Subscribe

Sign up for timely perspectives delivered to your inbox.

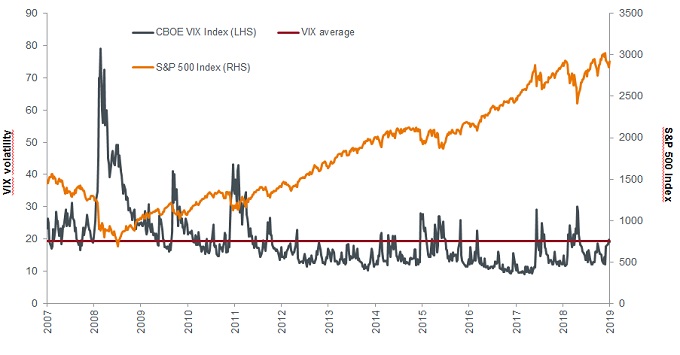

Against my expectations, most asset classes swooned in 2019 and volatility, as measured by the Chicago Board Options Exchange (CBOE) VIX Index, remained stubbornly low, ignoring global stresses. But we saw pins being readied to burst this particular bubble: protestors stood up to governments, inverted yield curves and negative rates rattled investors and unicorns disappointed or failed as reality bit. Hence I continue my view that volatility is under-priced. To me it seems inevitable that we will see increased volatility for both equity and fixed income markets in 2020, given the prevailing levels of political and economic risk. From Brexit uncertainty and a highly contentious US Presidential election to rising populism and further twists in the US-China trade conflict, the range of factors at play leads us to believe that the potential for large moves in the market has been underpriced.

Artificially low volatility has been underpinned by an extended period of easy fiscal and monetary policy, with trillions of dollars of stimulus from the US Federal Reserve, European Central Bank and the Bank of Japan. Many of the lessons that should have been learned from the global financial crisis have been ignored in lieu of sustaining the status quo (or ‘kicking the can down the road’). Meanwhile, the leverage effect has fuelled the price of risk assets, benefiting equities, and put a cap on interest rates, to the benefit of bonds.

In this environment, the most important role that an Alternative strategy can play is to deliver an attractive return for investors, with little or no correlation to the sources of return driving performance for traditional assets.

Diversification is an overused axiom of financial markets, but as the sharp drawdown we saw in December 2018 shows, true diversification is hard to deliver. During periods of increased market stress, price movements from seemingly uncorrelated assets can often synchronise. The question for Alternatives managers in 2020 is whether or not they can match the promise of delivering truly diversified returns for investors.

Our multi-strategy team takes a globally positioned view, aiming to deliver returns for investors with low correlation to both traditional and alternative asset classes, with relatively low volatility. We balance a bottom-up view of portfolio construction with an explicit protection strategy, plus some discretionary convexity. The low expected correlation among the sub-strategies aims to enhance the risk-adjusted return of the overall portfolio, providing investors with real diversification in the sources of potential return.

Markets right now are as intractable a problem as the classic Gordian knot, displaying a bizarre combination of highly elevated political and economic risk, which at the moment is not reflected in prices. We see potential signs for further uncertainty ahead, but timing the market is virtually impossible. Should the market move as we expect, the steady, defensive stance we took for 2019 seems a suitable choice, with a close focus on our core objective, to deliver attractive risk-adjusted returns for investors with little or no equity or fixed income beta.

The VIX Index (chart 1) is close to its 10-year average, giving us an interesting insight into current expectations for market volatility. We do not believe that markets will tread water in the months ahead. We expect a more significant resetting in markets at some point, which may provide an opportunity to buy positions which should react positively if risk premia widen and volatility spikes, which usually coincides with sharp market falls.

Source: Chicago Board Options Exchange (CBOE), Thomson Reuters Datastream, 31 August 2007 to 30 November 2019. The VIX is a calculation designed to provide a measure of constant 30-day expected volatility in the US stock market, derived from prices of stocks listed on the S&P 500 Index and put options.