Subscribe

Sign up for timely perspectives delivered to your inbox.

Co-Heads of Equities Alex Crooke and George Maris argue that while stock multiples have climbed above 10-year averages, relative value can be found. What’s more, low interest rates, a healthy U.S. consumer and a market rotation look set to support equities in 2020.

Global equities have been hitting new highs, and if the pattern continues, several major indices could end 2019 with double-digit gains.

The indices could also have higher-than-average multiples. The forward price-to-earnings ratio of the MSCI All Country World Index℠ was 15.8 as of 19 November 2019, up nearly 15% from its 10-year average of 13.9. Similarly, for the same time period, the S&P 500® Index traded at a premium of 17%, the MSCI Euro Index a premium of 13% and the MSCI Emerging Markets Index 11%.1

With valuations above long-term averages and the bull market in U.S. stocks more than a decade old, investors may wonder whether equities have more upside in 2020.

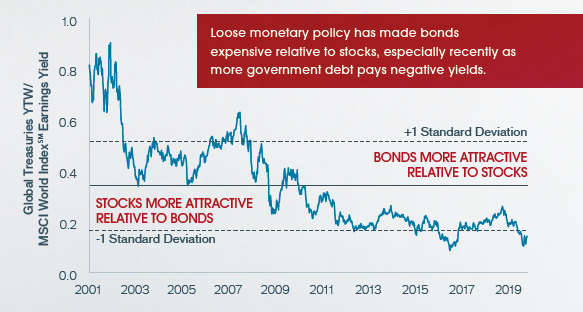

It’s impossible to predict future performance and political events such as trade negotiations and the U.S. election could lead to market volatility. But we believe the outlook for equities still remains positive. For one, in the face of a slowing global economy, major central banks cut interest rates and/or expanded their balance sheets in 2019. As long as slow growth persists, we believe monetary policy will stay accommodative. Bond yields, in turn, continue to hover near historical lows, making the earnings yield of stocks look comparatively attractive.

[caption id=”attachment_253228″ align=”alignnone” width=”583″] Source: Bloomberg; data are weekly from February 2, 2001 to October 25, 2019 and reflect the Bloomberg Barclays Global Treasury Index yield to worst and MSCI World Index℠ earnings yield. Yield to worst (YTW) is the lowest yield an investor can expect when investing in a callable bond.[/caption]

Source: Bloomberg; data are weekly from February 2, 2001 to October 25, 2019 and reflect the Bloomberg Barclays Global Treasury Index yield to worst and MSCI World Index℠ earnings yield. Yield to worst (YTW) is the lowest yield an investor can expect when investing in a callable bond.[/caption]

In addition, within equities, we believe it’s possible to find areas of relative value. For much of 2019, investors favored companies perceived to have defensive characteristics. Consequently, many of these stocks outperformed, pushing their multiples to levels above the broad market or long-term averages – even as some firms delivered subpar free-cash-flow growth.

The momentum changed in September, however, as investors signaled that they were no longer willing to pay any price for “safety.” Backed by strong labor markets, a healthy U.S. consumer and accommodative regulators, the rotation could continue in 2020, helping broaden equity outperformance. This broadening could manifest in other ways, too. With trade tensions still simmering, for example, business investment has been rising in parts of emerging Asia. At the same time, exports to the U.S. from areas such as Vietnam and Taipei have climbed. In our opinion, such growth could increasingly capture investor attention in 2020.

1Bloomberg, as of 19 November 2019. P/E data are weekly and based on forward 12-month earnings estimates.