Knowledge. Shared Blog

January 2020

Global Outlook 2020: A Tale of Two Halves

-

Andrew Mulliner, CFA

Andrew Mulliner, CFA

Portfolio Manager

Andrew Mulliner, a Global Bonds Portfolio Manager, believes 2020 will prove to be a year of two halves, with a rosier outlook likely later in the year. He cautions, however, that attractive opportunities might be harder to come by given downside risks such as a re-escalation of trade wars and uncertainty from U.S. elections.

Key Takeaways

- Two major themes are likely to dominate and shape financial markets and the global economy in 2020: trade and policy action.

- While the first half of the year may well be characterized by continued sluggish growth globally and in particular in the U.S., leading indicators from industry surveys paint a rosier picture in the second half.

- In our view, attractive opportunities will not be easy to come by in 2020; yet, there are interesting pockets in parts of emerging markets, asset-backed securities and loans. As always, we think a robust and discerning investment process is key to avoiding the inevitable bad apples.

Reflecting on 2019

We had expected a substantial slowdown in economic growth for the year, and while the slowing growth environment and lower rates outlook came to pass, it is notable how resilient risk markets were in 2019 (albeit coming off a very weak period in the fourth quarter of 2018).

Instead of slowing growth and concerns about recession driving credit spreads wider over the year, we found that dovish central banks, lower rates and the reapplication of quantitative easing (QE) in the U.S. and Europe helped sustain risk markets and deliver stellar returns across asset classes.

Despite the ongoing concerns that central banks are out of ammunition and pushing on a string, it seems that once again it has been the central bankers that have triumphed over economic fundamentals. The question now is, where do we go from here?

We see two major themes likely to shape financial markets and the global economy in 2020, both of which will help answer key questions: Will there be a recession in the U.S. (or elsewhere)? Or has the worst passed, allowing the longest economic cycle in U.S. history to continue?

The First Key Theme Is Trade …

Can the optimism about a trade resolution with China currently percolating through markets be matched by action from politicians? We have seen the announcement of a “phase one” deal. But it remains to be seen whether it will be signed and can last, as well as whether it will lead to a “phase two” or “phase three.” Just as importantly, even with the recent de-escalation, tariffs sit at extreme levels with only marginal rollback. Will recent progress be enough to prevent any longer-lasting damage to global supply chains and investment?

… the Second Is Policy Action

We shifted from rate hikes in 2018 to rate cuts in 2019, along with the tentative return of QE. Have central banks done enough to offset the risks to growth caused by trade disputes and geopolitical concerns and do they have the ammunition to make a difference if the recent optimism is misplaced? The other key policy decision lies with politicians and whether they choose to step up the role of fiscal policy in managing the economic cycle.

Rosier Outlook Ahead

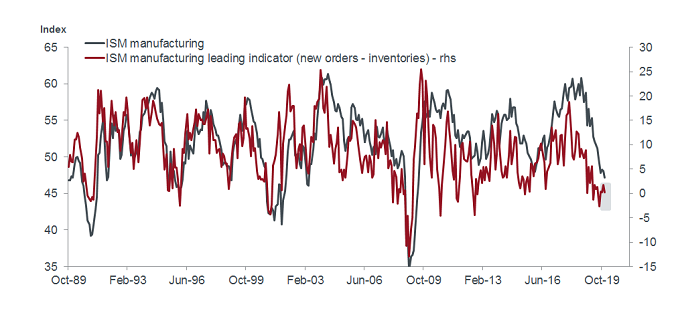

As things currently stand, we see a year of two halves. The first half of 2020 may well be characterized by continued sluggish growth globally and in the U.S. in particular, as the delayed effects of the trade war and tighter fiscal impulse continue to feed through to economic data. However, assuming no sudden economic shocks, the second half of 2020 looks rosier, with leading indicators from industry surveys, such as purchasing manager indices (PMIs) and money supply growth, suggesting better data to come.

ISM Manufacturing Leading Indicator Bottoming?

[caption id=”attachment_265059″ align=”alignnone” width=”680″] Source: Bloomberg, monthly data, as of 12/31/19. Note: Institute for Supply Management (ISM) manufacturing index versus a lead indicator (new orders minus inventories).[/caption]

Source: Bloomberg, monthly data, as of 12/31/19. Note: Institute for Supply Management (ISM) manufacturing index versus a lead indicator (new orders minus inventories).[/caption]

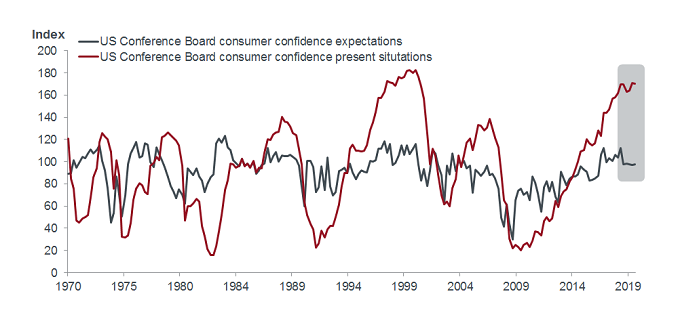

We believe risks remain to the downside, with a re-escalation in the trade war a real concern and uncertainties around the U.S. election likely to weigh increasingly heavily on market sentiment as we progress through the year. The chart below depicts the status of consumer confidence in the U.S. and illustrates the fact that U.S. consumers’ opinion of the future has rarely diverged so much from their assessment of the present situation. When the two have converged from these levels in the last 40 years, there has always been a recession in the U.S.

U.S. Consumers’ Outlook at Odds with Present Assessment

[caption id=”attachment_265070″ align=”alignnone” width=”680″] Source: Bloomberg, quarterly data, as of 12/31/19.[/caption]

Source: Bloomberg, quarterly data, as of 12/31/19.[/caption]

While some leading indicators are looking up, it by no means is a clean sweep. Much uncertainty remains regarding the strength and durability of the economic cycle in places like the U.S. However, the risk factors weighing on investors have abated somewhat, with fears of a chaotic hard Brexit reduced following the UK election in December and the “phase one” deal between the U.S. and China a positive development.

Scanning the Horizon in Search of Opportunities

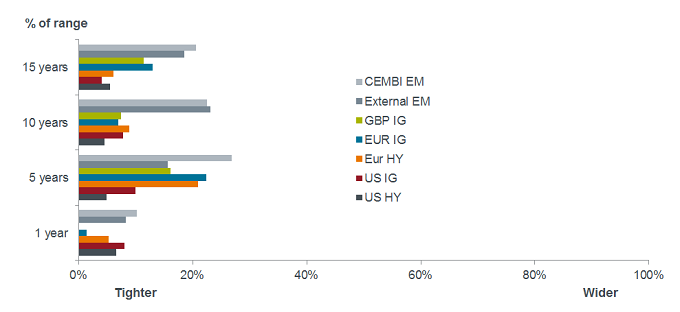

Turning to the financial markets, the biggest challenge facing investors is perhaps not “How do I protect capital if the risk case does materialize” but rather “Where do I invest capital should the benign outcome evolve?” Credit spreads are close to the tightest of this credit cycle and bond yields remain low, while equity markets continue to hit record highs and already assume a good rebound in corporate profitability in the coming year. Attractive investment opportunities are not the easiest to come by.

We do, however, see interesting opportunities in parts of emerging markets, where inflation-adjusted interest rates (real yields) remain very attractive in a low-growth low-inflation world. We also are of the view that secured loans and asset-backed securities (ABS) remain of value to investors but, as always, a robust and discerning investment process is key to avoiding the inevitable bad apples.

Within developed corporate credit markets, we remain generally cautious, with spreads offering little upside from further rate tightening and risks still to the downside, while lower-quality parts of the credit market continue to signal some distress. Should we see a revision to more attractive levels, possibly on the back of first-half economic weakness, we would look for opportunities here, too. The following chart is a good illustration of how, at the margin, emerging markets appear to potentially offer value.

Spreads as a Percentage of their Historical Range

[caption id=”attachment_265081″ align=”alignnone” width=”680″] Source: Bloomberg, ICE BoA Merrill Lynch indices for high-yield and investment-grade corporate bonds, JPMorgan emerging market corporate and external debt indices, as of 1/7/20.

Source: Bloomberg, ICE BoA Merrill Lynch indices for high-yield and investment-grade corporate bonds, JPMorgan emerging market corporate and external debt indices, as of 1/7/20.Note: Spreads as a percentage of their range shows how current credit spreads are situated within their historical range, with a low percentage showing spreads close to their tightest within the given time period and vice versa; HY = high yield, IG = investment grade, CEMBI = Corporate Emerging Markets Bond Index and, External EM = Emerging Markets Bond Index Global Diversified Index[/caption]

Thus, 2020 looks set to be a year of two halves. Ultimately, our base case is an increased focus on a benign outcome. However, we are very wary of downside risks and see markets as increasingly priced to perfection regarding the base case. Consequently, we think investors should retain a cautious approach and remain selective in asset class and security selection.

Abandon Your Doubts,

Not Your Goals

Learn MoreCredit Spread is the difference in yield between securities with similar maturity but different credit quality. In general, widening spreads indicate deteriorating credit worthiness of corporate borrowers, narrowing spreads are a sign of improving creditworthiness.

Knowledge. Shared

Blog

Back to all Blog Posts

Subscribe for relevant insights delivered straight to your inbox

I want to subscribe