Subscribe

Sign up for timely perspectives delivered to your inbox.

Incoming monetary information continues to disappoint: Euroland money measures barely rose in December.

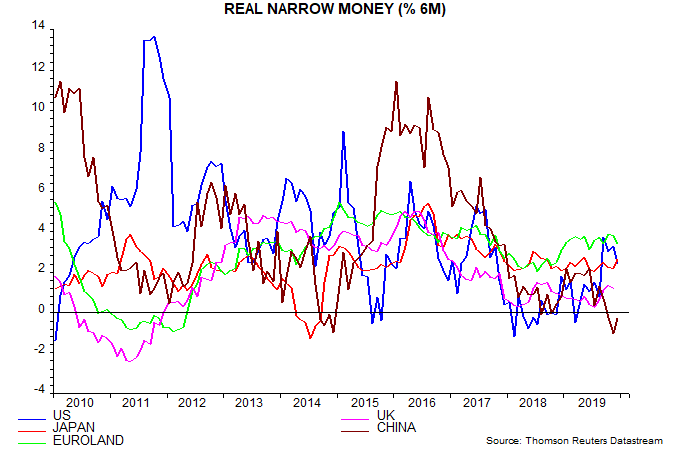

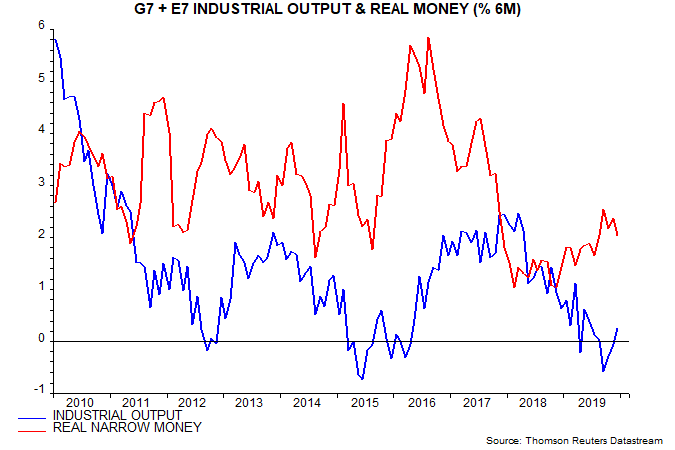

Six-month growth of G7 real narrow money was strong in late 2019 but the global (G7 plus E7) measure tracked here was held back by Chinese monetary weakness. It seemed plausible that Chinese money trends would revive, pushing six-month growth of the global measure up to the 3% level judged consistent with a full economic recovery.

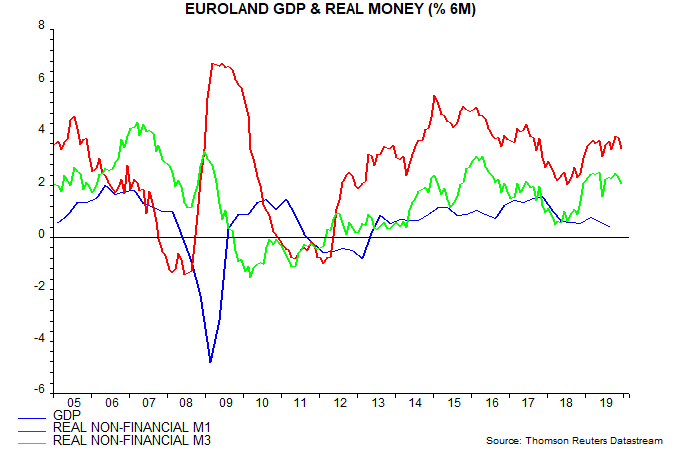

Chinese weakness, instead, persisted through December while US narrow money data were revised to show a September growth peak – see previous post. Euroland monetary strength may also now be fading. Non-financial M1 rose by only 0.1% month-on-month in December while non-financial M3 was flat (+0.02%). Six-month growth rates of the two measures, deflated by consumer prices, may have peaked in October – see first chart.

Incorporation of the Euroland data cuts the estimate of G7 plus E7 six-month real narrow money growth in December from 2.1% to 2.0%, which would be the lowest since August – second chart. December data for the remaining countries – with the exception of Korea – will be released on Friday.

Swedish December numbers were also released today and show a sharper fall in six-month narrow money growth than in Euroland. Swiss narrow and broad money measures, meanwhile, contracted in late 2019.

Euroland money growth is still respectable by historical standards and at the top end of the international range – third chart. This is of limited comfort given the region’s sensitivity to possible Chinese / global economic weakness and the suggestion that trends are cooling despite ECB policy stimulus, which is unlikely to be expanded anytime soon.