Subscribe

Sign up for timely perspectives delivered to your inbox.

Alison Porter, Graeme Clark and Richard Clode from the UK-based Global Technology Team, review the sector’s performance year to date, and provide their views on what is in store for tech investors in the year ahead, including key risks and opportunities.

![]()

Given a phase one trade deal between the US and China is finally in sight at the time of writing, a key headline risk to the global economy and to the technology sector may be removed. We believe this will pave the way for a return to stronger earnings growth in the sector next year after a more challenged 2019. However, that recovery has been discounted to varying degrees, across cyclical technology stocks in particular, so the team will remain focused on identifying unexpected and underappreciated growth at a reasonable valuation.

A dynamic and evolving tech sector requires an active manager

With a US presidential election later in the year we will also have to be cognisant of the dynamic probabilities of very different regulatory regimes, notably under Democrat presidential candidate Senator Elizabeth Warren (who has pledged to end the monopoly of big tech companies) being priced into stocks by the market. That, plus an ongoing multi-generational tussle for superpower supremacy between the US and China that will not be ended by any initial trade deal, and with technology at its epicentre, will ensure market volatility will remain elevated.

As experienced active investment managers, we can cut through the noise and take advantage of that volatility given our deep understanding of stocks as we have done over the past year with cyclical1 technology stocks such as semiconductors. This ties in with the Global Technology Team’s highly integrated environmental, social and governance (ESG) process, where we believe we take a truly differentiated approach to proactive engagement with company management to identify and mitigate these broader risks, aiming to generate more sustainable growth and more consistent returns.

Investing in secular growth themes by avoiding the hype

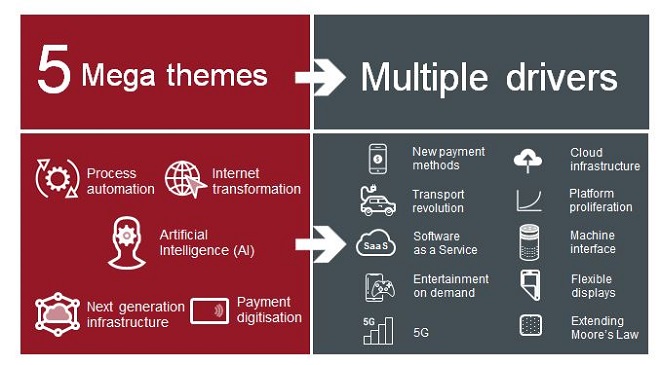

Our key technology themes remain: internet transformation, payment digitisation, next generation infrastructure, process automation and artificial intelligence (AI), with the convergence of those technologies accelerating disruption in multiple new industries. However, being investors rather than futurologists we continue to navigate the hype cycle to identify investable technologies. We do this by identifying and understanding where an emerging technology is on the hype cycle (hype, adoption, maturity, social application phases), which helps to provide exposure to the long-term secular growth themes in technology while avoiding areas of the market in the hype phase.

The team continues to believe that blockchain (digital information stored in a public database), quantum computing (storing and processing information using individual atoms, ions, electrons, or photons) and many areas of AI remain at or near the peak of the hype cycle. Within AI, we remain focused on areas that are seeing a real inflection, such as natural language processing, but continue to be wary of what we view to be overhyped AI development like autonomous driving. We believe there are more investable opportunities in process automation, which is more the ‘reality’ of the AI hype for the next couple of years.

Source: Janus Henderson Investors as at 30 November 2019.

Benefiting from a disciplined and consistent approach

Up until the summer, 2019 saw a continuation of the trends of last year before the late sell-off. Market fears around trade, China and giant tech companies’ regulation concentrated performance into a small pocket of technology stocks, notably in growth software, creating a momentum trade2 with scant regard for valuations. The MSCI Growth Software Index rose 99% from the start of 2018 to the end of July 20193. Given the team’s investment process, which is uniquely focused on a strong valuation discipline, that proved a challenging market backdrop where many technology funds are significantly overweight to the software sector. However, we stuck to our principles and were pleased to see some of the extreme software valuations reset in recent months. While the technology sector is constantly evolving, one investment constant is that extreme valuations do not sustain for long.

Failure can be instructive

While not a technology company, a leading shared workspace startup’s recent implosion will hopefully drive a cathartic cleansing of the excesses of the past few years. Private companies will need to be more profit and cashflow orientated and more realistic on valuation. That bodes well for our existing listed investments in markets exposed to these distortions, and should also create more attractive future investment opportunities as these earlier stage companies come to market.

Notes:

1Companies that sell discretionary consumer items, such as cars, or industries highly sensitive to changes in the economy, such as miners. The prices of equities and bonds issued by cyclical companies tend to be strongly affected by ups and downs in the overall economy, when compared to non-cyclical companies.

2Momentum trading: An investment strategy based on buying stocks that are rising in price with the expectation they will continue to rise, while those that underperform will continue to do so.

3Source: Bloomberg; MSCI Growth Software Index return for the period 31 December 2017 to 31 July 2019. Past performance is not a guide to future performance.

Janus Henderson Investors makes no representation as to whether any illustration/example mentioned in this document is now or was ever held in any portfolio. Illustrations shown are for the limited purpose of highlighting specific elements of the research process. The examples are not intended to be a recommendation to buy or sell a security, or an indication of the holdings of any portfolio or an indication of performance for the subject company.