Subscribe

Sign up for timely perspectives delivered to your inbox.

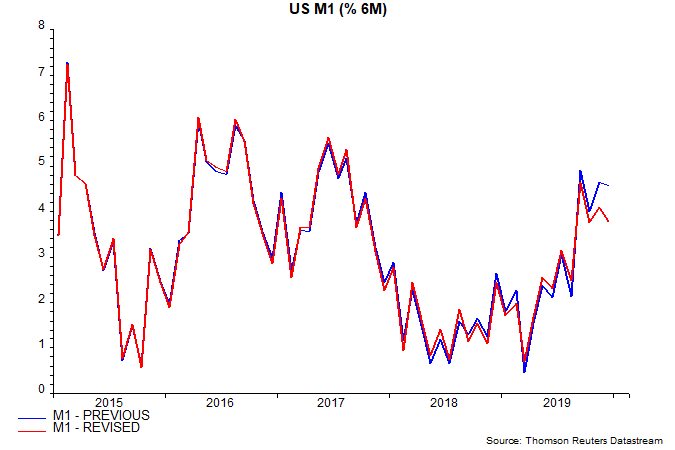

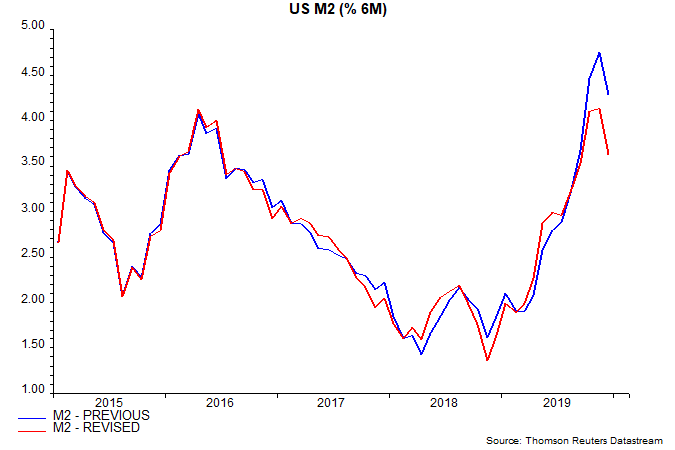

The Fed last week released the results of its annual revision of monetary data to incorporate updated seasonal factors and a new quarterly benchmark. The revision reduced six-month growth rates of M1 and M2 in late 2019 – see first and second charts.

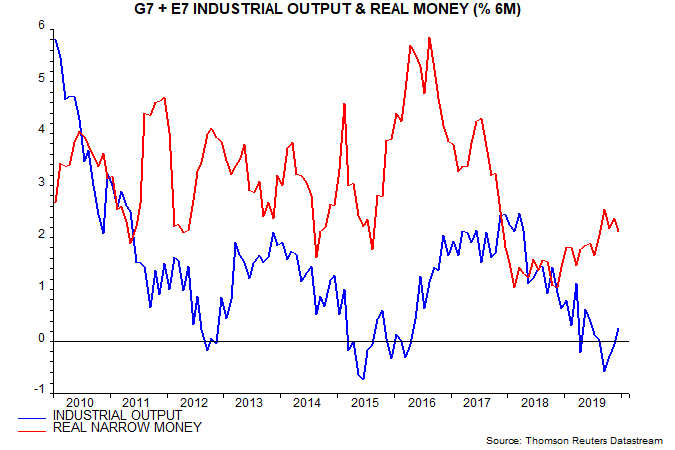

The global six-month real narrow money growth measure followed here, incorporating the revised US data, now shows a clearer peak, at 2.5%, in September 2019, with December estimated at 2.1% – third chart. A “final” December number will be available at the end of the week following monetary releases for countries accounting for a further 27% of the aggregate, including Eurozone data on Wednesday.

The fall since September suggests that global six-month industrial output momentum will reach a local high around June and weaken in Q3, allowing for an average nine-month lead.

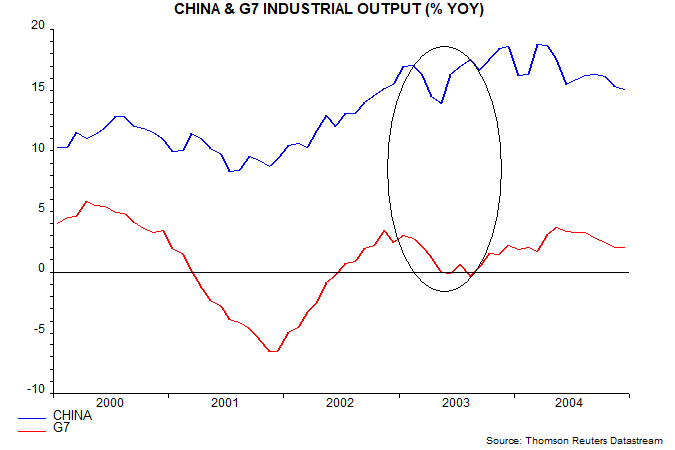

Disruption caused by the 2019 novel coronavirus (2019-nCoV) could advance economic weakness. The SARS epidemic of November 2002-July 2003 resulted in a significant but temporary slowdown in Chinese retail sales and industrial output into May 2003. This slowdown contributed to a “double dip” stagnation of G7 industrial output in H1 2003 following a 2002 recovery – fourth chart. China’s share of global GDP at purchasing power parity has risen from 9% in 2003 to 20% now, according to the IMF.