Subscribe

Sign up for timely perspectives delivered to your inbox.

“Canada’s the best country in the world” – Justin Bieber

Recently I purchased a new printer for my home – a third-party vendor on Amazon.com was selling it for $50 below all other online stores. It arrived last week and worked as expected, but notably the box was printed in English/French with a Canadian flag on top and manufacture date of June 2015. Clearly an enterprising person figured out that with the 20% drop in the Canadian dollar over the last six months, they could profitably buy printers in Canada and re-sell them online to US consumers.

There has been a lot of gloom about the Canadian economy as the precipitous drop in commodity prices pushes the currency to a 13-year low versus the US dollar. But while certainly exposed to the commodity sector, Canada is far from a petro-state with only about 8% of GDP coming from mining, oil, and gas-related activities combined. The country is also a significant energy consumer using about 2.5 million barrels of oil per day against production of around 4 million barrels. This provides a substantial offset at the national level, although hides a stark regional disparity, with oil-producing Western provinces losing out to the consuming East.

The cheap Canadian dollar is also poised to perpetuate the long-running housing boom, while boosting manufacturing and tourism.

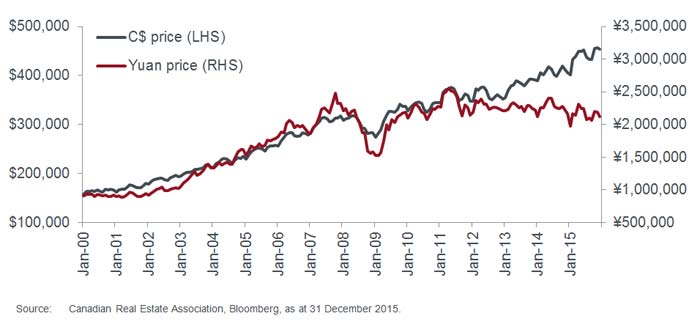

Housing in Canada has been bubbly, with average prices barely dipping during the financial crisis, and continuing to surge thereafter. But the exchange rate is bearing the brunt of the necessary price adjustment. In major Canadian cities, the marginal buyer is often an Asian immigrant with Chinese yuan or US dollar assets. The Canadian dollar collapse is enhancing their purchasing power, keeping the housing party going for now, even as local first-time homebuyers struggle with affordability.

Meanwhile, the previously struggling manufacturing sector is another direct beneficiary of the falling currency – motor vehicles recently overtook energy as Canada’s #1 export. This trend is likely to persist as automakers further ramp-up Canadian output, given favourable wage and healthcare costs compared to US-based production facilities.

Tourism is likely to be another bright spot. Looking at the top ski resorts in North America, it’s time to vacation in Canada. Cheap skiing…

| Winter resort | 1-day lift ticket price (US$) |

|---|---|

| Snowbird (Utah) | $98 |

| Jackson Hole (Wyoming) | $115 |

| Aspen (Colorado) | $139 |

| Whistler (British Columbia)* | $64 (C$92) |

| Tremblant (Quebec)* | $59 (C$84) |

| Item | USA price* | Canada price** | Discount |

|---|---|---|---|

| McDonalds Big Mac Combo Meal | $6.49 | $5.45 (C$7.79) | -16% |

| Starbucks Caffe Latte Grande | $3.75 | $2.77 (C$3.95) | -26% |

The short-run negative shock to Canada from the commodity bust will likely keep Canadian GDP growth close to zero while a rotation towards non-energy sectors takes place. But the long-run positives are equally clear: Canada has ample land, clean air, abundant water, low sovereign debt and well-educated immigrants. The new Trudeau government is sharply increasing infrastructure-related spending, providing a domestic fiscal boost. The cheap Canadian dollar will aid exports and encourage foreign inflows via purchases of hard assets as well as tourism, education and other services.

While purchasing power disparities are a poor short-term predictor of exchange rates, the open nature of the Canadian economy – including its free trade agreement with the US – should assist a quicker adjustment process. A gradual economic recovery will enable the currency to slowly rebound from its current drubbing.

And although it seems nearly inconceivable today, commodity prices might someday rise again…