive net payoff during the 2008-2009 Global Financial Crisis, its overall performance looks abysmal. Rolling these puts would have resulted in an average monthly loss of 0.6%, which is nearly equal to the average monthly price gain in the S&P 500 since January 2007. Thus the combination of long S&P 500 plus long S&P at-the-money puts would have returned approximately 0% per year (excluding dividends). Purchasing S&P monthly puts would reduce returns by over 7% per year.

Buying S&P 500 puts outright provides positive exposure to changes in volatility, but also negative exposure to changes in equity prices. Rolling options monthly also increases transaction costs. At-the-money options are costly, as they protect investors from even small portfolio losses. Instead, purchasing out-of-the-money puts reduces premiums paid – it’s akin to accepting a larger deductible on an insurance policy.

A popular hedging approach is to purchase longer-dated out-of-the-money puts and simultaneously delta-hedge stock price moves using the standard Black-Scholes model to isolate the volatility factor. For example, a prototypical program would target a certain level of volatility exposure, purchase a range of put options, and delta-hedge the stock position daily. This strategy, which we will refer to as the default delta-hedge, would be expected to work well as a “crisis hedge” when volatility spikes sharply, such as occurred in 2008.

However this default hedging approach is quite expensive in non-crisis periods due to the negatively correlated relationship between stocks and volatility.

Source: Janus Henderson Investors, Bloomberg, December 2006 to October 2019.

The example provided is hypothetical and used for illustrative purposes only. Assumes the purchase of at-the-money 1-month S&P 500 Index put options each month and holding each until expiration, excluding fees. Monthly option prices calculated using market-implied volatility and Black-Scholes model.

The default method of delta-hedging stock price moves in order to isolate volatility implicitly assumes that changes in equity prices are independent of changes in the level of volatility. But looking at past data shows this assumption is clearly not true – instead there is a strong negative correlation. For example, Exhibit 2 compares daily returns of the VIX® and S&P 500 indices – the correlation between them is -0.84 with an R2 of 0.70.

Source: Janus Henderson Investors, Bloomberg, December 2006 to November 2019.

Cboe Volatility Index® or VIX® Index shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500® Index options and is a widely used measure of market risk. The VIX Index methodology is the property of Chicago Board of Options Exchange, which is not affiliated with Janus Henderson.

A key reason why the default delta-hedge approach tends to underperform is that it ignores this strong empirical relationship. Volatility generally declines when stocks rise, and vice versa. Delta-hedging stock offsets the decreases in the value of the put due to the increase in stock price, but not the decrease due to the decline in volatility. A more effective hedge needs to incorporate this link when determining sizing. In practice, implementing this generally requires a modestly larger long equity hedge position combined with the put option. In rising markets, the increased equity should offset the fall in volatility. In declining markets, the spike in volatility should more than offset the additional equity drag.

Exhibit 3 below compares estimated returns of the default delta-hedge to the enhanced delta-hedge we have developed. We found that adjusting for the stock-volatility relationship improved the quality of the hedge. In our research, the enhanced hedge was nearly as reactive during crisis periods (2008, Q3 2011, Q1 2018), but carried much better during non-crisis periods. We estimate that the enhanced hedge would be about 40% cheaper to maintain than the default hedge.

Source: Janus Henderson Investors, Bloomberg, January 2007 to September 2019.

The example provided is hypothetical and used for illustrative purposes only. Excludes fees. Default Delta-Hedge assumes the purchase of a strip of medium-term S&P 500 Index options rebalanced quarterly, with daily delta-hedging per Black-Scholes model. Enhanced Delta-Hedge assumes daily delta-hedging per custom Janus Henderson model.

Option prices either from historical market data or calculated using market implied volatility and Black-Scholes model.

In Multi Strat, the enhanced delta hedge long volatility strategy was added in October 2017. The model strategy is designed to roll positions about once a quarter. Each rebalance assumes the purchase of a package of medium-dated S&P 500 puts, structured to approximate a “down-variance swap” with a range of strikes ranging from deep out-of-the-money to at-the-money. Expiring options typically roll off so transaction costs are minimized to entry. By varying strikes and dates, this creates diversified exposure to volatility. The aggregate exposure is delta-hedged daily using the enhanced approach covered above.

Notably, the use of vanilla options rather than variance swaps should make it possible to easily liquidate positions during crisis periods. This could then allow reinvestment of realized hedging profits into other strategies that have sold off sharply due to the surge in volatility.

Performance of the enhanced delta hedge long volatility model has been encouraging and in line with our expectations. Notably, the model demonstrated sharp gains around the February 2018 VIX event when volatility spiked suddenly (and the S&P 500 fell). Exhibit 4 shows the performance of our enhanced delta-hedge model versus the default delta-hedge model around that time period. The enhanced hedge provided a strong payoff during the crisis event, but carried flat otherwise. This compares favorably to the default hedge that also did well in February 2018, but otherwise lagged substantially.

Source: Janus Henderson Investors, Bloomberg, October 2017 to September 2018.

Default Delta-Hedge and Enhanced Delta-Hedge are based on the methodology described in Exhibit 3 and exclude fees. Default Delta-Hedge example provided is hypothetical and used for illustrative purposes only. Enhanced Delta-Hedge return contribution is based on a model portfolio, is internally calculated and may differ from actual contribution. It is intended to demonstrate the impact of the strategy within the portfolio.

Outright hedging is expensive and typically negates most of the positive returns from being exposed to risk assets. But a tailored and well-designed approach can provide portfolio protection against large, unexpected volatility jumps at a reasonable cost. Holding such an enhanced long volatility position can provide “crisis alpha” during extreme market conditions. Our research indicates that adding a systematic long volatility hedge can improve a portfolio’s resilience to periodic shocks.