Subscribe

Sign up for timely perspectives delivered to your inbox.

Xin Yan Low, Guy Barnard and Tim Gibson from the Global Property Equities Team, discuss the current impact of the coronavirus outbreak and how it is playing a part in the evolving real estate landscape.

The Covid-19 coronavirus has infected more than 75,000 people worldwide (at the time of writing), bringing China and other countries in Asia to a near standstill. While we have no particular insight into how this will play out, the impact is already causing significant disruption on the demand side through business and consumer activities, as well as global supply chains.

There may well be unintended consequences which will only become clear with the benefit of hindsight. The key point to focus on is not necessarily the severity of the virus but its duration – this will have the greatest impact on the global economy.

Equity markets turned ‘risk off’ in the middle of January; the outbreak of the Covid-19 virus curtailed any hopes of a recovery in global macroeconomic growth. The defensive nature of property equities has helped the sector outperform general equities globally, as well as in Asia since the outbreak began*. Closer to the eye of the storm, Asian equities have lagged most other markets, particularly Hong Kong, which has borne the brunt of the market sell-off.

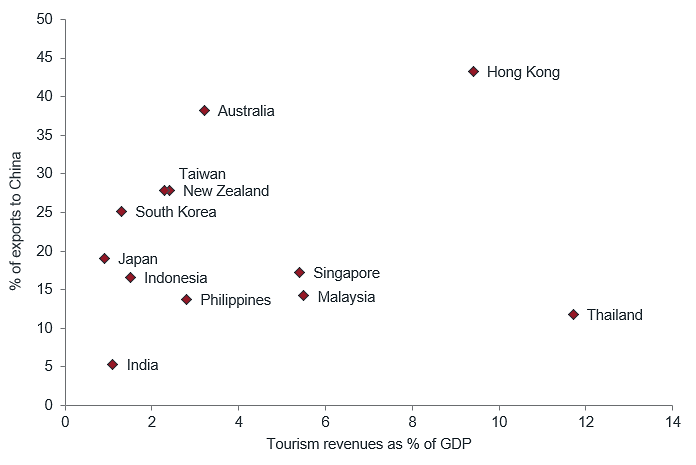

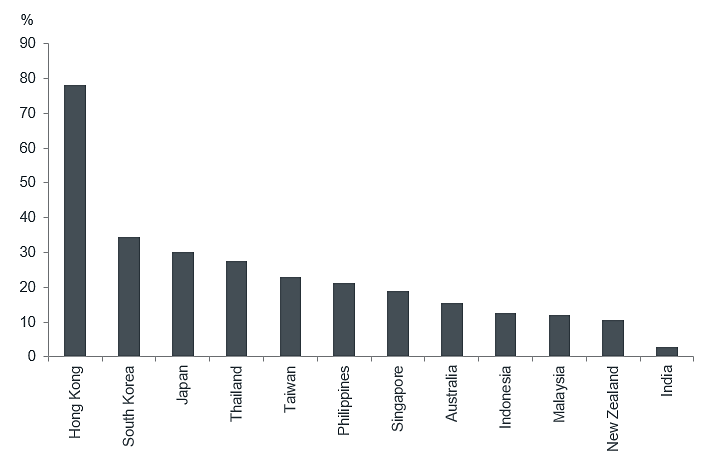

On the ground, markets and sectors related to retail and tourism have seen the greatest impact. The following charts highlight the importance of China to its Asian neighbours in terms of trade and tourism:

Source: IMF, UN Comtrade, OECD-WTO TiVA database, and CEIC as at 31 December 2019. Tourism revenues are 4Q sum to September 2019 for all countries except Thailand (June 2019) and Malaysia (December 2018).

Source: Nomura as at 31 December 2019. Note for Australia data is shown 4Q sum to September 2019; for India data is shown for 2018.

Hotels that derive a large proportion of their business from Chinese and/or business travellers have seen a significant decline in occupancies and future bookings. In countries where the virus has spread within the community, people have been staying home and avoiding crowded areas resulting in reduced footfall in retail malls, while retailers skewed towards luxury spending have seen a meaningful decline in sales. Some landlords have been pressured into bearing some of the loss of income from their tenants and have offered various forms of rental concessions.

Above and beyond the more obvious direct impact on hotel and retail, there may be some medium or longer-term implications for the property sector. Across Asia, the coronavirus outbreak has led many companies to roll out different forms of remote working plans, which is highlighting the viability of flexible workspace solutions and could change the way businesses think about their physical office space requirements in the future. The surge in online shopping and data connectivity as people stay and work from home during this period, also supports continued demand for underlying infrastructure such as logistics space and data centres.

Embracing the disruptive trends brought about by technological advances and changing demographics, our portfolios are positioned towards sectors that we think are benefiting from structural tailwinds. This includes an overweight to the logistics/industrial sector, being very selective towards retail and office landlords and investing in ‘non-core’ specialty sectors such as data centres, cell towers and manufactured housing communities. While we typically maintain a neutral stance to manage country risk, our largest country underweight has been to Hong Kong where fundamentals have been weak. Pro-democracy protests, which plagued the city for much of the second half of last year have dampened business and consumer sentiment, with the virus outbreak providing a ‘double whammy,’ prolonging the weakness in most property sectors.

It will take time to assess the full impact of the Covid-19 virus on the global economy and the property sector. Potential policy responses by governments and central banks will keep the situation fluid and potentially volatile.

The Covid-19 outbreak is causing some indirect consequences on real estate by accentuating the changing tides driven by technology advances and changing lifestyles, which are altering the demand and usage for real estate. With many uncertainties in the horizon, an allocation to property equities within a balanced portfolio may be beneficial, given the asset class has historically offered lower correlations to general equities and bonds, as well as a lower beta versus general equities**.

Past performance is not a guide to future performance.

*Source: Refinitiv Datastream. FTSE EPRA NAREIT Pure Asia Total Return Index (Asian property equities), FTSE World Asia Pacific Total Return Index (Asian equities), FTSE EPRA NAREIT Developed Total Return Index (global REITs), MSCI World Total Return Index (global equities) in USD from 31 December 2019 to 18 February 2020.

**Source: EPRA, monthly statistical bulletin as at 31 December 2019. comparative total return correlation versus global bonds and global equities. Factset; FTSE EPRA NAREIT Developed Total Return Index beta versus MSCI World Index from December 2010 to December 2019.