Knowledge. Shared Blog

February 2020

Markets Fear a Global Coronavirus Pandemic

Paul O’Connor

Paul O’Connor

Head of Multi-Asset | Portfolio Manager

Paul O’Connor, Head of the UK-based Multi-Asset Team, considers the potential impact on global economic growth as concerns grow about the spread of the COVID-19 coronavirus beyond China.

Key Takeaways

- While the daily growth rate of confirmed coronavirus cases has fallen, attention has turned toward recent flare-ups in other countries, fueling worry that the virus will continue to break out on additional regional fronts.

- Consensus expectations have focused on a “v”-shaped recovery in global growth based on the anticipation of relatively swift containment of the virus. The broadening geographic spread of the virus raises many questions about this milder scenario, however.

- Given the general unpredictability, it seems prudent to emphasize capital preservation and defensive strategies until the fog of uncertainty begins to lift.

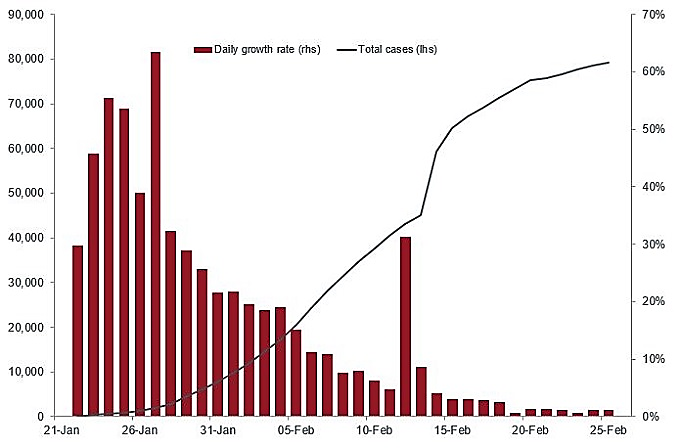

It seems somewhat paradoxical that investors have panicked over the COVID-19 coronavirus just as the daily growth rate in the number of confirmed cases of the illness drops to its lowest rate since the epidemic began (see exhibit 1). In fact, daily recoveries from the illness have exceeded new infections throughout the past week, so the number of active cases globally has now actually fallen for eight consecutive days.

Exhibit 1: COVID-19 Cases Globally

[caption id=”attachment_274019″ align=”alignnone” width=”680″] Source: Worldometer, as of 2/25/20[/caption]

Source: Worldometer, as of 2/25/20[/caption]

Given that 96% of confirmed cases of the virus have been in China, developments there explain most of these recent trends. The aggressive containment measures taken in Hubei province seem to have been fairly effective in containing the spread within China so far. Indeed, the number of confirmed cases in the rest of China have almost stabilized over the past week, growing at less than 1% a day. While these recent trends are undoubtedly encouraging, there is still a clear possibility that the return to work of an estimated 180 million migrant workers in February and March could cause a meaningful resurgence of the virus within China.

Coronavirus Goes Global

As the progress of the virus in China has eased in recent weeks, concerns have now shifted toward recent flare-ups in other countries, most notably Italy, Iran and South Korea. The worry here is that COVID-19 has now broken out on a number of new regional fronts and is potentially building enough momentum to become a global pandemic. Given that the number of cases outside of China and cruise ships is relatively small – just over 2,200 globally – such fears might seem excessive. However, it is troubling nevertheless that these more recent outbreaks have developed very rapidly (see exhibit 2) and, in some cases, have already seeded new infections in other countries. Furthermore, given that some of the aggressive techniques used to contain the epidemic in China are likely to be considered less acceptable in other countries, efforts to contain new outbreaks may not be as effective as the Chinese experience.

Exhibit 2: COVID-19 Cases Outside of China

[caption id=”attachment_274030″ align=”alignnone” width=”680″] Source: Worldometer, as of 2/25/20[/caption]

Source: Worldometer, as of 2/25/20[/caption]

One specific area of concern is the potential for the virus to spread particularly rapidly in countries that have limited resources for health care, low levels of virus testing and inadequate disease management. The latest flare-up in Iran is an example that appears to have at least some of these characteristics. Authorities seem to have been slow to respond to the outbreak of the coronavirus, and medical staff in Iran have expressed concerns about the availability of appropriate medical equipment. In recent days, Kuwait, Bahrain, Oman and Iraq have all reported new coronavirus cases involving people who had been to Iran. Widespread disquiet about the Iranian regime’s ability to handle the contagion has seen several neighboring countries closing land borders, ceasing flights and imposing restrictions on trade.

“V”-Shaped Recovery at Risk

With the global situation remaining highly fluid, it is impossible to make any meaningful estimate of the full potential impact of the coronavirus on the global economy right now. When the virus was largely contained to China, consensus expectations were generally focused on a “v”-shaped recovery in global growth based on the anticipation of relatively swift containment of the virus and an energetic policy response. The broadening geographic spread of the virus raises many questions about this milder scenario, especially given the uncertainties surrounding both the effectiveness of containment measures and the scale of the policy response expected in most countries outside China.

Investor concern about the economic impact of COVID-19 is likely to remain closely linked to its geographical progress. If the virus continues to spread internationally, then consensus expectations will shift from a “v”-shaped recovery to a deeper and more protracted setback for the global economy. Given that many indicators of positioning and sentiment were showing signs of widespread investor complacency just last week, it is hard to conclude that financial markets are now fully braced for the growth downgrades and the corporate earnings misses that could accompany such a scenario.

Furthermore, given recent trends in the spread of the virus itself and the general unpredictability of its future progress, it seems prudent to emphasize capital preservation and defensive strategies until the fog of uncertainty begins to lift or until markets have repriced sufficiently to offer better risk/return opportunities. This may take quite some time yet. Prepare for the worst – hope for the best.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox