Subscribe

Sign up for timely perspectives delivered to your inbox.

Seth Meyer, Co-Portfolio Manager of the Multi-Sector Income Fund, prioritises low volatility over high yield, as fixed income markets face a potentially difficult year.

Two months into 2020 and the only thing that appears certain is more uncertainty. Global economic growth is fairly weak and central banks continue to scramble for new tools to support jobs, trade and credit. Meanwhile, COVID-19 has sparked significant volatility across global markets.

Against this backdrop, we believe it is crucial to strike the right balance between holdings with the potential for high total return and those with more stable prices and steady income, particularly in the high-yield market. Additionally, diversifying one’s sources of return can help mitigate portfolio volatility.

Our investment approach seeks to acquire high, consistent income while incurring less than half the risk of a dedicated high-yield strategy. The Multi-Sector Income strategy is actively managed and adapts to changes in the interest rate and credit risk environment. It has a global remit that includes developing markets for the sake of income diversification, while emerging markets too, including Asia, are also evaluated for opportunities.

Making the most of a diverse set of return drivers, our goal is to provide clients with opportunities for capital preservation and low correlation to equities. In order to achieve this, we take two main approaches to risk management, through utilising a ‘core’ sleeve and a ‘plus’ sleeve within the Multi-Sector Income strategy.

The core sleeve consists of things such as treasuries, agency mortgages and investment grade credit and is designed to help mitigate volatility and drawdowns. The sleeve can range from 35% to 65% of holdings.

The ‘plus’ sleeve targets high, consistent income from high yield corporates, bank loans, asset-backed and commercial mortgage-backed securities as well as emerging debt. Correlation between the two sleeves is just 0.20, balancing risk between them with the aim of dampening volatility and delivering regular income.

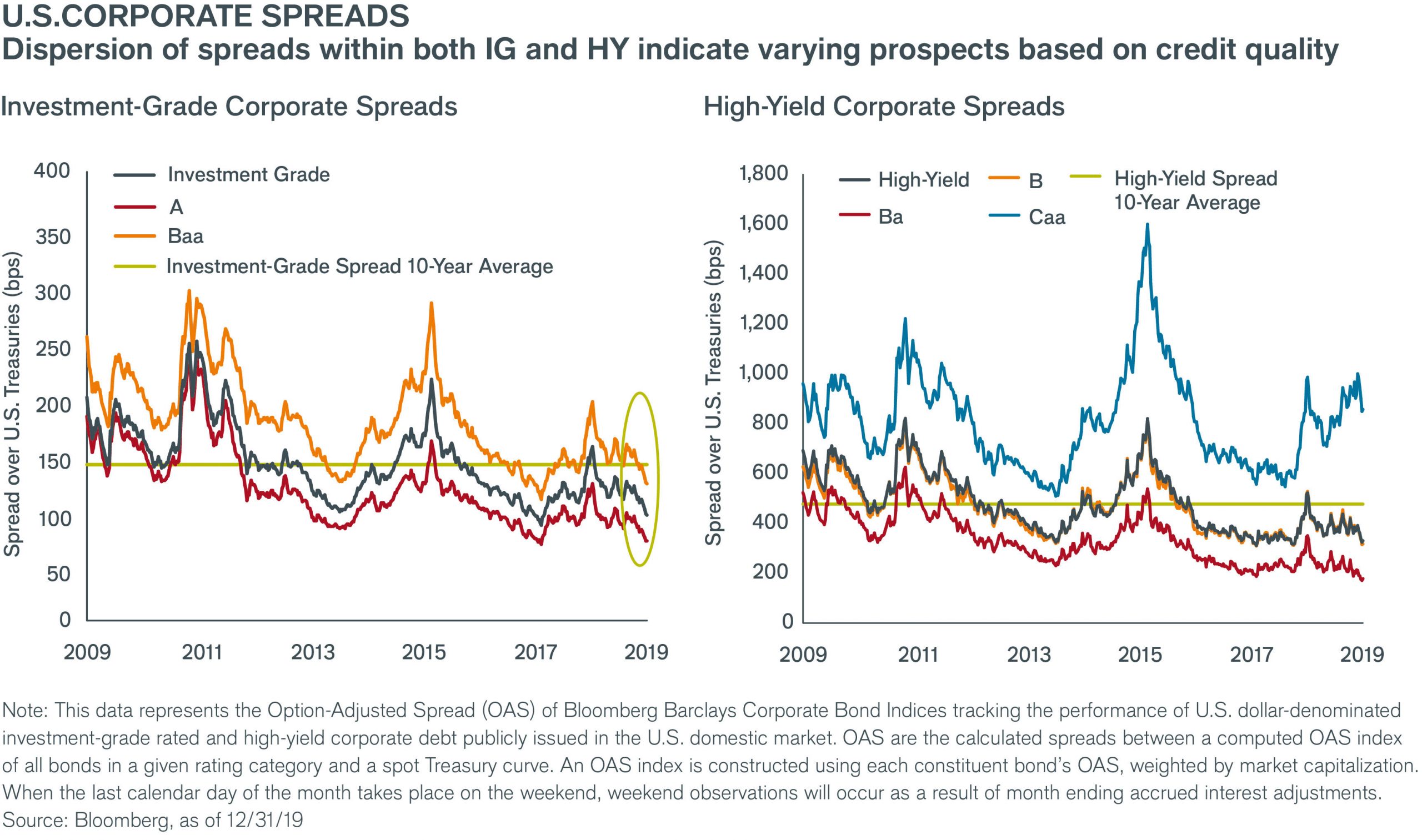

Over the summer of 2019, the gap between the spreads of higher and lower-rated bonds widened dramatically. And while the higher BB-rated bonds (the highest-rated junk segment) returned an average of 15% last year, the lower rated CCC bonds (the lowest-rated junk segment) failed to top 5% for much of the year, until it experienced a sharp rally in December. This divergence illustrates the importance of strong company fundamentals in below-trend growth environments–and the need to alter exposures to maintain income and protect capital.

The CCC market has been shrinking and deservedly so. After a decade of economic expansion, companies still in the CCC category are being justifiably vetted by the market. Strong economic growth can mask many mistakes, while slower economic growth tends to unmask them.

The current market environment has highlighted the importance of well-diversified strategies that have the expertise and resources to dynamically allocate between different sectors, without merely relying on a single sector such as high yield, emerging market debt or bank loans to provide returns. Due to the uncertain landscape, we think it is key to focus on yield that can be captured with minimal volatility and by seeking diversified sources of return to further mitigate portfolio volatility.

In our view, a combination of total return and steady income opportunities across all segments of fixed income will be critical in navigating an uncertain 2020.