Subscribe

Sign up for timely perspectives delivered to your inbox.

Global Head of Multi-Asset and Alternatives Michael Ho says the corporate leverage boom that has helped fuel equity returns since the Global Financial Crisis could face pressure in 2020. Alternatives could be a source of diversification, he says, but warns that not all strategies are created equal.

Demand for alternatives is on the rise, with global assets under management projected to climb by an average of 8% annually from 2018 to 2023, one of the highest growth rates among investment products, according to the Boston Consulting Group1.

No doubt, many investors are turning to alternatives in an effort to diversify returns. By 2050, one in six people globally will be over 65, up from one in 11 in 2019. The ratio is even more striking in Europe and North America, where roughly 25% of the population will be 65 or older.2 As the population ages, sensitivity to investment loss is likely to rise – creating demand for assets with the potential to smooth returns.

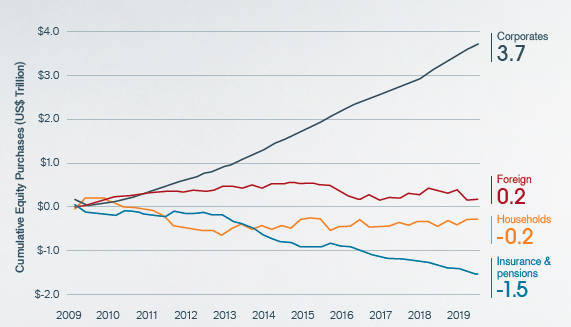

This demand could become amplified in 2020, given potential structural risks. In our view, corporate debt is one of these risks. Since the Global Financial Crisis, monetary easing has caused bond yields to plummet, prompting companies to expand their debt and use the funds to go on a share buyback shopping spree.

That could start to change. Already in many countries, yields on 10-year government bonds are at or near historical lows. What’s more, we believe yields are pricing in extremely negative growth scenarios for the economy and, therefore, may not stay at these lows. At the same time, corporate profit margins are starting to decline. Both factors could spell trouble for the pace of buybacks in the future and, consequently, stock returns.

[caption id=”attachment_253569″ align=”alignnone” width=”571″]

Source: Michael Hartnett, The Flow Show, Bank of America Merrill Lynch Research, September 5, 2019.[/caption]

Alternatives aim to provide returns that are uncorrelated with traditional asset classes such as stocks and bonds. But the recent performance of some strategies has been disappointing. Over the past 25 years, statistical estimates show that hedge funds have delivered alpha (excess return) of -2% per annum, driven in large part by the funds’ disproportionate exposure to the S&P 500® Index3.

Fortunately, alternatives as an asset class offers variety, and many strategies today can invest across a diversified suite of alternative risk premia (the expected excess return of a security) and hedge fund strategies.

1 As of July 2019

2 https://www.un.org/en/sections/issues-depth/ageing/

3 Source: Bloomberg and Datastream, HFRI Fund Weighted Composite Index data to 30 August 2019. Past performance is not a guide to future performance.