Subscribe

Sign up for timely perspectives delivered to your inbox.

A recent pick-up in Chinese PMIs has boosted recovery hopes but the view here, based on monetary trends, is that such optimism is premature. December results of the Cheung Kong Graduate School of Business (CKGSB) survey support this scepticism.

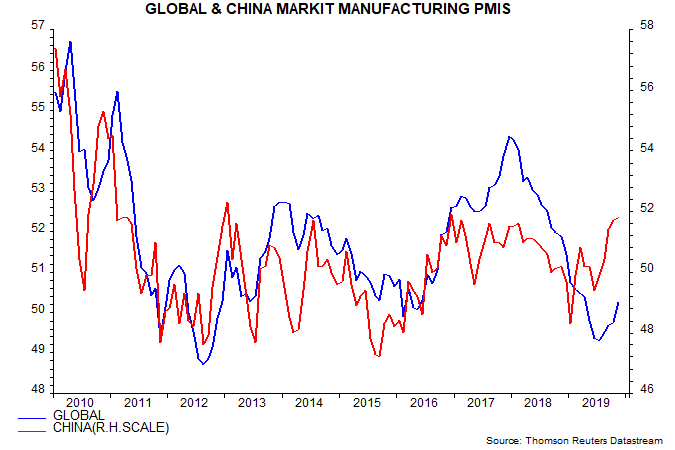

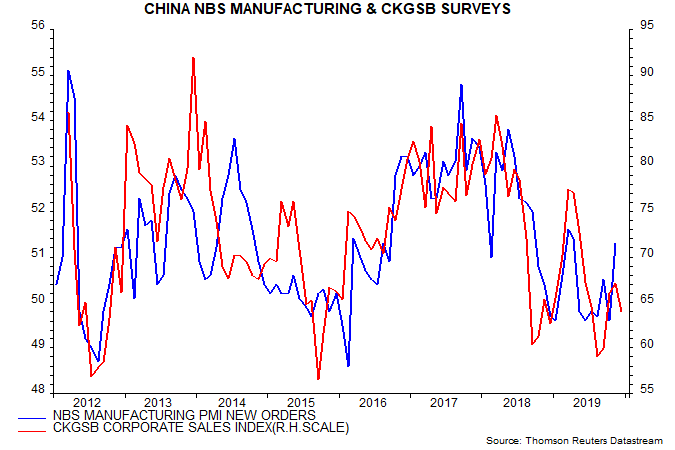

The CKGSB corporate sales index correlates with official and Markit manufacturing PMIs and fell back in December after a modest three-month rise – see first chart.

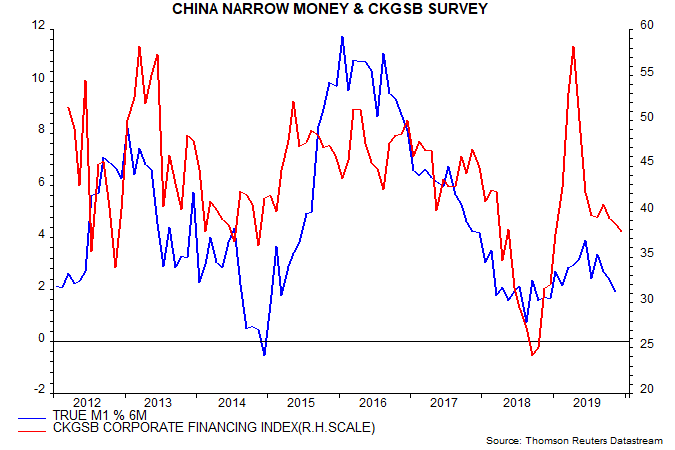

Monetary trends were recovering in early 2019 but went into reverse post-spring as secondary banking problems caused a tightening of credit conditions. This tightening was reflected in a sharp fall in the CKGSB corporate financing index – which measures the ease of obtaining external funds – from an April peak. The index slid further to an 11-month low in December – second chart.

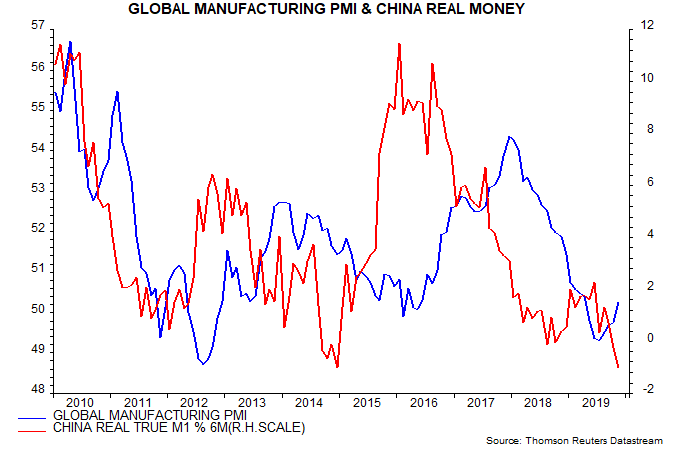

The Chinese PMI pick-up has contributed to a recent revival in optimism about global economic prospects, with commentators noting that Chinese manufacturing PMIs have tended to lead the global Markit measure in recent years – third chart. The common driver, however, may be Chinese real money trends, with very different implications – fourth chart.