Subscribe

Sign up for timely perspectives delivered to your inbox.

For much of 2019, worries about a global economic slowdown prevailed. Now, some indicators suggest growth could reaccelerate in 2020, albeit slowly. Should the growth materialize, stocks could benefit, says Director of Research Carmel Wellso.

Markets spent much of 2019 worrying about global growth stalling. In 2020, we believe the outlook could turn more positive as the economy potentially reaccelerates, even if slowly.

Already, we’re seeing green shoots. In November, global manufacturing activity increased for the first time in seven months, buoyed by strength in new orders and output, according to IHS Markit. In addition, headline purchasing managers’ indices (PMI), a measure of manufacturing and service sector trends, increased in 18 out of 30 regions – the highest ratio in two years1. Even hard-hit economies such as Germany are showing signs of improvement. According to the ifo Institute, sentiment among German executives improved slightly in November from the previous month2. And in the U.S., year-over-year wage growth has been running at 3.0% or more this year, suggesting a healthy consumer3.

At the same time, the benefits of looser monetary policy undertaken by a number of major central banks in the second half of 2019 could add liquidity to markets in 2020. And next year, some governments could introduce fiscal stimulus to help kick-start domestic economies (if not improve their parties’ standing leading up to elections).

In light of these trends, the global economy is projected to grow an inflation-adjusted 2.94% in 2020, up slightly from an estimated 2.91% in 2019, according to the Organisation for Economic Co-operation and Development.4 Our discussions with management teams suggest many companies are expecting this acceleration to occur in the first half of 2020.

If such growth materializes, we believe equities broadly would benefit, but particularly areas of the market that have lagged because of worries about a global slowdown. In the UK, for example, more than three years of Brexit-related uncertainty has pushed equity valuations below long-term averages. Many of these companies are high-quality operations that, in our opinion, could be lifted if Brexit gets resolved and a stronger economy improves confidence. Similarly, we think Chinese equities look attractive. A ceasefire in the U.S.-China trade war would remove a significant overhang for the country’s equity market, while a stronger global economy could increase demand for Chinese exports, a significant portion of the country’s gross domestic product.

The average price-to-earnings (P/E) ratio of UK and Chinese stocks has declined in recent years.

[caption id=”attachment_257206″ align=”alignnone” width=”862″] Source: Bloomberg. Data are weekly from 12/5/14 through 12/4/19. P/Es based on forward, estimated 12-month earnings. The FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange.[/caption]

Source: Bloomberg. Data are weekly from 12/5/14 through 12/4/19. P/Es based on forward, estimated 12-month earnings. The FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. The Shanghai Stock Exchange Composite Index is a capitalization-weighted index that tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange.[/caption]

More broadly, traditionally cyclical stocks (firms closely tied to the business cycle) could also be well positioned if the global economy reaccelerates. These stocks have lagged growth peers and now have attractive valuations, something the market has recently caught on to: In September, a rotation into cyclicals began as investors signaled they were no longer willing to pay any price for growth.

In our opinion, this rotation could continue so long as economic growth materializes. If the expansion stalls – whether because the U.S. and China fail to make progress on trade talks or the U.S. presidential election upends business expectations, among other things – equities could suffer and cyclicals would likely lose their leadership. As such, we think investors should keep a close eye on economic indicators in 2020, including measures of capex. To date, stimulus measures such as the Trump tax cuts of 2017 have not yielded higher capex. Rather, firms have used the proceeds to buy back shares or pay dividends, both of which benefited shareholders and boosted equity markets but failed to significantly drive new orders for capital goods. If global demand begins to strengthen, companies may once again begin to invest – a trend that is likely to further benefit global equities.

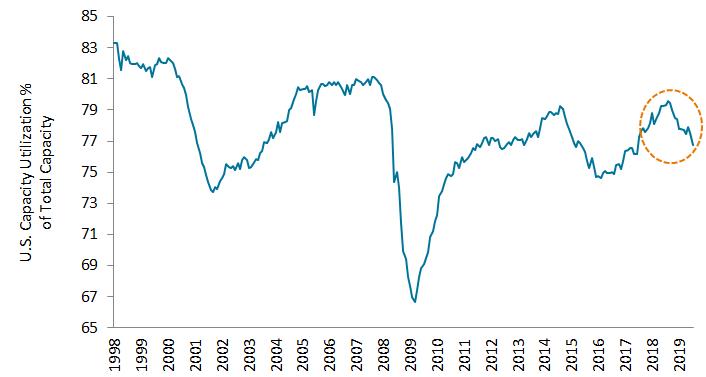

Capacity utilization has declined in recent months in the U.S. Should the trend reverse, it could signal rising demand and prompt companies to increase capex.

[caption id=”attachment_257218″ align=”alignnone” width=”706″] Source: Federal Reserve. Data are monthly from 4/30/98 through 10/31/19. U.S. capacity utilization % of total capacity measures how much capacity is being used from the total available capacity to produce demanded finished products.[/caption]

Source: Federal Reserve. Data are monthly from 4/30/98 through 10/31/19. U.S. capacity utilization % of total capacity measures how much capacity is being used from the total available capacity to produce demanded finished products.[/caption]

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.