Subscribe

Sign up for timely perspectives delivered to your inbox.

Greg Kuhl, Portfolio Manager, Global Property Equities, highlights the increasing importance of non-core property sub-sectors in an evolving real estate landscape.

Our urban and suburban landscapes are dotted with myriad buildings of all types. Many of these buildings fall into one of five core property sub-sectors: industrial, apartments, office, shopping centers/regional malls and lodging/resorts. Historically, most investors’ exposure to real estate has been focused on these core property areas. Retail and office combined typically account for more than half of most core property fund holdings.

While in the past these core sub-sectors have provided attractive risk-adjusted returns to investors, we believe structural headwinds in office and retail justify exploring other types of real estate investments that have the potential for superior performance.

Office properties require significant levels of ongoing maintenance capital expense to maintain competitive positioning. This spending can consume up to 30% of asset level income over time, resulting in a reduction of investment returns. At the same time, office demand is stagnating in many markets as tenants strive for more efficiency and flexibility, i.e., leasing the minimum possible space per employee and demanding shorter lease contracts.

Brick-and-mortar retail arguably faces a greater challenge than office. Given the broad-based and growing adoption of online shopping, retail space requirements are shrinking significantly, evidenced by the 9,302 retail stores that closed in the U.S. in 2019 (up from 5,844 closings in 2018).1 This decline is leaving many landlords in an unfortunate competitive position with little or no pricing power and rendering some retail properties obsolete.

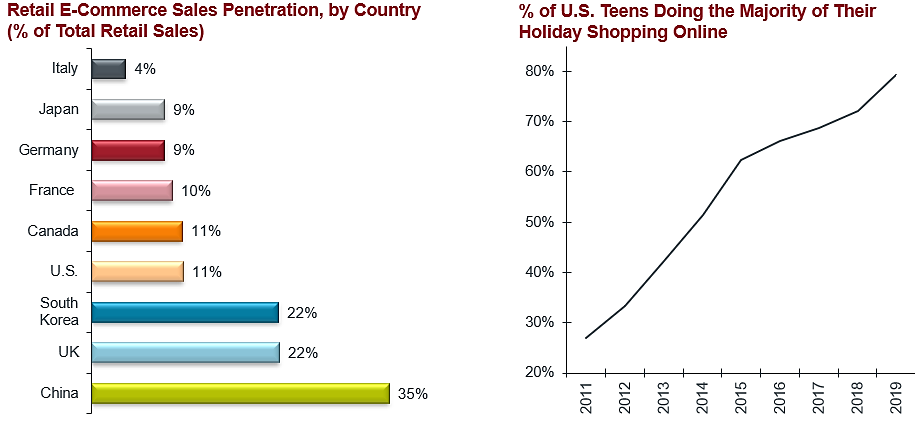

Our belief is that e-commerce penetration rates will continue to rise in most developed markets, boosted by the growing share of consumer spending that will come from a generation fully embracing online shopping, as highlighted in the following charts.

[caption id=”attachment_268210″ align=”alignnone” width=”923″] Source: eMarketer, Prologis, Evercore ISI Research company surveys, as of February 2019.[/caption]

Source: eMarketer, Prologis, Evercore ISI Research company surveys, as of February 2019.[/caption]

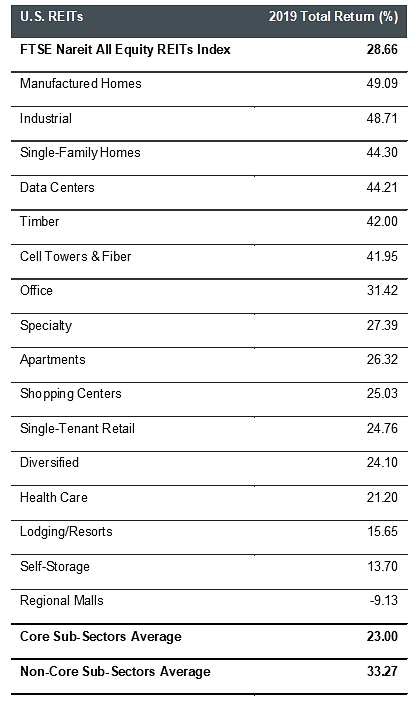

Real estate investment trust (REIT) markets, which tend to be forward looking, have already acknowledged that a rising tide will not lift all boats. For example, while U.S. REITs delivered a pleasing total return of 28.66% in 2019, they also exhibited the second-highest year of intra-sector return dispersion in the past 15 years (2009 was the highest over that period).2

[caption id=”attachment_268221″ align=”aligncenter” width=”420″] Source: Nareit, as of 12/31/19. Core sub-sectors are industrial, apartments, office, shopping centers/regional malls and lodging/resorts. Non-core is all remaining sub-sectors.[/caption]

Source: Nareit, as of 12/31/19. Core sub-sectors are industrial, apartments, office, shopping centers/regional malls and lodging/resorts. Non-core is all remaining sub-sectors.[/caption]

The confluence of technological advance and evolving demographics has created an unavoidable force that we believe will continue to reshape the commercial real estate landscape for years to come.

Based on our forward-looking analysis, non-core real estate sub-sectors look positioned to deliver superior growth and total returns over the medium term and, as such, the performance exhibited in 2019 may only be the latest chapter in a lengthy story. Just as most consumers no longer listen to music on cassette tapes, watch movies on VHS or talk to friends on landline telephones, investors may want to reconsider building allocations solely around real estate’s core sub-sectors.

Instead, we think specialized property sub-sectors with attractive supply/demand characteristics, such as manufactured housing communities, professionally managed single-family rentals, data centers and cell towers, to name a few, present more attractive investment opportunities.

In our view, listed REITs, more than any other real estate ownership vehicle, offer the most comprehensive, cost-effective and investor-friendly access to these property categories, which we think could be real estate’s darlings of tomorrow. Superior access to specialty property types, which now comprise nearly 60% of U.S. REITs market capitalization, is one important reason why listed REITs have delivered an annualized return of 10% since the dawn of the “modern REIT era” in the mid-1990s.3 Like private core real estate funds, REITs have also delivered returns with generally low correlation to traditional assets classes, such as equities and bonds.4 We expect the divergence in return between core and non-core property sectors to continue, or even widen, over the coming years as the needs for and uses of real estate continue to evolve.

Learn more 1Coresight Research, “US & UK Store Openings & Closures Tracker,” December 13, 2019.

2Nareit; Morgan Stanley Research, REIT Outlook North America: “Narrow Focus for 20/20 Vision,” December 18, 2019.

3Market capitalization data provided by Nareit, as of 12/31/19. Return data provided by Bloomberg, from 3/31/94 through 12/31/19. Returns based on the Bloomberg Real Estate Investment Trust Index, an index of U.S. REITs with a market capitalization of $15 million or greater.

4Nareit, FactSet. Data from December 1989 through December 2019.