Subscribe

Sign up for timely perspectives delivered to your inbox.

With infrastructure investment the last reliable lever policymakers have to manage the Chinese economy’s trajectory, Emerging Market Equity Portfolio Manager Daniel Graña explains why he believes the golden age of the Chinese economic boom is over.

The Wuhan coronavirus, which has brought China’s economy to a standstill in recent weeks, will no doubt negatively impact the country’s gross domestic product (GDP) output in 2020. But as serious as the outbreak is, we believe China faces even bigger, long-term secular headwinds.

In fact, for more than a year, we have believed that the options available to Chinese policymakers to stabilize and reaccelerate GDP growth have been dwindling. Income tax cuts and other consumption-friendly measures do not have the same multiplier effect in China as they do elsewhere due the low ratio of income taxpayers to total population in China, a high marginal propensity to save and weak consumer sentiment.

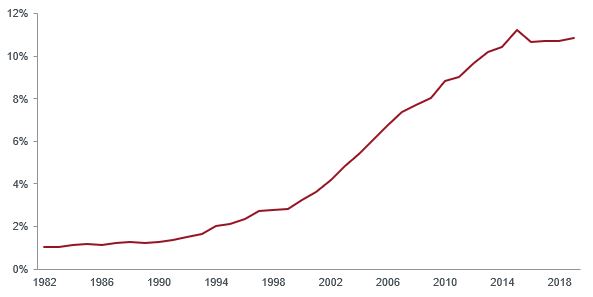

Cuts to interest rates are unlikely to help much, either, because creditors are reluctant to lend and borrowers reluctant to borrow. We believe this is because of diminished growth expectations, high economy-wide leverage and tougher consequences for state-owned enterprise (SOE) management teams for rising leverage. Furthermore, given China’s already high global export market share (see chart below) and rising global protectionism, we do not think currency depreciation is a sustainable solution.

Source: OECD as of 31 December 2019.[/caption]

Source: OECD as of 31 December 2019.[/caption]

Arguably, the most effective policy measures to grow the economy since the Global Financial Crisis have been leverage-intensive infrastructure investment and residential property investment. But stimulating residential property is no longer a preferred lever for China. Given highly elevated home ownership levels, unfavorable demographics and concerns about social stability (due to problematic affordability and high systemwide leverage), Chinese officials worry that the property policies that stimulated real demand in the past will now only stimulate unproductive speculative demand and exacerbate leverage levels.

All of this leaves infrastructure investment as the last reliable lever Chinese policymakers have to manage the economy’s trajectory. Concerns about medium-term financial stability now outweigh the perceived diminished benefits of stimulating the property market. As a result, Chinese policymakers now accept lower and falling GDP growth rates that in the past would have induced a stronger policy response.

In early 2019, relatively quick resolutions to trade disagreements with Korea, Canada and Mexico raised market expectations about the speed of finding a solution to the U.S.-China trade talks. The problem is U.S. economic objectives in relation to China – including intellectual property protection, broad market access and the end of SOE preferential treatment – are not issues with easy solutions.

With further escalation bound to affect the U.S. stock market, economy and his chances for reelection, President Trump proposed a phase one agreement that is effectively a ceasefire. We believe a phase two agreement is unlikely to happen before the U.S. election in November 2020 because aid to SOEs and national security as it relates to technology are very sticky issues. Further, buying time suits China’s interest because it helps further the government’s newfound quest to be technologically self-reliant from the U.S.

Ultimately, we believe trade is just the tip of the iceberg. Trust and technology are the key issues.

The ability to weaponize U.S. technology exports as part of the U.S-China trade dispute has convinced Chinese policymakers that self-reliance in technology must be pursued regardless of how the trade talks evolve. But China’s pursuit of technological independence will not be easy. In certain areas such as telecom equipment, Chinese firms are globally competitive and relatively independent from U.S. intellectual property. In others, Chinese competitiveness would disappear without access to equipment, materials and chips from the U.S.

An additional wrinkle in the technological symbiotic relationship between the U.S. and China is the national security angle. We should expect U.S. tech restrictions to China to strengthen over time. The degree and scope of restrictions will play out in Congress between the lobbying efforts of Intel, Xilinx, Qualcomm, Applied Materials, Apple and other U.S. tech companies on one hand and the national security hawks on the other. National security concerns will play out regardless of who wins the U.S. presidential election, so the competing interests in Congress will ultimately decide the issue.

If technology decoupling becomes a reality, the end market for Western technology companies will shrink, as China is one of the largest consumers of seemingly everything in the tech “food chain.” Such a loss would likely translate into less investment, a slower rate of innovation and eventually slower growth.

In this time of uncertainty, Chinese government authorities seem to prefer making small tweaks to all available dials rather than making drastic changes to the overall economic model. They appear unwilling to increase economy-wide leverage materially unless the trade war substantially escalates, which would negatively affect consumer and business sentiment. A collapsing property market would be another reason to reverse course given that residential property represents more than 70% of Chinese household wealth. Conversely, a rapidly bursting rather than slowly deflating property market would represent an existential threat to the Chinese Communist Party.

It remains to be seen how the Wuhan coronavirus will impact China’s economy in the near term. But even before the outbreak, the consensus view was that China’s 2020 GDP growth rate would be slightly lower than that of 2019. Chinese officials are now willing to tolerate lower growth: Authorities talk about 5.5% GDP growth, which was inconceivable only a year ago.

All of this has led us to develop the view that the golden age of the Chinese economic boom is over and that investors in the region will need to set their expectations lower.